BIPRU 1

Application

BIPRU 1.1

Application

- 01/01/2007

BIPRU 1.1.1

See Notes

There is no overall application statement for BIPRU. Each chapter or section has its own application statement. Broadly speaking however, BIPRU applies to:

- (1) a bank;

- (2) a building society;

- (3) a BIPRU investment firm; and

- (4) groups containing such firms.

BIPRU 1.1.2

See Notes

BIPRU 1.1.3

See Notes

Purpose

BIPRU 1.1.4

See Notes

Guidance on the categorisation of BIPRU investment firms

BIPRU 1.1.5

See Notes

The definition of a BIPRU firm

BIPRU 1.1.6

See Notes

Subject to BIPRU 1.1.7 R, a BIPRU firm means a firm that is:[deleted]

- (1) a building society; or

- (2) a bank; or

- (3) a full scope BIPRU investment firm; or

- (4) a BIPRU limited licence firm; or

- (5) a BIPRU limited activity firm.

BIPRU 1.1.7

See Notes

None of the following is a BIPRU firm and each of the following is excluded from each of the categories of BIPRU investment firm listed in BIPRU 1.1.6 R (3) to BIPRU 1.1.6R (5) and BIPRU 1.1.18 R (2) to (4):

- (1) an incoming EEA firm;

- (2) an incoming Treaty firm;

- (3) any other overseas firm;

- (4) an ELMI;

- (5) an insurer; and

- (6) an ICVC.

BIPRU 1.1.8

See Notes

BIPRU 1.1.9

See Notes

BIPRU 1.1.10

See Notes

- (1) This paragraph applies to an undertaking that would be a third country BIPRU firm if it were authorised under the Act.

- (2) Except in exceptional circumstances, it is the FSA's policy that it will not give an overseas applicant a Part IV permission unless the FSA is satisfied that the applicant will be subject to prudential regulation by its home state regulatory body that is broadly equivalent to that provided for in the Handbook and the applicable EEA prudential sectoral legislation. The FSA will take into account not only the requirements to which the firm is subject but how they are enforced. The FSA will also take into account the laws, regulations and administrative provisions to which it is subject in its home state. The reasons for that policy include:

- (a) it is unlikely that a firm that is not subject to equivalent supervision will be able to satisfy the threshold conditions (and in particular threshold condition 5 (Suitability)) and it is unlikely that it will be possible to establish that the firm does satisfy them;

- (b) such a firm is likely to pose a threat to the interests of consumers and potential consumers, particularly as effective supervision of an overseas firm depends on cooperation between the FSA and the regulatory body that authorises the firm in its home country and on the FSA being able to place appropriate reliance on the supervision carried out by such regulatory body; and

- (c) under Article 38(1) of the Banking Consolidation Directive the FSA should not apply to branches of credit institutions having their head office outside the EEA, when commencing or carrying on their business, provisions which result in more favourable treatment than that accorded to branches of credit institutions having their head office in the EEA.

- (3) If an undertaking is not subject to equivalent supervision in its home state and it wishes to carry on in the United Kingdom regulated activities coming within the scope of the activities that define a BIPRU firm it should establish a subsidiary undertaking in the United Kingdom. Such a subsidiary undertaking should be able to show, amongst other things, how it would comply with the threshold conditions (and in particular threshold conditions 3 (Close links) and 5 (Suitability)).

- (4) If in exceptional circumstances the FSA does grant a Part IV permission to an undertaking that is not subject to equivalent prudential regulation the FSA is likely to take measures under the regulatory system to compensate for the lack of equivalent supervision. These may include applying the prudential requirements for BIPRU firms to the firm.

- (5) An overseas firm that is subject to equivalent supervision is subject to the threshold conditions and the Principles. BIPRU and GENPRU do not generally apply. However BIPRU 12 applies to a credit institution with respect to liquidity risk in relation to its United Kingdom branch.

Types of investment firm: Limited activity firms

BIPRU 1.1.11

See Notes

A limited activity firm means (as specified by Article 20(3) of the Capital Adequacy Directive (Exemptions from operational risk)) a CAD investment firm that satisfies the following conditions:

- (1) it meets the criteria in (a) or the criteria in (b):

- (a) it deals on own account only:

- (i) for the purpose of fulfilling or executing a client order; or

- (ii) for the purpose of gaining entrance to a clearing and settlement system or a recognised investment exchange or designated investment exchange when acting in an agency capacity or executing a client order; or

- (b) it satisfies the following conditions:

- (i) it does not hold client money or securities in relation to investment services that it provides and is not authorised to do so;

- (ii) the only investment service it undertakes is dealing on own account;

- (iii) it has no external customers in relation to investment services it provides; and

- (iv) the execution and settlement of its transactions in relation to investment services it provides takes place under the responsibility of a clearing institution and are guaranteed by that clearing institution;

- (2) (in the case of a CAD investment firm that is a BIPRU investment firm) its base capital resources requirement is €730,000;

- (3) (in the case of a CAD investment firm that is an EEA firm) it is subject to the CRD implementation measures of its Home State for Article 9 of the Capital Adequacy Directive (Initial capital requirement of €730,000); and

- (4) (in the case of any other CAD investment firm) its base capital resources requirement would be €730,000 if it had been a BIPRU investment firm on the basis of the assumptions in BIPRU 1.1.14 R (3)(a) and BIPRU 1.1.14 R (3)(b).

