1

Application and Definitions

1.1

This Part applies to:

- (a) a firm that is a CRR firm; and

- (b) a CRR consolidation entity.

- 01/01/2022

- Legal Instruments that change this rule 1.1

1.2

In this Part, the following definitions shall apply:

means the net market value of all the transactions within a netting set gross of any collateral held or posted where positive and negative market values are netted in computing the CMV.

[Note: This rule corresponds to Article 272(12) of the CRR as it applied immediately before revocation by the Treasury.]

means a group of transactions within a single netting set for which full or partial offsetting is allowed for determining the potential future exposure under the methods set out in Section 3 or 4 of this Chapter.

[Note: This rule corresponds to Article 272(6) of the CRR as it applied immediately before revocation by the Treasury.]

means the largest amount of an exposure that remains outstanding before one party has the right to call for collateral.

[Note: This rule corresponds to Article 272(8) of the CRR as it applied immediately before revocation by the Treasury.]

net independent collateral amount or NICA

means the sum of the volatility-adjusted value of net collateral received or posted, as applicable, to the netting set other than variation margin.

means a margin agreement under which an institution is required to post variation margin to a counterparty but is not entitled to receive variation margin from that counterparty or vice-versa.

means one year expressed in business days.

means the payment agreed in an OTC derivative transaction with a linear risk profile which stipulates the exchange of a financial instrument for a payment.

In the case of transactions that stipulate the exchange of payment against payment, those two payment legs shall consist of the contractually agreed gross payments, including the notional amount of the transaction.

[Note: This rule corresponds to Article 272(26) of the CRR as it applied immediately before revocation by the Treasury.]

- 01/01/2022

- Legal Instruments that change this rule 1.2

1.3

For the purposes of Section 9 of this Part, the following definitions apply:

in relation to client assets, means that effective arrangements exist which ensure that those assets will not be available to the creditors of a CCP or of a clearing member in the event of the insolvency of that CCP or clearing member respectively, or that the assets will not be available to the clearing member to cover losses it incurred following the default of a client or clients other than those that provided those assets.

means a transaction in cash, debt instruments or equities, a spot foreign exchange transaction or a spot commodities transaction; however, repurchase transactions, securities or commodities lending transactions, and securities or commodities borrowing transactions, are not cash transactions.

means a contract or a transaction listed in Article 301(1) between a client and a clearing member that is directly related to a contract or a transaction listed in that paragraph between that clearing member and a CCP.

means a clearing member as defined in point (14) of Article 2 of Regulation (EU) No 648/2012.

means a client as defined in point (15) of Article 2 of Regulation (EU) No 648/2012 or an undertaking that has established indirect clearing arrangements with a clearing member in accordance with Article 4(3) of that Regulation.

fully guaranteed deposit lending or borrowing transaction

means a fully collateralised money market transaction in which two counterparties exchange deposits and a CCP interposes itself between them to ensure the performance of those counterparties' payment obligations.

means an entity providing clearing services to a lower-level client.

means an arrangement that meets the conditions set out in the second subparagraph of Article 4(3) of Regulation (EU) No 648/2012.

means an entity accessing the services of a CCP through a higher-level client.

means an indirect clearing arrangement under which clearing services are provided to an institution by an entity which is not a clearing member, but is itself a client of a clearing member or of a higher-level client.

unfunded contribution to a default fund

means a contribution that an institution that acts as a clearing member has contractually committed to provide to a CCP after the CCP has depleted its default fund to cover the losses it incurred following the default of one or more of its clearing members.

[Note: This rule corresponds to Article 300 of the CRR as it applied immediately before revocation by the Treasury.]

- 01/01/2022

- Legal Instruments that change this rule 1.3

Export chapter as

2

Level of Application

2.1

Title II of Part One (Level of application) of the CRR applies to Chapter 3 of this Part as that Title applies to Part Three (Capital Requirements) of the CRR.

- 01/01/2022

- Legal Instruments that change this rule 2.1

3

Counterparty Credit Risk (Part Three, Title Two, Chapter Six CRR)

Section 1 Definitions

Article 271 Determination of the Exposure Value

[Note: Article 271 remains in the CRR]

Article 272 Definitions

Export Article as

Section 2 Methods for Calculating the Exposure Value

Article 273 Methods for Calculating the Exposure Value

1.

Institutions shall calculate the exposure value for the contracts listed in Annex II of the CRR on the basis of one of the methods set out in Sections 3 to 6 in accordance with this Article.

An institution which does not meet the conditions set out in Article 273a(1) shall not use the method set out in Section 4. An institution which does not meet the conditions set out in Article 273a(2) shall not use the method set out in Section 5.

Institutions may use in combination the methods set out in Sections 3 to 6 on a permanent basis within a group. A single institution shall not use in combination the methods set out in Sections 3 to 6 on a permanent basis.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Where permitted by the competent authorities in accordance with Article 283(1) and (2), an institution may determine the exposure value for the following items using the Internal Model Method set out in Section 6:

- (a) the contracts listed in Annex II of the CRR;

- (b) repurchase transactions;

- (c) securities or commodities lending or borrowing transactions;

- (d) margin lending transactions;

- (e) long settlement transactions.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

When an institution purchases protection through a credit derivative against a non-trading book exposure or against a counterparty risk exposure, it may calculate its own funds requirement for the hedged exposure in accordance with either of the following:

- (a) Articles 233 to 236;

- (b) in accordance with Article 153(3), or Article 183, where permission has been granted in accordance with Article 143.

The exposure value for CCR for those credit derivatives shall be zero, unless an institution applies the approach in point (h)(ii) of Article 299(2).

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

Notwithstanding paragraph 3, an institution may choose consistently to include for the purposes of calculating own funds requirements for counterparty credit risk all credit derivatives not included in the trading book and purchased as protection against a non-trading book exposure or against a counterparty credit risk exposure where the credit protection is recognised under the CRR.

- 01/01/2022

- Legal Instruments that change this rule 4.

5.

Where credit default swaps sold by an institution are treated by an institution as credit protection provided by that institution and are subject to own funds requirement for credit risk of the underlying for the full notional amount, their exposure value for the purposes of CCR in the non-trading book shall be zero.

- 01/01/2022

- Legal Instruments that change this rule 5.

6.

Under the methods set out in Sections 3 to 6, the exposure value for a given counterparty shall be equal to the sum of the exposure values calculated for each netting set with that counterparty.

By way of derogation from the first subparagraph, where one margin agreement applies to multiple netting sets with that counterparty and the institution is using one of the methods set out in Sections 3 to 6 to calculate the exposure value of those netting sets, the exposure value shall be calculated in accordance with the relevant Section.

For a given counterparty, the exposure value for a given netting set of OTC derivative instruments listed in Annex II of the CRR calculated in accordance with this Chapter shall be the greater of zero and the difference between the sum of exposure values across all netting sets with the counterparty and the sum of credit valuation adjustments for that counterparty being recognised by the institution as an incurred write-down. The credit valuation adjustments shall be calculated without taking into account any offsetting debit value adjustment attributed to the own credit risk of the firm that has been already excluded from own funds under Article 33(1).

- 01/01/2022

- Legal Instruments that change this rule 6.

7.

In calculating the exposure value in accordance with the methods set out in Sections 3, 4 and 5, institutions may treat two OTC derivative contracts included in the same netting agreement that are perfectly matching as if they were a single contract with a notional principal equal to zero.

For the purposes of the first subparagraph, two OTC derivative contracts are perfectly matching when they meet all the following conditions:

- (a) their risk positions are opposite;

- (b) their features, with the exception of the trade date, are identical;

- (c) their cash flows fully offset each other.

- 01/01/2022

- Legal Instruments that change this rule 7.

8.

Institutions shall determine the exposure value for exposures arising from long settlement transactions by any of the methods set out in Sections 3 to 6 of this Chapter, regardless of which method the institution has chosen for treating OTC derivatives and repurchase transactions, securities or commodities lending or borrowing transactions, and margin lending transactions. In calculating the own funds requirements for long settlement transactions, an institution that uses the approach set out in Chapter 3 may assign the risk weights under the approach set out in Chapter 2 on a permanent basis and irrespective of the materiality of such positions.

- 01/01/2022

- Legal Instruments that change this rule 8.

9.

For the methods set out in Sections 3 to 6 of this Chapter, institutions shall treat transactions where Specific Wrong-Way risk has been identified in accordance with Article 291(2), (4), (5) and (6).

[Note: This rule corresponds to Article 273 of the CRR as it applied immediately before revocation by the Treasury.]

- 01/01/2022

- Legal Instruments that change this rule 9.

Article 273a Conditions for Using Simplified Methods for Calculating the Exposure Value

1.

Subject to the restriction set out in Article 237b(2), an institution may calculate the exposure value of its derivative positions in accordance with the method set out in Section 4, provided that the size of its on- and off-balance-sheet derivative business is equal to or less than both of the following thresholds on the basis of an assessment carried out on a monthly basis using the data as of the last day of the month:

- (a) 10% of the institution's total assets;

- (b) GBP 260 million.

2.

Subject to the restriction set out in Article 237b(2), an institution may calculate the exposure value of its derivative positions in accordance with the method set out in Section 5, provided that the size of its on- and off-balance-sheet derivative business is equal to or less than both of the following thresholds on the basis of an assessment carried out on a monthly basis using the data as of the last day of the month:

- (a) 5% of the institution's total assets;

- (b) GBP 88 million.

3.

For the purposes of paragraphs 1 and 2, institutions shall calculate the size of their on- and off-balance-sheet derivative business on the basis of data as of the last day of each month in accordance with the following requirements:

- (a) derivative positions shall be valued at their market values on that given date; where the market value of a position is not available on a given date, institutions shall take a fair value for the position on that date; where the market value and fair value of a position are not available on a given date, institutions shall take the most recent of the market value or fair value for that position;

- (b) the absolute value of long derivative positions shall be summed with the absolute value of short derivative positions;

- (c) all derivative positions shall be included, except credit derivatives that are recognised as internal hedges against non-trading book credit risk exposures.

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

By way of derogation from paragraph 1 or 2, as applicable, where the derivative business on a consolidated basis does not exceed the thresholds set out in paragraph 1 or 2, as applicable, an institution which is included in the consolidation and which would have to apply the method set out in Section 3 or 4 because it exceeds those thresholds on an individual basis, may, subject to the approval of competent authorities, instead choose to apply the method that would apply on a consolidated basis.

[Note: This is a permission under section 144G of FSMA to which Part 8 of the Capital Requirements Regulations applies]

- 01/01/2022

- Legal Instruments that change this rule 4.

5.

- 01/01/2022

- Legal Instruments that change this rule 5.

6.

Institutions shall not enter into a derivative transaction or buy or sell a derivative instrument for the sole purpose of complying with any of the conditions set out in paragraphs 1 and 2 during the monthly assessment.

- 01/01/2022

- Legal Instruments that change this rule 6.

Article 273b Non-Compliance with the Conditions for Using Simplified Methods for Calculating the Exposure Value of Derivatives

1.

An institution that no longer meets one or more of the conditions set out in Article 273a(1) or (2) shall immediately notify the competent authority thereof.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

An institution shall cease to calculate the exposure values of its derivative positions in accordance with Section 4 or 5, as applicable, within six months of one of the following occurring:

- (a) the institution does not meet the conditions set out in point (a) of Article 273a(1) or (2), as applicable, or the conditions set out in point (b) of Article 273a(1) or (2), as applicable, for three consecutive months;

- (b) the institution does not meet the conditions set out in point (a) of Article 273a(1) or (2), as applicable, or the conditions set out in point (b) of Article 273a(1) or (2), as applicable, for more than six of the preceding 12 months.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

Where an institution has ceased to calculate the exposure values of its derivative positions in accordance with Section 4 or 5, as applicable, it shall only be permitted to resume calculating the exposure value of its derivative positions as set out in Section 4 or 5 where it demonstrates to the competent authority that all the conditions set out in Article 273a(1) or (2) have been met for an uninterrupted period of one year.

[Note: This is a permission under section 144G and 192XC of FSMA to which Part 8 of the Capital Requirements Regulations applies]

- 01/01/2022

- Legal Instruments that change this rule 3.

Section 3 Standardised Approach for Counterparty Credit Risk

Article 274 Exposure Value

1.

An institution may calculate a single exposure value at netting set level for all the transactions covered by a contractual netting agreement where all the following conditions are met:

- (a) the netting agreement belongs to one of the types of contractual netting agreements referred to in Article 295;

- (b) the netting agreement has been recognised by competent authorities in accordance with Article 296;

- (c) the institution has fulfilled the obligations laid down in Article 297 in respect of the netting agreement.

Where any of the conditions set out in the first subparagraph are not met, the institution shall treat each transaction as if it was its own netting set.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Institutions shall calculate the exposure value of a netting set under the standardised approach for counterparty credit risk as follows:

Exposure value = α · (RC + PFE)

where:

RC = the replacement cost calculated in accordance with Article 275; and

PFE = the potential future exposure calculated in accordance with Article 278;

α = 1.4.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

The exposure value of a netting set that is subject to a contractual margin agreement shall be capped at the exposure value of the same netting set not subject to any form of margin agreement.

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

Where multiple margin agreements apply to the same netting set, institutions shall calculate the replacement cost of the netting set in accordance with Article 275(2) for margined transactions. The potential future exposure of the netting set shall be calculated in accordance with Article 278 with the modification that AggAddOn shall be set equal to the sum of AggAddOn across each sub-netting set, with sub-netting sets constructed as follows:

- (a) all transactions that are unmargined or are subject to a one way margin agreement where the institution is required to post, but not entitled to receive, variation margin, within the netting set form a single sub-netting set;

- (b) all margined transactions within the netting set that share the same margin period of risk form a single sub-netting set.

- 01/01/2022

- Legal Instruments that change this rule 4.

5.

Institutions may set to zero the exposure value of a netting set that satisfies all the following conditions:

- (a) the netting set is solely composed of sold options;

- (b) the current market value of the netting set is at all times negative;

- (c) the premium of all the options included in the netting set has been received upfront by the institution to guarantee the performance of the contracts;

- (d) the netting set is not subject to any margin agreement.

- 01/01/2022

- Legal Instruments that change this rule 5.

6.

In a netting set, institutions shall replace a transaction which is a finite linear combination of bought or sold call or put options with all the single options that form that linear combination, taken as an individual transaction, for the purpose of calculating the exposure value of the netting set in accordance with this Section. Each such combination of options shall be treated as an individual transaction in the netting set in which the combination is included for the purpose of calculating the exposure value.

- 01/01/2022

- Legal Instruments that change this rule 6.

7.

The exposure value of a credit derivative transaction representing a long position in the underlying may be capped to the amount of outstanding unpaid premium provided it is treated as its own netting set that is not subject to a margin agreement.

- 01/01/2022

- Legal Instruments that change this rule 7.

Export Article as

Article 275 Replacement Cost

1.

Institutions shall calculate the replacement cost RC for netting sets that are not subject to a margin agreement, or are subject to a one way margin agreement where the institution is required to post, but not entitled to receive, variation margin, in accordance with the following formula:

RC = max{CMV – NICA, 0}

For netting sets that are subject to one way margin agreements where the institution is required to post, but not entitled to receive, variation margin, NICA shall include VM (as defined in paragraph 2).