Types of investment firm: Limited licence firms

BIPRU 1.1.12

See Notes

A limited licence firm means (as specified by Article 20(2) of the Capital Adequacy Directive (Exemptions from operational risk)) a CAD investment firm that is not authorised to:

- (1) deal on own account; or

- (2) provide the investment services of underwriting or placing financial instruments (as referred to in point 6 of Section A of Annex I of MiFID) on a firm commitment basis.

Types of investment firm: CAD full scope firm

BIPRU 1.1.13

See Notes

Types of investment firm: CAD investment firm

BIPRU 1.1.14

See Notes

- (1) In accordance with Article 3(1)(b) of the Capital Adequacy Directive, a person is a CAD investment firm if it falls into (2) or (3).

- (2) A person whose head office is in an EEA State is a CAD investment firm if it is an investment firm that is subject to the requirements imposed by MiFID but excludes the following:

- (a) a bank, a building society or an ELMI;

- (b) a credit institution;

- (c) a local; and

- (d) an exempt CAD firm.

- (3) An investment firm whose head office is not in an EEA State is a CAD investment firm if it would have fallen into (2) if:

BIPRU 1.1.15

See Notes

The following are excluded from the definition of a CAD investment firm and hence from the definition of BIPRU investment firm:

- (1) an investment firm to which MiFID does not apply under Article 2(1); and

- (2) an investment firm with the benefit of an exemption pursuant to Article 3 of MiFID.

Types of investment firm: Exempt CAD firm

BIPRU 1.1.16

See Notes

In accordance with Article 3(1)(b)(iii) of the Capital Adequacy Directive (Definitions), an exempt CAD firm means an investment firm that satisfies the following conditions:

- (1) it would have been a CAD investment firm if exempt CAD firms were not excluded from the definition; and

- (2) it is only authorised to provide the service of investment advice and/or receive and transmit orders from investors (as referred to in Section A of Annex I of MiFID) without in both cases holding money or securities belonging to its clients and which for that reason may not at any time place itself in debit with its clients.

Types of BIPRU investment firm

BIPRU 1.1.17

See Notes

- (1) A BIPRU limited licence firm means a limited licence firm that falls into (4).

- (2) A BIPRU limited activity firm means a limited activity firm that falls into (4).

- (3) A full scope BIPRU investment firm means a CAD full scope firm that falls into (4).

- (4) A limited licence firm, limited activity firm or CAD full scope firm falls into (4) if:

- (a) it is a firm; and

- (b) its head office is in the United Kingdom and it is not otherwise excluded from the definition of BIPRU firm under BIPRU 1.1.7 R.

Alternative classification of BIPRU investment firms

BIPRU 1.1.18

See Notes

BIPRU investment firm are divided into the following classes for the purposes of the calculation of the base capital resources requirement and for the purpose of any other provision of the Handbook that applies this classification:

- (1) a UCITS investment firm;

- (2) a BIPRU 50K firm;

- (3) a BIPRU 125K firm; and

- (4) a BIPRU 730K firm.

Types of investment firm: BIPRU 125K firm

BIPRU 1.1.19

See Notes

A BIPRU 125K firm means a BIPRU investment firm that satisfies the following conditions:

- (1) it does not:

- (a) deal on own account; or

- (b) underwrite issues of financial instruments (as referred in Section A of Annex I of MiFID) on a firm commitment basis;

- (2) it holds clients' money or securities in relation to investment services it provides or is authorised to do so;

- (3) it offers one or more of the following services (all as referred to in Section A of Annex I of MiFID):

- (a) reception and transmission of investors' orders for financial instruments; or

- (b) the execution of investors' orders for financial instruments; or

- (c) the management of individual portfolios of investments in financial instruments;

- (4) it is not a UCITS investment firm and;

- (5) it does not operate a multilateral trading facility.

Types of investment firm: BIPRU 50K firm

BIPRU 1.1.20

See Notes

A BIPRU 50K firm means a BIPRU investment firm that satisfies the following conditions:

- (1) it satisfies the conditions in BIPRU 1.1.19 R (1) and (3);

- (2) it does not hold clients' money or securities in relation to investment services it provides and it is not authorised to do so;

- (3) it is not a UCITS investment firm; and

- (4) it does not operate a multilateral trading facility.

Types of investment firm: 730K firm

BIPRU 1.1.21

See Notes

Types of investment firm: Part IV permission

BIPRU 1.1.22

See Notes

Meaning of dealing on own account

BIPRU 1.1.23

See Notes

- (1) Dealing on own account means (for the purpose of GENPRU and BIPRU) the service of dealing in any financial instruments for own account as referred to in point 3 of Section A of Annex I to MiFID, subject to (2) and (3).