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Institutions shall calculate the replacement cost for single netting sets that are subject to margin agreements (other than those subject to the treatment under Article 275(1)) in accordance with the following formula:

RC = max{CMV – VM – NICA, TH + MTA – NICA, 0}

where:

RC = the replacement cost;

VM = the volatility-adjusted value of the net variation margin received or posted, as applicable, to the netting set on a regular basis to mitigate changes in the netting set's CMV;

TH = the margin threshold applicable to the netting set under the margin agreements below which the institution cannot call for collateral; and

MTA = the minimum transfer amount applicable to the netting set under the margin agreements.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

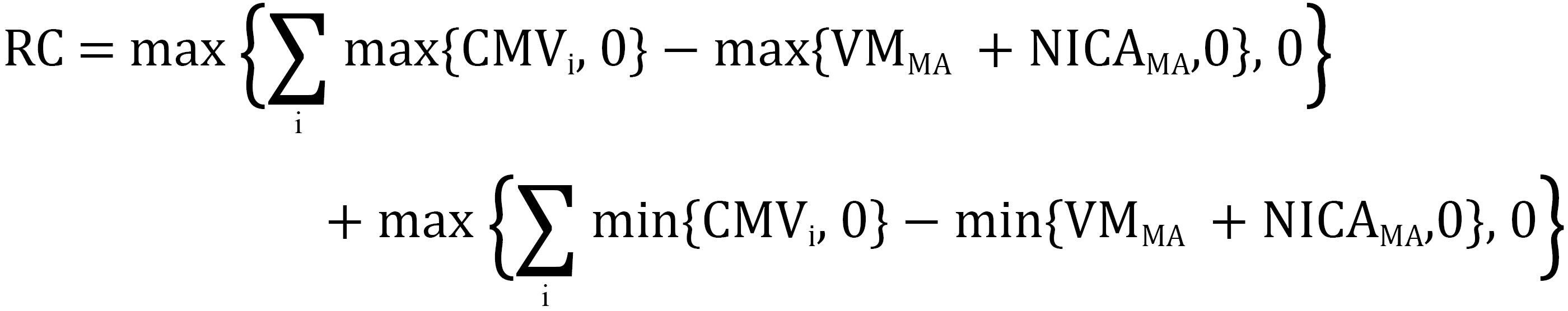

Institutions shall calculate the replacement cost for multiple netting sets that are subject to the same margin agreement in accordance with the following formula:

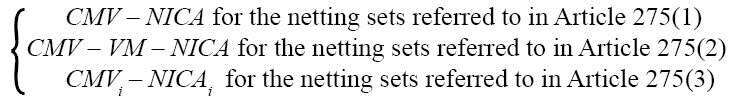

where:

- RC = the replacement cost;

- i = the index that denotes the netting sets that are subject to the single margin agreement;

- CMVi = the CMV of netting set i;

- VMMA = the sum of the volatility-adjusted value of collateral received or posted, as applicable, to multiple netting sets on a regular basis to mitigate changes in their CMV; and

- NICAMA = the sum of the volatility-adjusted value of collateral received or posted, as applicable, to multiple netting sets other than VMMA.

For the purposes of the first subparagraph, NICAMA may be calculated at trade level, at netting set level or at the level of all the netting sets to which the margin agreement applies depending on the level at which the margin agreement applies.

- 01/01/2022

- Legal Instruments that change this rule 3.

Export Article as

Article 276 Recognition and Treatment of Collateral

1.

For the purposes of this Section, institutions shall calculate the collateral amounts of VM, VMMA, NICA and NICAMA, by applying all the following requirements:

- (a) where all the transactions included in a netting set belong to the trading book, only collateral that is eligible under Articles 197 and 299 shall be recognised;

- (b) where a netting set contains at least one transaction that belongs to the non-trading book, only collateral that is eligible under Article 197 shall be recognised;

- (c) collateral received from a counterparty shall be recognised with a positive sign and collateral posted to a counterparty shall be recognised with a negative sign;

- (d) the volatility-adjusted value of any type of collateral received or posted shall be calculated in accordance with Article 223; for the purposes of that calculation, institutions shall not use the method set out in Article 225;

- (e) the same collateral item shall not be included in both VM and NICA at the same time;

- (f) the same collateral item shall not be included in both VMMA and NICAMA at the same time;

- (g) any collateral posted to the counterparty that is segregated from the assets of that counterparty and, as a result of that segregation, is bankruptcy remote in the event of the default or insolvency of that counterparty shall not be recognised in the calculation of NICA and NICAMA.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the calculation of the volatility-adjusted value of collateral posted referred to in point (d) of paragraph 1 of this Article, institutions shall replace the formula set out in Article 223(2) with the following formula:

CVA = C · (1 + HC + Hfx)

where:

CVA = the volatility-adjusted value of collateral posted; and

C = the collateral;

HC and Hfx are defined in accordance with Article 223(2).

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

For the purposes of point (d) of paragraph 1, institutions shall set the liquidation period relevant for the calculation of the volatility-adjusted value of any collateral received or posted in accordance with one of the following time horizons:

- (a) the longest remaining maturity of transactions in the netting set, capped at OneBusinessYear, for the netting sets referred to in Article 275(1);

- (b) the margin period of risk determined in accordance with point (b) of Article 279c(1) for the netting sets referred to in Article 275(2) and (3).

- 01/01/2022

- Legal Instruments that change this rule 3.

Article 277 Mapping of Transactions to Risk Categories

1.

Institutions shall map each transaction of a netting set to one of the following risk categories to determine the potential future exposure of the netting set referred to in Article 278:

- (a) interest rate risk;

- (b) foreign exchange risk;

- (c) credit risk;

- (d) equity risk;

- (e) commodity risk;

- (f) other risks.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Institutions shall conduct the mapping referred to in paragraph 1 on the basis of the primary risk driver of a derivative transaction. The primary risk driver shall be the only material risk driver of a derivative transaction.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

By way of derogation from paragraph 2, institutions shall map derivative transactions that have more than one material risk driver to more than one risk category. Where all the material risk drivers of one of those transactions belong to the same risk category, institutions shall only be required to map that transaction once to that risk category on the basis of the most material of those risk drivers. Where the material risk drivers of one of those transactions belong to different risk categories, institutions shall map that transaction once to each risk category for which the transaction has at least one material risk driver, on the basis of the most material of the risk drivers in that risk category.

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

Notwithstanding paragraphs 1, 2 and 3, when mapping transactions to the risk categories listed in paragraph 1, institutions shall apply the following requirements:

- (a) where the primary risk driver of a transaction, or the most material risk driver in a given risk category for transactions referred to in paragraph 3, is an inflation variable, institutions shall map the transaction to the interest rate risk category;

- (b) where the primary risk driver of a transaction, or the most material risk driver in a given risk category for transactions referred to in paragraph 3, is a climatic conditions variable, institutions shall map the transaction to the commodity risk category.

- 01/01/2022

- Legal Instruments that change this rule 4.

5.

[Note: Provision left blank]

- 01/01/2022

- Legal Instruments that change this rule 5.

Article 277a Hedging Sets

1.