- (2) In accordance with article5(2) of the Capital Adequacy Directive (Definition of dealing on own account), a CAD investment firm that executes investors' orders for financial instruments and holds such financial instruments for its own account does not for that reason deal on own account if the following conditions are met:

- (a) such position only arise as a result of the CAD investment firm's failure to match investors' orders precisely;

- (b) the total market value of all such positions is no higher than 15% of the CAD investment firm's initial capital;

- (c) (in the case of a BIPRU investment firm) it complies with the main BIPRU firm Pillar 1 rules and BIPRU 10 (Large exposures requirements);

- (d) (in the case of a CAD investment firm that is an EEA firm) it complies with the CRD implementation measures of its Home State for Articles 18 and 20 (Minimum capital requirements) and 28 (Large exposures) of the Capital Adequacy Directive;

- (e) (in the case of any other CAD investment firm) it would comply with the rules in (2)(c) if it had been a BIPRU investment firm on the basis of the assumptions in BIPRU 1.1.14 R (3)(a) and BIPRU 1.1.14R (3)(b); and

- (f) such positions are incidental and provisional in nature and strictly limited to the time required to carry out the transaction in question.

- (3) In accordance with Article 5(2) of the Capital Adequacy Directive, the holding of non-trading book positions in financial instruments in order to invest capital resources is not dealing on own account for the purposes referred to in BIPRU 1.1.18 R.

Interpretation of the definition of types of firm and undertaking

BIPRU 1.1.24

See Notes

For the purposes of the definitions in BIPRU 1.1, a person does any of the activities referred to in BIPRU 1.1 if:

- (1) it does that activity anywhere in the world; or

- (2) if its permission includes that activity; or

- (3) (in the case of an EEA firm) it is authorised by its Home State regulator to do that activity; or

- (4) (if the carrying on of that activity is prohibited in a state or territory without an authorisation in that state or territory) that firm has such an authorisation.

BIPRU 1.1.25

See Notes

For the purposes of the definitions in BIPRU 1.1, a person offers any of the services referred to in BIPRU 1.1.19 R (3) if:

- (1) it offers that service anywhere in the world; or

- (2) any of BIPRU 1.1.24 R (1) to BIPRU 1.1.24R (4) apply.

BIPRU 1.1.26

See Notes

BIPRU 1.2

Definition of the trading book

- 01/01/2007

Application

BIPRU 1.2.1

See Notes

Purpose

BIPRU 1.2.2

See Notes

Definition of the trading book: General

BIPRU 1.2.3

See Notes

The trading book of a firm consists of all position in CRD financial instrument and commodities held either with trading intent or in order to hedge other elements of the trading book and which are either free of any restrictive covenants on their tradability or able to be hedged.

[Note: CAD Article 11(1)]

Definition of the trading book: Positions

BIPRU 1.2.4

See Notes

The term position includes proprietary positions and positions arising from client servicing and market making.

BIPRU 1.2.5

See Notes

Definition of the trading book: Repos

BIPRU 1.2.6

See Notes

[Note: CAD Annex VII Part D point 4]

BIPRU 1.2.6A

See Notes

CRD financial instruments

BIPRU 1.2.7

See Notes

A CRD financial instrument means any contract that gives rise to both a financial asset of one party and a financial liability or equity instrument of another party.

BIPRU 1.2.8

See Notes

CRD financial instruments include both primary CRD financial instrument or cash instruments, and derivative CRD financial instruments the value of which is derived from the price of an underlying CRD financial instrument, a rate, an index or the price of another underlying item and include as a minimum the instruments specified in Section C of Annex I to the MIFID.

[Note: CAD Article 3(1) last paragraph]

BIPRU 1.2.9

See Notes

Generally, for the purpose of the definition of CRD financial instrument:

- (1) a financial asset means cash, the right to receive cash or another financial asset, the contractual right to exchange financial assets on potentially favourable terms or an equity instrument; and

- (2) a financial liability means the contractual obligation to deliver cash or another financial asset or to exchange financial liabilities under conditions that are potentially unfavourable.

Trading intent

BIPRU 1.2.10

See Notes

Positions held with trading intent for the purpose of the definition of the trading book are those held intentionally for short-term resale and/or with the intention of benefiting from actual or expected short-term price differences between buying and selling prices, or from other price or interest rate variations.

BIPRU 1.2.11

See Notes

Trading intent must be evidenced on the basis of the strategies, policies and procedures set up by the firm to manage the position or portfolio in accordance with BIPRU 1.2.12 R.

BIPRU 1.2.12

See Notes

Positions/portfolios held with trading intent must comply with the following requirements:

- (1) there must be a clearly documented trading strategy for the position/instrument or portfolios, approved by senior management, which must include the expected holding horizon;

- (2) there must be clearly defined policies and procedures to monitor the position against the firm's trading strategy including the monitoring of turnover and stale position in the firm's trading book; and

- (3) there must be clearly defined policies and procedures for the active management of the position, which must include the following:

- (a) position entered into on a trading desk;

- (b) position limits are set and monitored for appropriateness;

- (c) dealers have the autonomy to enter into/manage the position within agreed limits and according to the approved strategy;

- (d) positions are reported to senior management as an integral part of the firm's risk management process; and

- (e) positions are actively monitored with reference to market information sources and an assessment made of the marketability or hedge-ability of the position or its component risks, including the assessment of, the quality and availability of market inputs to the valuation process, level of market turnover, sizes of positions traded in the market.

[Note: CAD Annex VII Part A]

Internal hedges

BIPRU 1.2.13

See Notes

Internal hedges may be included in the trading book, in which case BIPRU 1.2.14 R to BIPRU 1.2.16 R apply.

[Note: CAD Article 11(5)]

BIPRU 1.2.14

See Notes

- (1) An internal hedge is a position that materially or completely offsets the component risk element of a non-trading book position or a set of position. Positions arising from internal hedges are eligible for trading book capital treatment, provided that they are held with trading intent and that the general criteria on trading intent and prudent valuation specified in BIPRU 1.2.12 R and the trading book systems and controls rules. In particular:

- (a) internal hedges must not be primarily intended to avoid or reduce capital requirements;

- (b) internal hedges must be properly documented and subject to particular internal approval and audit procedures;

- (c) the internal transaction must be dealt with at market conditions;

- (d) the bulk of the market risk that is generated by the internal hedge must be dynamically managed in the trading book within the authorised limits; and

- (e) internal transactions must be carefully monitored.

- (2) Monitoring must be ensured by adequate procedures.

[Note: CAD Annex VII Part C point 1]

BIPRU 1.2.15

See Notes

The treatment referred to in BIPRU 1.2.14 R applies without prejudice to the capital requirements applicable to the "non-trading book leg" of the internal hedge.

BIPRU 1.2.16

See Notes

By way of derogation from BIPRU 1.2.14 R to BIPRU 1.2.15 R, when a firm hedges a non-trading book credit risk exposure using a credit derivative booked in its trading book (using an internal hedge), the non-trading book exposure is not deemed to be hedged for the purposes of calculating capital requirements unless the firm purchases from an eligible third party protection provider a credit derivative meeting the requirements set out in BIPRU 5.7.13 R (Additional requirements for credit derivatives) with regard to the non-trading book exposure. Without prejudice to the second sentence of BIPRU 14.2.10 R, where such third party protection is purchased and is recognised as a hedge of a non-trading book exposure for the purposes of calculating capital requirements, neither the internal nor external credit derivative hedge must be included in the trading book for the purposes of calculating capital requirements.

Size thresholds

BIPRU 1.2.17

See Notes

- (1) Subject to (3), a firm may calculate its capital requirements for its trading book business in accordance with the standardised approach to credit risk (or, if it has an IRB permission, the IRB approach) as it applies to the non-trading book where the size of the trading book business meets the following requirements:

- (a) the trading book business of the firm does not normally exceed 5% of its total business;

- (b) its total trading book position do not normally exceed €15 million; and

- (c) the trading book business of the firm never exceeds 6% of its total business and its total trading book positions never exceed €20 million.

- (2) Subject to (3), if (1) applies, the following are disapplied:

- (a) the rules relating to the interest rate PRR, the equity PRR, the CIU PRR and the PRR calculated under BIPRU 7.11 (Credit derivatives in the trading book);

- (b) the rules relating to the option PRR (but only in relation to positions which under BIPRU 7.6.5 R (Table: Appropriate calculation for an option or warrant) may be subject to one of the other PRR charges listed in (2)(a) or which would be subject to such a PRR charge if BIPRU 7.6.5 R did not require an option PRR to be calculated);

- (c) BIPRU 7.10 (Use of a Value at Risk Model) so far as BIPRU 7.10 relates to the risks covered by the requirements in (a) and (b); and

- (d) BIPRU 14 (Capital requirements for settlement and counterparty risk).

- (3) If (1) applies, the following continue to apply:

- (a) the rules relating to the commodity PRR and the foreign currency PRR;

- (b) the rules relating to the option PRR (so far as not disapplied under (2)(b);

- (c) BIPRU 7.10 (so far as not disapplied under (2)(c));

- (d) BIPRU 14.2.3 R to BIPRU 14.2.8 R (Credit derivatives); and

- (e) BIPRU 14.2.15 R to BIPRU 14.2.16 R (Collateral for repurchase transactions and other products).

[Note: CAD Article 18(2)]

BIPRU 1.2.18

See Notes

In order to calculate the proportion that trading book business bears to total business for the purpose of BIPRU 1.2.17 R (1)(a) to BIPRU 1.2.17R (1)(c) the firm must refer to the size of the combined on- and off-balance-sheet business. For this purpose, debt instruments must be valued at their market prices or their principal values, equities at their market prices and derivatives according to the nominal or market values of the instruments underlying them. Long positions and short positions must be summed regardless of their signs.

[Note: CAD Article 18(3)]

BIPRU 1.2.19

See Notes

If a firm should happen for more than a short period to exceed either or both of the limits imposed in BIPRU 1.2.17 R (1)(a) and BIPRU 1.2.17R (1)(b) or either or both of the limits imposed in BIPRU 1.2.17 R (1)(c):

- (1) BIPRU 1.2.17 R ceases to apply; and

- (2) the firm must notify the FSA.

[Note: CAD Article 18(4)]

BIPRU 1.2.20

See Notes

Systems and controls for the trading book

BIPRU 1.2.21

See Notes

A firm must implement policies and processes for the measurement and management of all material sources and effects of market risks.

BIPRU 1.2.22

See Notes

A firm must establish and maintain systems and controls to manage its trading book, in accordance with the trading book systems and controls rules, BIPRU 1.2.6 R (Definition of the trading book: Repos) and the overall financial adequacy rule to BIPRU 1.2.27 R (Trading book policy statements).

BIPRU 1.2.23

See Notes

A firm must establish and maintain systems and controls sufficient to provide prudent and reliable valuation estimates.