Institutions shall establish the relevant hedging sets for each risk category of a netting set and assign each transaction to those hedging sets as follows:

- (a) transactions mapped to the interest rate risk category shall be assigned to the same hedging set only where their primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3), is denominated in the same currency;

- (b) transactions mapped to the foreign exchange risk category shall be assigned to the same hedging set only where their primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3)), is based on the same currency pair;

- (c) all the transactions mapped to the credit risk category shall be assigned to the same hedging set;

- (d) all the transactions mapped to the equity risk category shall be assigned to the same hedging set;

- (e) transactions mapped to the commodity risk category shall be assigned to one of the following hedging sets on the basis of the nature of their primary risk driver or the most material risk driver in the given risk category for transactions referred to in Article 277(3):

- (i) energy;

- (ii) metals;

- (iii) agricultural goods;

- (iv) other commodities;

- (v) climatic conditions;

- (f) transactions mapped to the other risks category shall be assigned to the same hedging set only where their primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3), is identical.

For the purposes of point (a) of the first subparagraph of this paragraph, transactions mapped to the interest rate risk category that have an inflation variable as the primary risk driver shall be assigned to separate hedging sets, other than the hedging sets established for transactions mapped to the interest rate risk category that do not have an inflation variable as the primary risk driver. Those transactions shall be assigned to the same hedging set only where their primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3), is denominated in the same currency.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

By way of derogation from paragraph 1 of this Article, institutions shall establish separate individual hedging sets in each risk category for the following transactions:

- (a) transactions for which the primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3), is either the market implied volatility or the realised volatility of a risk driver or the correlation between two risk drivers;

- (b) transactions for which the primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3), is the difference between two risk drivers mapped to the same risk category or transactions that consist of two payment legs denominated in the same currency and for which a risk driver from the same risk category of the primary risk driver is contained in the other payment leg than the one containing the primary risk driver.

For the purposes of point (a) of the first subparagraph of this paragraph, institutions shall assign transactions to the same hedging set of the relevant risk category only where their primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3), is identical.

For the purposes of point (b) of the first subparagraph, institutions shall assign transactions to the same hedging set of the relevant risk category only where the pair of risk drivers in those transactions as referred to therein is identical and the two risk drivers contained in this pair are positively correlated. Otherwise, institutions shall assign transactions referred to in point (b) of the first subparagraph to one of the hedging sets established in accordance with paragraph 1, on the basis of only one of the two risk drivers referred to in point (b) of the first subparagraph.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

Institutions shall make available upon request by the competent authorities the number of hedging sets established in accordance with paragraph 2 of this Article for each risk category, with the primary risk driver, or the most material risk driver in the given risk category for transactions referred to in Article 277(3), or the pair of risk drivers of each of those hedging sets and with the number of transactions in each of those hedging sets.

- 01/01/2022

- Legal Instruments that change this rule 3.

Export Article as

Article 278 Potential Future Exposure

1.

Institutions shall calculate the potential future exposure of a netting set as follows:

PFE = multiplier · AggAddOn

where:

PFE = the potential future exposure;

multiplier = the multiplication factor calculated in accordance with the formula referred to in paragraph 3;

AggAddOn = ∑a AddOn(a);

where:

a = the index that denotes the risk categories included in the calculation of the potential future exposure of the netting set;

AddOn(a) = the add-on for risk category a calculated in accordance with Articles 280a to 280f, as applicable.

For the purpose of this calculation, institutions shall include the add-on of a given risk category in the calculation of the potential future exposure of a netting set where at least one transaction of the netting set has been mapped to that risk category.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

The potential future exposure of multiple netting sets that are subject to one margin agreement, as referred in Article 275(3), shall be calculated as the sum of the potential future exposures of all the individual netting sets as if they were not subject to any form of a margin agreement.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

For the purposes of paragraph 1, the multiplier shall be calculated as follows:

where:

Floorm = 5%;

y = 2 . (1 – Floorm) . AggAddOn

z =

NICAi = the net independent collateral amount calculated only for transactions that are included in netting set i. NICAi shall be calculated at trade level or at netting set level depending on the margin agreement.

- 01/01/2022

- Legal Instruments that change this rule 3.

Article 279 Calculation of the Risk Position

For the purpose of calculating the risk category add-ons referred to in Articles 280a to 280f, institutions shall calculate the risk position of each transaction of a netting set as follows:

RiskPosition = δ · AdjNot · MF

where:

δ = the supervisory delta of the transaction calculated in accordance with the formula laid down in Article 279a;

AdjNot = the adjusted notional amount of the transaction calculated in accordance with Article 279b; and

MF = the maturity factor of the transaction calculated in accordance with the formula laid down in Article 279c.

Article 279a Supervisory Delta

1.

Institutions shall calculate the supervisory delta as follows:

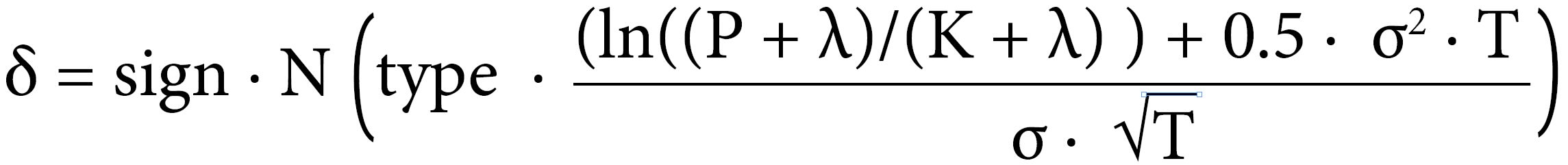

- (a) for call and put options that entitle the option buyer to purchase or sell an underlying instrument at a positive price on a single or multiple dates in the future, except where those options are mapped to the interest rate risk category, institutions shall use the following formula:

- where:

- δ = the supervisory delta;

- sign = – 1 where the transaction is a sold call option or a bought put option;

- sign = + 1 where the transaction is a bought call option or sold put option;

- type = – 1 where the transaction is a put option;

- type = + 1 where the transaction is a call option;

- N(x) = the cumulative distribution function for a standard normal random variable meaning the probability that a normal random variable with mean zero and variance of one is less than or equal to x;

- P = the spot or forward price of the underlying instrument of the option; for options the cash flows of which depend on an average value of the price of the underlying instrument, P shall be equal to the average value at the calculation date;

- K = the strike price of the option;

- T = the period between the expiry date of the option (Texp) and the calculation date; for options which can be exercised at one future date only, Texp is equal to that date; for options which can be exercised at multiple future dates, Texp is equal to the latest of those dates; T shall be expressed in years using business days;

- σ = the supervisory volatility of the option determined in accordance with Table 1 on the basis of the risk category of the transaction and the nature of the underlying instrument of the option; and

- λ = the presumed lowest possible extent to which prices of the underlying instrument of the option can become negative. The same parameter must be used consistently for all options in the same underlying instrument. For options on interest rates, the same parameter must be used consistently for all options in the same currency.