BIPRU 1.2.24

See Notes

Systems and controls must include at least the following elements:

- (1) documented policies and procedures for the process of valuation (including clearly defined responsibilities of the various areas involved in the determination of the valuation, sources of market information and review of their appropriateness, frequency of independent valuation, timing of closing prices, procedures for adjusting valuations, month end and ad-hoc verification procedures); and

- (2) reporting lines for the department accountable for the valuation process that are clear and independent of the front office.

[Note: CAD Annex VII Part B point 2]

BIPRU 1.2.25

See Notes

The reporting line in relation to the matters covered by BIPRU 1.2.21 R to BIPRU 1.2.24 R must ultimately be to an executive director on the firm's governing body.

Trading book policy statements

BIPRU 1.2.26

See Notes

A firm must have clearly defined policies and procedures for determining which positions to include in the trading book for the purposes of calculating its capital requirements, consistent with the criteria set out in BIPRU 1.2.3 R to BIPRU 1.2.4 R, BIPRU 1.2.10 R to BIPRU 1.2.11 R, BIPRU 1.1.13 R and BIPRU 1.2.22 R and taking into account the firm's risk management capabilities and practices. Compliance with these policies and procedures must be fully documented and subject to periodic internal audit.

[Note: CAD Annex VII Part D point 1]

BIPRU 1.2.27

See Notes

A firm must have clearly defined policies and procedures for overall management of the trading book. At a minimum these policies and procedures must address:

- (1) the activities the firm considers to be trading and as constituting part of the trading book for capital requirement purposes;

- (2) the extent to which a position can be marked-to-market daily by reference to an active, liquid two-way market;

- (3) for positions that are marked-to-model, the extent to which the firm can:

- (a) identify all material risks of the position;

- (b) hedge all material risks of the position with instruments for which an active, liquid two-way market exists; and

- (c) derive reliable estimates for the key assumptions and parameters used in the model;

- (4) the extent to which the firm can, and is required to, generate valuations for the position that can be validated externally in a consistent manner;

- (5) the extent to which legal restrictions or other operational requirements would impede the firm's ability to effect a liquidation or hedge of the position in the short term;

- (6) the extent to which the firm can, and is required to, actively risk manage the position within its trading operation; and

- (7) the extent to which the firm may transfer risk or positions between the non-trading book and trading book and the criteria for such transfers.

[Note: CAD Annex VII Part D point 2]

BIPRU 1.2.28

See Notes

The policies and procedures referred to in BIPRU 1.2.27 R (1) should cover:

- (1) the CRD financial instrument and commodities that the firm proposes to trade in, including the currencies, maturities, issuers and quality of issues; and

- (2) any instruments to be excluded from its trading book.

BIPRU 1.2.29

See Notes

- (1) The policies and procedures referred to in the overall financial adequacy rule and BIPRU 1.2.27 R must be recorded in a single written document. A firm may record those policies and procedures in more than one written document if the firm has a single written document that identifies:

- (a) all those other documents; and

- (b) the parts of those documents that record those policies and procedures.

- (2) A trading book policy statement means the single document referred to in this rule.

BIPRU 1.2.30

See Notes

- (1) A firm must notify the FSA as soon as is reasonably practicable when it adopts a trading book policy statement.

- (2) A firm must notify the FSA as soon as is reasonably practicable if the trading book policy statement is subject to significant changes.

BIPRU 1.2.31

See Notes

BIPRU 1.2.32

See Notes

BIPRU 1.2.33

See Notes

Treatments common to the trading book and the non-trading book

BIPRU 1.2.34

See Notes

Trading book treatments

BIPRU 1.2.35

See Notes

Non-trading book treatments

BIPRU 1.2.36

See Notes

BIPRU 1.3

Applications for advanced approaches and waivers

- 31/12/2010

- Past version of BIPRU 1.3 before 31/12/2010

Application

BIPRU 1.3.1

See Notes

Purpose

BIPRU 1.3.2

See Notes

- (1) A firm may apply for an Article 129 permission or a waiver in respect of:

- (a) the IRB approach;

- (b) the advanced measurement approach;

- (c) the CCR internal model method; and

- (d) the VaR model approach.

- (2) A firm should apply for a waiver if it wants to:

- (a) apply the CAD 1 model approach; or

- (b) apply the master netting agreement internal models approach; or

- (c) disapply consolidated supervision under BIPRU 8 for its UK consolidation group or non-EEA sub-group; or

- (d) apply the treatment in BIPRU 2.1 (Solo-consolidation waiver); or

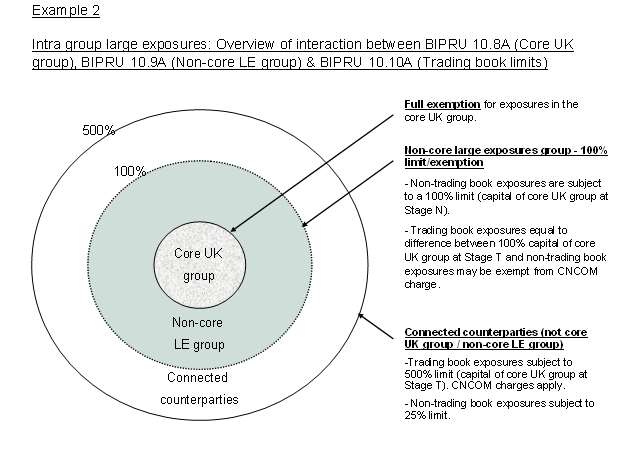

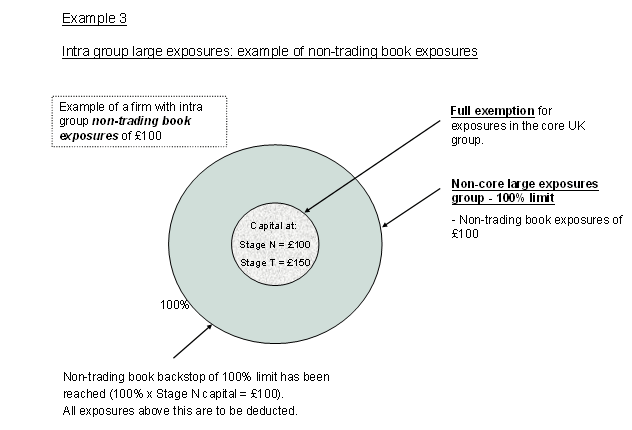

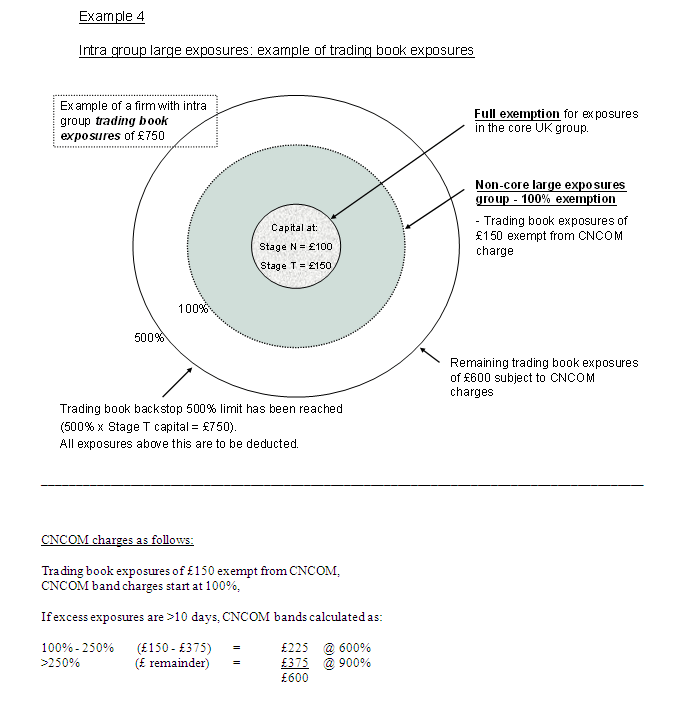

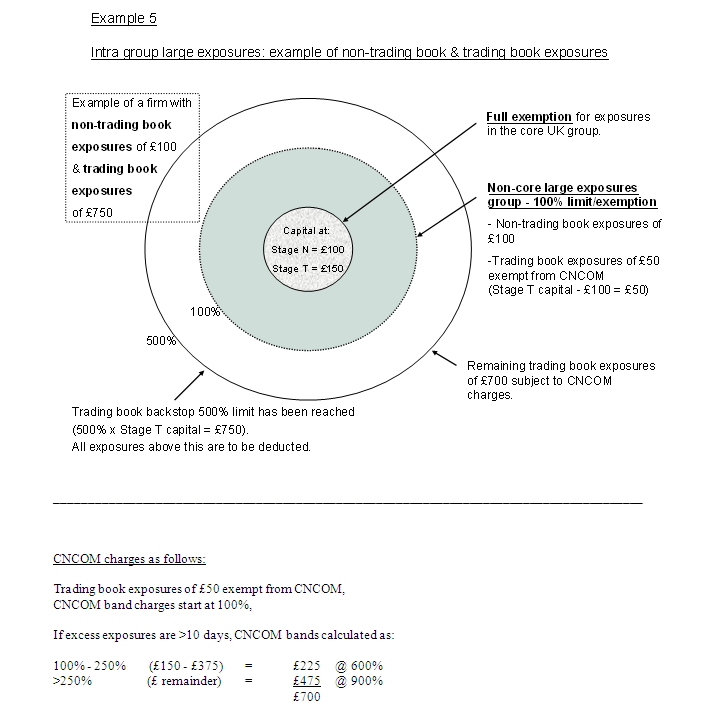

- (da) apply the treatment for a core UK group in BIPRU 3.2.25 R (Zero risk-weighting for intra-group exposures) or in BIPRU 10.8A (Intra-group exposures: core UK group); or

- (e) apply the treatment for a non-core large exposures group in BIPRU 10.9A (Intra-group exposures: non-core large exposures group); or

- (f) apply the treatment in BIPRU 10.6.35 R (Sovereign large exposure waiver).