- Table 1

-

Risk category Underlying instrument Supervisory volatility Interest rate All 50% Foreign exchange All 15% Credit Single-name instrument 100% Multiple names instrument 80% Equity Single-name instrument 120% Multiple names instrument 75% Commodity Electricity 150% Other commodities (excluding electricity) 70% Others All 150% - Institutions using the forward price of the underlying instrument of an option shall ensure that:

- (i) the forward price is consistent with the characteristics of the option;

- (ii) the forward price is calculated using a relevant interest rate prevailing at the calculation date;

- (iii) the forward price integrates the expected cash flows of the underlying instrument before the expiry of the option;

- (b) for tranches of a synthetic securitisation and a nth-to-default credit derivative, institutions shall use the following formula:

- where:

- A = the attachment point of the tranche; for a nth-to-default credit derivative transaction based on reference entities k, A = (n – 1)/k; and

- D = the detachment point of the tranche; for a nth-to-default credit derivative transaction based on reference entities k, D = n/k;

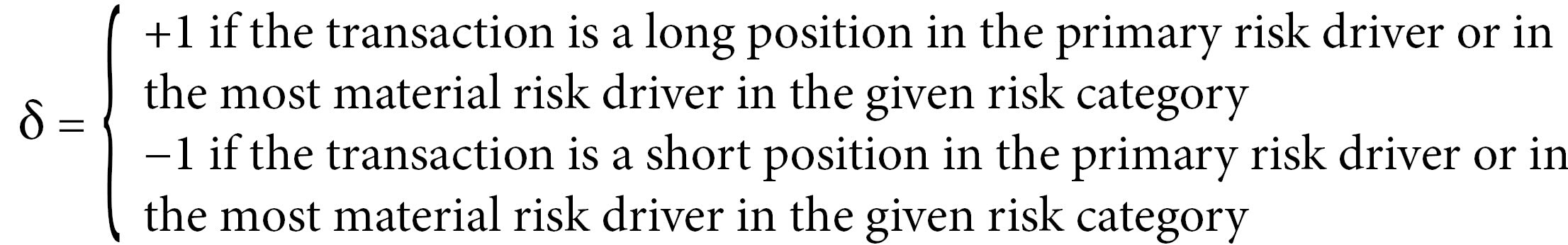

- (c) for transactions not referred to in point (a) or (b), institutions shall use the following supervisory delta:

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the purposes of this Section, a long position in the primary risk driver or in the most material risk driver in the given risk category for transactions referred to in Article 277(3) means that the market value of the transaction increases when the value of that risk driver increases and a short position in the primary risk driver or in the most material risk driver in the given risk category for transactions referred to in Article 277(3) means that the market value of the transaction decreases when the value of that risk driver increases.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

[Note: Provision left blank]

- 01/01/2022

- Legal Instruments that change this rule 3.

Article 279b Adjusted Notional Amount

1.

Institutions shall calculate the adjusted notional amount as follows:

- (a) for transactions mapped to the interest rate risk category or the credit risk category, institutions shall calculate the adjusted notional amount as the product of the notional amount of the derivative contract and the supervisory duration factor, which shall be calculated as follows:

-

- where:

- R = the supervisory discount rate; R = 5%;

- S = the period between the start date of a transaction and the calculation date, which shall be expressed in years using business days;

- E = the period between the end date of a transaction and the calculation date, which shall be expressed in years using business days.

- The start date of a transaction is the earliest date at which at least a contractual payment under the transaction, to or from the institution, is either fixed or exchanged, other than payments related to the exchange of collateral in a margin agreement. Where the transaction has already been fixing or making payments at the calculation date, the start date of a transaction shall be equal to 0.

- Where a transaction involves one or more contractual future dates on which the institution or the counterparty may decide to terminate the transaction prior to its contractual maturity, the start date of a transaction shall be equal to the earliest of the following:

- (i) the date or the earliest of the multiple future dates at which the institution or the counterparty may decide to terminate the transaction earlier than its contractual maturity;

- (ii) the date at which a transaction starts fixing or making payments, other than payments related to the exchange of collateral in a margin agreement.

- Where a transaction has a financial instrument as the underlying instrument that may give rise to contractual obligations additional to those of the transaction, the start date of a transaction shall be determined on the basis of the earliest date at which the underlying instrument starts fixing or making payments.

- The end date of a transaction is the latest date at which a contractual payment under the transaction, to or from the institution, is or may be exchanged.

- Where a transaction has a financial instrument as an underlying instrument that may give rise to contractual obligations additional to those of the transaction, the end date of a transaction shall be determined on the basis of the last contractual payment of the underlying instrument of the transaction.

- Where a transaction is structured to settle an outstanding exposure following specified payment dates and where the terms are reset so that the market value of the transaction is zero on those specified dates, the settlement of the outstanding exposure at those specified dates is considered a contractual payment under the same transaction;

- (b) for transactions mapped to the foreign exchange risk category, institutions shall calculate the adjusted notional amount as follows:

- (i) where the transaction consists of one payment leg, the adjusted notional amount shall be the notional amount of the derivative contract;

- (ii) where the transaction consists of two payment legs and the notional amount of one payment leg is denominated in the institution's reporting currency, the adjusted notional amount shall be the notional amount of the other payment leg;

- (iii) where the transaction consists of two payment legs and the notional amount of each payment leg is denominated in a currency other than the institution's reporting currency, the adjusted notional amount shall be the largest of the notional amounts of the two payment legs after those amounts have been converted into the institution's reporting currency at the prevailing spot exchange rate;

- (c) for transactions mapped to the equity risk category or commodity risk category, institutions shall calculate the adjusted notional amount as the product of the market price of one unit of the underlying instrument of the transaction and the number of units in the underlying instrument referenced by the transaction;

- where a transaction mapped to the equity risk category or commodity risk category is contractually expressed as a notional amount, institutions shall use the notional amount of the transaction rather than the number of units in the underlying instrument as the adjusted notional amount;

- (d) for transactions mapped to the other risks category, institutions shall calculate the adjusted notional amount on the basis of the most appropriate method among the methods set out in points (a), (b) and (c), depending on the nature and characteristics of the underlying instrument of the transaction.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Institutions shall determine the notional amount or number of units of the underlying instrument for the purpose of calculating the adjusted notional amount of a transaction referred to in paragraph 1 as follows:

- (a) where the notional amount or the number of units of the underlying instrument of a transaction is not fixed until its contractual maturity:

- (i) for deterministic notional amounts and numbers of units of the underlying instrument, the notional amount shall be the weighted average of all the deterministic values of notional amounts or number of units of the underlying instrument, as applicable, until the contractual maturity of the transaction, where the weights are the proportion of the time period during which each value of notional amount applies;

- (ii) for stochastic notional amounts and numbers of units of the underlying instrument, the notional amount shall be the amount determined by fixing current market values within the formula for calculating the future market values;

- (b) for contracts with multiple exchanges of the notional amount, the notional amount shall be multiplied by the number of remaining payments still to be made in accordance with the contracts;

- (c) for contracts that provide for a multiplication of the cash-flow payments or a multiplication of the underlying of the derivative contract, the notional amount shall be adjusted by an institution to take into account the effects of the multiplication on the risk structure of those contracts.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

Institutions shall convert the adjusted notional amount of a transaction into their reporting currency at the prevailing spot exchange rate where the adjusted notional amount is calculated under this Article from a contractual notional amount or a market price of the number of units of the underlying instrument denominated in another currency.

- 01/01/2022

- Legal Instruments that change this rule 3.

Article 279c Maturity Factor

1.

Institutions shall calculate the maturity factor as follows:

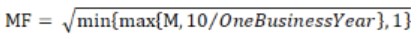

- (a) for transactions included in the netting sets referred to in Article 275(1), institutions shall use the following formula:

- where:

- MF = the maturity factor;

- M = the remaining maturity of the transaction which is equal to the period of time needed for the termination of all contractual obligations of the transaction; for that purpose, any optionality of a derivative contract shall be considered to be a contractual obligation; the remaining maturity shall be expressed in years using business days;

- where a transaction has another derivative contract as underlying instrument that may give rise to additional contractual obligations beyond the contractual obligations of the transaction, the remaining maturity of the transaction shall be equal to the period of time needed for the termination of all contractual obligations of the underlying instrument;

- where a transaction is structured to settle outstanding exposure following specified payment dates and where the terms are reset so that the market value of the transaction is zero on those specified dates, the remaining maturity of the transaction shall be equal to the time until the next reset date; and

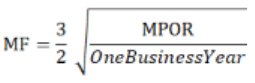

- (b) for transactions included in the netting sets referred to in Article 275(2) and (3), the maturity factor is defined as:

-

- where:

- MF = the maturity factor;

- MPOR = the margin period of risk of the netting set determined in accordance with Article 285(2) to (5); and

- When determining the margin period of risk for transactions between a client and a clearing member, an institution acting either as the client or as the clearing member shall replace the minimum period set out in point (b) of Article 285(2) with five business days.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the purposes of paragraph 1, the remaining maturity shall be equal to the period of time until the next reset date for transactions that are structured to settle outstanding exposure following specified payment dates and where the terms are reset in such a way that the market value of the contract shall be zero on those specified payment dates.