Article 129

BIPRU 1.3.3

See Notes

BIPRU 1.3.4

See Notes

BIPRU 1.3.5

See Notes

BIPRU 1.3.6

See Notes

Article 129 permissions and waivers - specific conditions

BIPRU 1.3.7

See Notes

[Note: BCD Article 105(2)]

BIPRU 1.3.8

See Notes

[Note: BCD annex X Part 3 point 30]

BIPRU 1.3.9

See Notes

[Note: BCD annex X Part 3 point 31]

Waiver - general

BIPRU 1.3.11

See Notes

BIPRU 1.3.12

See Notes

Forms and method of application

BIPRU 1.3.13

See Notes

BIPRU 1.3.14

See Notes

BIPRU 1.3.15

See Notes

BIPRU 1.3.16

See Notes

BIPRU 1.3.17

See Notes

BIPRU 1.3.18

See Notes

BIPRU 1.3.19

See Notes

BIPRU 1.3.20

See Notes

BIPRU 1.3.21

See Notes

BIPRU 1.4

Actions for damages

- 01/01/2007

BIPRU 1.4.1

See Notes

BIPRU 1 Annex 1D

Application form to apply the advanced measurement approach

- 01/01/2007

See Notes

This annex consists only of one or more forms. Forms are to be found through the 'Forms' link at www.fashandbook.info or through the Handbook section of the CD-ROM under Forms. |

BIPRU 1 Annex 2D

Application form to apply the IRB approach

- 01/01/2007

See Notes

This annex consists only of one or more forms. Forms |

BIPRU 1 Annex 3D

Application form to apply the CCR internal model method approach

- 01/01/2007

See Notes

This annex consists only of one or more forms. Forms |

BIPRU 2

Capital

BIPRU 2.1

Solo consolidation

- 01/01/2007

Application

BIPRU 2.1.1

See Notes

Purpose

BIPRU 2.1.2

See Notes

BIPRU 2.1.3

See Notes

Applying for a solo consolidation waiver

BIPRU 2.1.4

See Notes

General

BIPRU 2.1.5

See Notes

BIPRU 2.1.6

See Notes

The basic rules for solo consolidation

BIPRU 2.1.7

See Notes

BIPRU 2.1.8

See Notes

- (1) A firm that has a solo consolidation waiver must meet the obligations in SYSC 12.1.13 R (Application of certain systems and controls rules on a consolidated basis) on a consolidated basis with respect to the firm and each subsidiary undertaking to which the firm's solo consolidation waiver applies.

- (2) If (1) applies, SYSC 12.1.13 R applies to the group made up of the firm and its subsidiary undertakings referred to in (1) in the same way as it applies to a UK consolidation group or non-EEA sub-group.

- (3) If (1) applies, the provisions of SYSC and BIPRU listed in SYSC 12.1.13 R do not apply to the firm on a solo basis.

Solo consolidation and capital and concentration risk requirements

BIPRU 2.1.9

See Notes

BIPRU 2.1.10

See Notes

BIPRU 2.1.11

See Notes

BIPRU 2.1.12

See Notes

BIPRU 2.1.13

See Notes

BIPRU 2.1.14

See Notes

BIPRU 2.1.15

See Notes

BIPRU 2.1.16

See Notes

BIPRU 2.1.17

See Notes

BIPRU 2.1.18

See Notes

Minimum standards

BIPRU 2.1.19

See Notes

BIPRU 2.1.20

See Notes

BIPRU 2.1.21

See Notes

BIPRU 2.1.22

See Notes

BIPRU 2.1.23

See Notes

BIPRU 2.1.24

See Notes

BIPRU 2.1.25

See Notes

The following are the criteria that the FSA will take into account when considering whether the condition in BIPRU 2.1.24 R is going to be met:

- (1) the speed with which funds can be transferred or liabilities repaid to the firm and the simplicity of the method for the transfer or repayment;

- (2) whether there are any interests other than those of the firm in the subsidiary undertaking and what impact those other interests may have on the firm's control over the subsidiary undertaking and on the ability of the firm to require a transfer of funds or repayment of liabilities;

- (3) whether the prompt transfer of funds or repayment of liabilities to the firm might harm the reputation of the firm or its subsidiary undertakings;

- (4) whether there are any tax disadvantages for the firm or the subsidiary undertaking as a result of the transfer of funds or repayment of liabilities;

- (5) whether there are any exchange controls that may have an impact on the transfer of funds or repayment of liabilities;

- (6) whether there are assets in the subsidiary undertaking available either to be transferred or liquidated for the purposes of the transfer of funds or repayment of liabilities;

- (7) whether any regulatory requirements impact on the ability of the subsidiary undertaking to transfer funds or repay liabilities promptly;

- (8) whether the purpose of the subsidiary undertaking prejudices the prompt transfer of funds or repayment of liabilities;

- (9) whether the legal structure of the subsidiary undertaking prejudices the prompt transfer of funds or repayment of liabilities;

- (10) whether the contractual relationships of the subsidiary undertaking with the firm and other third parties prejudices the prompt transfer of funds or repayment of liabilities;

- (11) whether past and proposed flows of funds between the subsidiary undertaking and the firm demonstrate the ability to make prompt transfer of funds or repayment of liabilities; and

- (12) whether the degree of solo consolidation by the firm undermines the FSA's ability to assess the soundness of the firm as a legal entity (taking into account any other subsidiary undertakings to which BIPRU 2.1 is being applied).

BIPRU 2.1.26

See Notes

BIPRU 2.1.27

See Notes

BIPRU 2.1.28

See Notes

BIPRU 2.2

Internal capital adequacy standards

- 01/01/2007

Application

BIPRU 2.2.1

See Notes

Purpose

BIPRU 2.2.2

See Notes

- (1) BIPRU 2.2 sets out guidance on GENPRU 1.2 (Adequacy of financial resources) so far as it applies to a BIPRU firm. In particular it sets out guidance on how a firm should carry out its ICAAP, as well as some factors the FSA will take into consideration when undertaking a SREP. The terms ICAAP and SREP are explained in BIPRU 2.2.4 G. BIPRU 2.2.41 R-BIPRU 2.2.43 R are rules that apply to a firm with an IRB permission.