- 01/01/2022

- Legal Instruments that change this rule 2.

Export Article as

Article 280 Hedging Set Supervisory Factor Coefficient

For the purpose of calculating the add-on of a hedging set as referred to in Articles 280a to 280f, the hedging set supervisory factor coefficient ‘ε’ shall be the following:

ε = 1 for the hedging sets established in accordance with Article 277a(1)

5 for the hedging sets established in accordance with point (a) of Article 277a(2)

0.5 for the hedging sets established in accordance with point (b) of Article 277a(2)

Article 280a Interest Rate Risk Category Add-On

1.

For the purposes of Article 278, institutions shall calculate the interest rate risk category add-on for a given netting set as follows:

where:

AddOnIR = the interest rate risk category add-on;

j = the index that denotes all the interest risk rate hedging sets established in accordance with point (a) of Article 277a(1) and with Article 277a(2) for the netting set; and

= the interest rate risk category add-on for hedging set j calculated in accordance with paragraph 2.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Institutions shall calculate the interest rate risk category add-on for hedging set j as follows:

where:

εj = the hedging set supervisory factor coefficient of hedging set j determined in accordance with the applicable value specified in Article 280;

SFIR = the supervisory factor for the interest rate risk category with a value equal to 0.5%; and

EffNotIR = the effective notional amount of hedging set j calculated in accordance with paragraph 3.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

For the purpose of calculating the effective notional amount of hedging set j, institutions shall first map each transaction of the hedging set to the appropriate bucket in Table 2. They shall do so on the basis of the end date of each transaction as determined under point (a) of Article 279b(1):

Table 2

| Bucket | End date (in years) |

| 1 | > 0 and <= 1 |

| 2 | > 1 and <= 5 |

| 3 | > 5 |

Institutions shall then calculate the effective notional amount of hedging set j in accordance with the following formula:

where:

= the effective notional amount of hedging set j; and

Dj,k = the effective notional amount of bucket k of hedging set j calculated as follows:

where:

l = the index that denotes the risk position.

- 01/01/2022

- Legal Instruments that change this rule 3.

Article 280b Foreign Exchange Risk Category Add-On

1.

For the purposes of Article 278, institutions shall calculate the foreign exchange risk category add-on for a given netting set as follows:

where:

AddOnFX = the foreign exchange risk category add on;

J = the index that denotes the foreign exchange risk hedging sets established in accordance with point (b) of Article 277a(1) and with Article 277a(2) for the netting set; and

= the foreign exchange risk category add-on for hedging set j calculated in accordance with paragraph 2.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

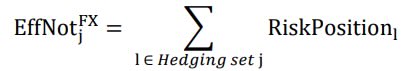

Institutions shall calculate the foreign exchange risk category add-on for hedging set j as follows:

where:

εj the hedging set supervisory factor coefficient of hedging set j determined in accordance with Article 280;

SFFX the supervisory factor for the foreign exchange risk category with a value equal to 4%;

the effective notional amount of hedging set j calculated as follows:

where:

l = the index that denotes the risk position

- 01/01/2022

- Legal Instruments that change this rule 2.

Article 280c Credit Risk Category Add-On

1.

For the purposes of paragraph 2, institutions shall establish the relevant credit reference entities of the netting set in accordance with the following:

- (a) there shall be one credit reference entity for each issuer of a reference debt instrument that underlies a single-name transaction allocated to the credit risk category; single-name transactions shall be assigned to the same credit reference entity only where the underlying reference debt instrument of those transactions is issued by the same issuer;

- (b) there shall be one credit reference entity for each group of reference debt instruments or single-name credit derivatives that underlie a multi-name transaction allocated to the credit risk category; multi-names transactions shall be assigned to the same credit reference entity only where the group of underlying reference debt instruments or single-name credit derivatives of those transactions have the same constituents.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the purposes of Article 278, institutions shall calculate the credit risk category add-on for a given netting set as follows:

where:

= credit risk category add-on;

j = the index that denotes all the credit risk hedging sets established in accordance with point (c) of Article 277a(1) and with Article 277a(2) for the netting set; and

= the credit risk category add-on for hedging set j calculated in accordance with paragraph 3.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

Institutions shall calculate the credit risk category add-on for hedging set j as follows:

where:

= the credit risk category add-on for hedging set j;

εj = the hedging set supervisory factor coefficient of hedging set j determined in accordance with Article 280;

k = the index that denotes the credit reference entities of the netting set established in accordance with paragraph 1;

= the correlation factor of the credit reference entity k; where the credit reference entity k has been established in accordance with point (a) of paragraph 1,

= 50%, where the credit reference entity k has been established in accordance with point (b) of paragraph 1,

= 80%; and

AddOn(Entityk) = the add-on for the credit reference entity k determined in accordance with paragraph 4.

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

Institutions shall calculate the add-on for the credit reference entity k as follows:

where:

the effective notional amount of the credit reference entity k calculated as follows:

where:

l = the index that denotes the risk position; and

= the supervisory factor applicable to the credit reference entity k calculated in accordance with paragraph 5.

- 01/01/2022

- Legal Instruments that change this rule 4.

5.

Institutions shall calculate the supervisory factor applicable to the credit reference entity k as follows:

- (a) for the credit reference entity k established in accordance with point (a) of paragraph 1,

shall be mapped to one of the six supervisory factors set out in Table 3 of this paragraph on the basis of an external credit assessment by a nominated ECAI of the corresponding individual issuer; for an individual issuer for which a credit assessment by a nominated ECAI is not available:

- (i) an institution using the approach referred to in Chapter 3 shall map the internal rating of the individual issuer to one of the external credit assessments;

- (ii) an institution using the approach referred to in Chapter 2 shall assign

= 0.54% to that credit reference entity; however, where an institution applies Article 128 to risk weight counterparty credit risk exposures to that individual issuer,

=1.6% shall be assigned to that credit reference entity;

- (b) for the credit reference entity k established in accordance with point (b) of paragraph 1:

- (i) where a risk position l assigned to the credit reference entity k is a credit index listed on a recognised exchange,

shall be mapped to one of the two supervisory factors set out in Table 4 of this paragraph on the basis of the credit quality of the majority of its individual constituents;

- (ii) where a risk position l assigned to the credit reference entity k is not referred to in point (i) of this point,

shall be the weighted average of the supervisory factors mapped to each constituent in accordance with the method set out in point (a), where the weights are defined by the proportion of notional of the constituents in that position.

Table 3

| Credit quality step | Supervisory factor for single-name transactions |

| 1 | 0.38% |

| 2 | 0.42% |

| 3 | 0.54% |

| 4 | 1.06% |

| 5 | 1.6% |

| 6 | 6.0% |

Table 4

| Dominant credit quality | Supervisory factor for quoted indices |

| Investment grade | 0.38% |

| Non-investment grade | 1.06% |

- 01/01/2022

- Legal Instruments that change this rule 5.

Article 280d Equity Risk Category Add-On

1.

For the purposes of paragraph 2, institutions shall establish the relevant equity reference entities of the netting set in accordance with the following:

- (a) there shall be one equity reference entity for each issuer of a reference equity instrument that underlies a single-name transaction allocated to the equity risk category; single-name transactions shall be assigned to the same equity reference entity only where the underlying reference equity instrument of those transactions is issued by the same issuer;

- (b) there shall be one equity reference entity for each group of reference equity instruments or single-name equity derivatives that underlie a multi-name transaction allocated to the equity risk category; multi-names transactions shall be assigned to the same equity reference entity only where the group of underlying reference equity instruments or single-name equity derivatives of those transactions, as applicable, has the same constituents.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the purposes of Article 278, institutions shall calculate the equity risk category add-on for a given netting set as follows:

where:

AddOnEquity = the equity risk category add-on;

j = the index that denotes all the equity risk hedging sets established in accordance with point (d) of Article 277a(1) and Article 277a(2) for the netting set; and

= the equity risk category add-on for hedging set j calculated in accordance with paragraph 3.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

Institutions shall calculate the equity risk category add-on for hedging set j as follows:

where:

= the equity risk category add-on for hedging set j;

εj = the hedging set supervisory factor coefficient of hedging set j determined in accordance with Article 280;

k = the index that denotes the equity reference entities of the netting set established in accordance with paragraph 1;

= the correlation factor of the equity reference entity k; where the equity reference entity k has been established in accordance with point (a) of paragraph 1,

= 50%; where the equity reference has been established in accordance with point (b) of paragraph 1,

= 80%; and

AddOn(Entityk) = the add-on for the equity reference entity k determined in accordance with paragraph 4.

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

Institutions shall calculate the add-on for the equity reference entity k as follows:

where:

AddOn(Entityk) = the add-on for the equity reference entity k;

= the supervisory factor applicable to the equity reference entity k; where the equity reference entity k has been established in accordance with point (a) of paragraph 1,

= 32%; where the equity reference entity k has been established in accordance with point (b) of paragraph 1,

= 20%; and

= the effective notional amount of the equity reference entity k calculated as follows:

where:

l = the index that denotes the risk position.

- 01/01/2022

- Legal Instruments that change this rule 4.

Article 280e Commodity Risk Category Add-On

1.

For the purposes of Article 278, institutions shall calculate the commodity risk category add-on for a given netting set as follows:

where:

AddOnCom = the commodity risk category add-on;

j = the index that denotes the commodity hedging sets established in accordance with point (e) of Article 277a(1) and with Article 277a(2) for the netting set; and

= the commodity risk category add-on for hedging set j calculated in accordance with paragraph 4.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the purpose of calculating the add-on for a commodity hedging set of a given netting set in accordance with paragraph 4, institutions shall establish the relevant commodity reference types of each hedging set. Commodity derivative transactions shall be assigned to the same commodity reference type only where the underlying commodity instrument of those transactions has the same nature, irrespective of the delivery location and quality of the commodity instrument.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

[Note: Provision left blank]

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

Institutions shall calculate the commodity risk category add-on for hedging set j as follows:

where:

= the commodity risk category add-on for hedging set j;

εj = the hedging set supervisory factor coefficient of hedging set j determined in accordance with Article 280;

= the correlation factor of the commodity risk category with a value equal to 40%;

k = the index that denotes the commodity reference types of the netting set established in accordance with paragraph 2; ande

= the add-on for the commodity reference type k calculated in accordance with paragraph 5.

- 01/01/2022

- Legal Instruments that change this rule 4.

5.

Institutions shall calculate the add-on for the commodity reference type k as follows:

where:

= the add-on for the commodity reference type k;

= the supervisory factor applicable to the commodity reference type k; where the commodity reference type k corresponds to transactions allocated to the hedging set referred to in point (e) of Article 277a(1), excluding transactions concerning electricity,

= 18%; for transactions concerning electricity,

= 40%; and

=the effective notional amount of the commodity reference type k calculated as follows:

where:

l = the index that denotes the risk position.

- 01/01/2022

- Legal Instruments that change this rule 5.

Article 280f Other Risks Category Add-On

1.

For the purposes of Article 278, institutions shall calculate the other risks category add-on for a given netting set as follows:

where:

AddOnOther = the other risks category add-on;

j = the index that denotes the other risk hedging sets established in accordance with point (f) of Article 277a(1) and Article 277a(2) for the netting set; and

= the other risks category add-on for hedging set j calculated in accordance with paragraph 2.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Institutions shall calculate the other risks category add-on for hedging set j as follows:

where:

= the other risks category add-on for hedging set j;

εj = the hedging set supervisory factor coefficient of hedging set j determined in accordance with Article 280;

SFOther= the supervisory factor for the other risk category with a value equal to 8%; and

= the effective notional amount of hedging set j calculated as follows:

where:

l = the index that denotes the risk position.

- 01/01/2022

- Legal Instruments that change this rule 2.

Section 4 Simplified Standardised Approach for Counterparty Credit Risk

Article 281 Calculation of the Exposure Value

1.

Institutions shall calculate a single exposure value at netting set level in accordance with Section 3, subject to paragraph 2 of this Article.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

The exposure value of a netting set shall be calculated in accordance with the following requirements:

- (a) institutions shall not apply the treatment referred to in Article 274(6);

- (b) by way of derogation from Article 275(1), for netting sets that are not referred to in Article 275(2), institutions shall calculate the replacement cost in accordance with the following formula:

- RC = max{CMV, 0}

- where:

- RC = the replacement cost; and

- CMV = the current market value.

- (c) by way of derogation from Article 275(2), for netting sets of transactions: that are traded on a recognised exchange; that are centrally cleared by a central counterparty authorised in accordance with Article 14 of Regulation (EU) No 648/2012 or recognised in accordance with Article 25 of that Regulation; or for which collateral is exchanged bilaterally with the counterparty in accordance with Article 11 of Regulation (EU) No 648/2012, institutions shall calculate the replacement cost in accordance with the following formula:

- RC = TH + MTA

- where:

- RC = the replacement cost;

- TH = the margin threshold applicable to the netting set under the margin agreement below which the institution cannot call for collateral; and

- MTA = the minimum transfer amount applicable to the netting set under the margin agreement;

- (d) by way of derogation from Article 275(3), for multiple netting sets that are subject to a margin agreement, institutions shall calculate the replacement cost as the sum of the replacement cost of each individual netting set, calculated in accordance with paragraph 1 as if they were not margined;

- (e) all hedging sets shall be established in accordance with Article 277a(1);

- (f) institutions shall set to 1 the multiplier in the formula that is used to calculate the potential future exposure in Article 278(1), as follows:

-

- where:

- PFE = the potential future exposure; and

- AddOn(a) = the add-on for risk category a;

- (g) by way of derogation from Article 279a(1), for all transactions, institutions shall calculate the supervisory delta as follows:

- δ =

- where:

- δ = the supervisory delta;

- (h) the formula referred to in point (a) of Article 279b(1) that is used to compute the supervisory duration factor shall read as follows:

- supervisory duration factor = E – S

- where:

- E = the period between the end date of a transaction and the calculation date; and

- S = the period between the start date of a transaction and the calculation date;

- (i) the maturity factor referred to in Article 279c(1) shall be calculated as follows:

- (i) for transactions included in netting sets referred to in Article 275(1), MF = 1;

- (ii) for transactions included in netting sets referred to in Article 275(2) and (3), MF = 0.42;

- (j) the formula referred to in Article 280a(3) that is used to calculate the effective notional amount of hedging set j shall read as follows:

-

- where:

-

= the effective notional amount of hedging set j; and

- Dj,k = the effective notional amount of bucket k of hedging set j;

- (k) the formula referred to in Article 280c(3) that is used to calculate the credit risk category add-on for hedging set j shall read as follows:

-

- where:

-

= the credit risk category add-on for hedging set j; and

- AddOn(Entityk) = the add-on for the credit reference entity k;

- (l) the formula referred to in Article 280d(3) that is used to calculate the equity risk category add-on for hedging set j shall read as follows:

-

- where:

-

= the equity risk category add-on for hedging set j; and

- AddOn(Entityk) = the add-on for the credit reference entity k;

- (m) the formula referred to in Article 280e(4) that is used to calculate the commodity risk category add-on for hedging set j of the commodity risk category in Article 280e(3) shall read as follows:

-

- where:

-

= the commodity risk category add-on for hedging set j; and

-

= the add-on for the commodity reference type k.

- 01/01/2022

- Legal Instruments that change this rule 2.

Section 5 Original Exposure Method

Article 282 Calculation of the Exposure Value

1.

Institutions may calculate a single exposure value for all the transactions within a contractual netting agreement where all the conditions set out in Article 274(1) are met. Otherwise, institutions shall calculate an exposure value separately for each transaction, which shall be treated as its own netting set.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

The exposure value of a netting set or a transaction shall be the product of 1.4 times the sum of the current replacement cost and the potential future exposure.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

The current replacement cost referred to in paragraph 2 shall be calculated as follows:

- (a) for netting sets of transactions: that are traded on a recognised exchange; centrally cleared by a central counterparty authorised in accordance with Article 14 of Regulation (EU) No 648/2012 or recognised in accordance with Article 25 of that Regulation; or for which collateral is exchanged bilaterally with the counterparty in accordance with Article 11 of Regulation (EU) No 648/2012, institutions shall use the following formula:

- RC = TH + MTA

- where:

- RC = the replacement cost;

- TH = the margin threshold applicable to the netting set under the margin agreement below which the institution cannot call for collateral; and

- MTA = the minimum transfer amount applicable to the netting set under the margin agreement;

- (b) for all other netting sets or individual transactions, institutions shall use the following formula:

- RC = max{CMV, 0}

- where:

- RC = the replacement cost; and

- CMV = the current market value.

In order to calculate the current replacement cost, institutions shall update current market values at least monthly.

- 01/01/2022

- Legal Instruments that change this rule 3.

4.

Institutions shall calculate the potential future exposure referred to in paragraph 2 as follows:

- (a) the potential future exposure of a netting set is the sum of the potential future exposure of all the transactions included in the netting set, calculated in accordance with point (b);

- (b) the potential future exposure of a single transaction is its notional amount multiplied by:

- (i) the product of 0.5% and the residual maturity of the transaction expressed in years for interest-rate derivative contracts;

- (ii) the product of 6% and the residual maturity of the transaction expressed in years for credit derivative contracts;

- (iii) 4% for foreign-exchange derivatives;

- (iv) 18% for gold and commodity derivatives other than electricity derivatives;

- (v) 40% for electricity derivatives;

- (vi) 32% for equity derivatives;

- (c) the notional amount referred to in point (b) of this paragraph shall be determined in accordance with Article 279b(2) and (3) for all derivatives listed in that point; in addition, the notional amount of the derivatives referred to in points (b)(iii) to (b)(vi) of this paragraph shall be determined in accordance with points (b) and (c) of Article 279b(1);

- (d) the potential future exposure of netting sets referred to in point (a) of paragraph 3 shall be multiplied by 0.42.

For calculating the potential exposure of interest-rate derivatives and credit derivatives in accordance with points b(i) and (b)(ii), an institution may choose to use the original maturity instead of the residual maturity of the contracts.

[Note: Articles 283 to 299 remain in the CRR]

- 01/01/2022

- Legal Instruments that change this rule 4.

Section 9 Own Funds Requirements for Exposures to a Central Counterparty

Article 301 Material Scope

1.

This Section applies to the following contracts and transactions, for as long as they are outstanding with a CCP:

- (a) the derivative contracts listed in Annex II of the CRR and credit derivatives;

- (b) securities financing transactions and fully guaranteed deposit lending or borrowing transactions; and

- (c) long settlement transactions.

This Section does not apply to exposures arising from the settlement of cash transactions. Institutions shall apply the treatment laid down in Title V to trade exposures arising from those transactions and a 0% risk weight to default fund contributions covering only those transactions. Institutions shall apply the treatment set out in Article 307 to default fund contributions that cover any of the contracts listed in the first subparagraph of this paragraph in addition to cash transactions.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the purposes of this Section, the following requirements shall apply:

- (a) the initial margin shall not include contributions to a CCP for mutualised loss sharing arrangements;

- (b) the initial margin shall include collateral deposited by an institution acting as a clearing member or by a client in excess of the minimum amount required respectively by the CCP or by the institution acting as a clearing member, provided the CCP or the institution acting as a clearing member may, in appropriate cases, prevent the institution acting as a clearing member or the client from withdrawing such excess collateral;

- (c) where a CCP uses the initial margin to mutualise losses among its clearing memberss, institutions that act as clearing members shall treat that initial margin as a default fund contribution.

[Note: This rule corresponds to Article 301 of the CRR as it applied immediately before revocation by the Treasury.]

- 01/01/2022

- Legal Instruments that change this rule 2.

Export Article as

Article 302 Monitoring of Exposures to CCPs

1.

Institutions shall monitor all their exposures to CCPs and shall lay down procedures for the regular reporting of information on those exposures to senior management and appropriate committee or committees of the management body.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Institutions shall assess, through appropriate scenario analysis and stress testing, whether the level of own funds held against exposures to a CCP, including potential future or contingent credit exposures, exposures from default fund contributions and, where the institution is acting as a clearing member, exposures resulting from contractual arrangements as laid down in Article 304, adequately relates to the inherent risks of those exposures.

[Note: This rule corresponds to Article 302 of the CRR as it applied immediately before revocation by the Treasury.]

- 01/01/2022

- Legal Instruments that change this rule 2.

Article 303 Treatment of Clearing Members' Exposures to CCPs

1.

An institution that acts as a clearing member, either for its own purposes or as a financial intermediary between a client and a CCP, shall calculate the own funds requirements for its exposures to a CCP as follows:

- (a) it shall apply the treatment set out in Article 306 to its trade exposures with the CCP;

- (b) it shall apply the treatment set out in Article 307 to its default fund contributions to the CCP.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

For the purposes of paragraph 1, the sum of an institution's own funds requirements for its exposures to a QCCP due to trade exposures and default fund contributions shall be subject to a cap equal to the sum of own funds requirements that would be applied to those same exposures if the CCP were a non-qualifying CCP.

[Note: This rule corresponds to Article 303 of the CRR as it applied immediately before revocation by the Treasury.]

- 01/01/2022

- Legal Instruments that change this rule 2.

Article 304 Treatment of Clearing Members' Exposures to Clients

1.

An institution that acts as a clearing member and, in that capacity, acts as a financial intermediary between a client and a CCP shall calculate the own funds requirements for its CCP-related transactions with that client in accordance with Sections 1 to 8 of this Chapter, with Section 4 of Chapter 4 of this Title and with Title VI, as applicable.

- 01/01/2022

- Legal Instruments that change this rule 1.

2.

Where an institution acting as a clearing member enters into a contractual arrangement with a clientt of another clearing member that facilitates, in accordance with Article 48(5) and (6), of Regulation (EU) No 648/2012, the transfer of positions and collateral referred to in Article 305(2)(b) for that client, and that contractual agreement gives rise to a contingent obligation for that institution, that institution may attribute an exposure value of zero to that contingent obligation.

- 01/01/2022

- Legal Instruments that change this rule 2.

3.

Where an institution that acts as a clearing member uses the methods set out in Section 3 or 6 of this Chapter to calculate the own funds requirement for its exposures, the following provisions shall apply:

- (a) by way of derogation from Article 285(2), the institution may use a margin period of risk of at least five business days for its exposures to a client;