- (2) BIPRU 2.2 is for the most part written on the basis that GENPRU 1.2 (Adequacy of financial resources) applies to a firm on a solo basis. However it is still relevant when GENPRU 1.2 applies on a consolidated basis. When GENPRU 1.2 applies on a consolidated basis, BIPRU 2.2 should be read with appropriate adjustments.

Meaning of capital

BIPRU 2.2.3

See Notes

The ICAAP and the SREP: Introduction

BIPRU 2.2.4

See Notes

The adequacy of a firm's capital needs to be assessed both by a firm and the FSA. This process involves:

- (1) an internal capital adequacy assessment process (ICAAP), which a firm is obliged to carry out in accordance with the ICAAP rules; and

- (2) a supervisory review and evaluation process (SREP), which is conducted by the FSA.

The ICAAP and the SREP: The ICAAP

BIPRU 2.2.5

See Notes

The obligation to conduct an ICAAP, includes requirements on a firm to:

- (1) carry out regularly assessments of the amounts, types and distribution of financial resources, capital resources and internal capital that it considers adequate to cover the nature and level of the risks to which it is or might be exposed (GENPRU 1.2.30 R to GENPRU 1.2.41 G (the overall Pillar 2 rule and related rules);

- (2) identify the major sources of risk to its ability to meet its liabilities as they fall due (the overall Pillar 2 rule);

- (3) conduct stress and scenario tests (the general stress and scenario testing rule), taking into account, in the case of a firm with an IRB permission, the stress test required by BIPRU 4.3.39 R to BIPRU 4.3.40 R (Stress tests used in assessment of capital adequacy for a firm with an IRB permission);

- (4) ensure that the processes, strategies and systems required by the overall Pillar 2 rule and used in its ICAAP, are both comprehensive and proportionate to the nature, scale and complexity of that firm's activities (GENPRU 1.2.35 R); and

- (5) document its ICAAP (GENPRU 1.2.60 R).

BIPRU 2.2.6

See Notes

BIPRU 2.2.7

See Notes

A firm should ensure that its ICAAP is:

- (1) the responsibility of the firm's governing body;

- (2) reported to the firm's governing body; and

- (3) forms an integral part of the firm's management process and decision-making culture.

The ICAAP and the SREP: The SREP

BIPRU 2.2.8

See Notes

BIPRU 2.2.9

See Notes

The SREP is a process under which the FSA:

- (1) reviews the arrangements, strategies, processes and mechanisms implemented by a firm to comply with GENPRU, BIPRU and SYSC and with requirements imposed by or under the regulatory system and evaluates the risks to which the firm is or might be exposed;

- (2) determines whether the arrangements, strategies, processes and mechanisms implemented by the firm and the capital held by the firm ensures a sound management and coverage of the risks in (1); and

- (3) (if necessary) requires the firm to take the necessary actions or steps at an early stage to address any failure to meet the requirements referred to in (1).

BIPRU 2.2.10

See Notes

BIPRU 2.2.11

See Notes

BIPRU 2.2.12

See Notes

BIPRU 2.2.12A

See Notes

BIPRU 2.2.12B

See Notes

BIPRU 2.2.12C

See Notes

BIPRU 2.2.13

See Notes

BIPRU 2.2.13A

See Notes

BIPRU 2.2.14

See Notes

BIPRU 2.2.15

See Notes

The drafting of individual capital guidance and capital planning buffer

BIPRU 2.2.16

See Notes

BIPRU 2.2.17

See Notes

- (1) Individual capital guidance may refer to two types of capital resources.

- (2) The first type is referred to as general capital. It refers to total tier one capital resources and tier two capital resources after deductions.

- (3) The second type is referred to as total capital. It refers to total tier one capital resources, tier two capital resources and tier three capital resources after deductions.

BIPRU 2.2.18

See Notes

- (1) In both of the cases in BIPRU 2.2.17 G capital resources should be calculated in the same way as they are in GENPRU 2.2 (Capital resources). This includes the rules limiting the amount of capital that can be included in the various tiers of capital when capital resources are being calculated.

- (2) GENPRU 2.2.42 R does not allow innovative tier one capital to count as tier one capital resources for certain purposes. This restriction does not apply for the purposes in BIPRU 2.2.17 G.

BIPRU 2.2.19

See Notes

- (1) Individual capital guidance may also be given with respect to group capital resources. This paragraph explains how such guidance should be interpreted unless the individual capital guidance specifies another interpretation.

- (2) If BIPRU 8.2.1 R (General consolidation rule for a UK consolidation group) applies to the firm the guidance relates to its UK consolidation group. If BIPRU 8.3.1 R (General consolidation rule for a non-EEA sub-group) applies to the firm the guidance relates to its non-EEA sub-group. If both apply to the firm the guidance relates to its UK consolidation group and to its non-EEA sub-group.

- (3) The guidance will be on the overall financial adequacy rule as it applies on a consolidated basis under GENPRU 1.2.59 R (Application of GENPRU 1.2 on a solo and consolidated basis: Adequacy of resources) and insofar as it refers to capital resources.

- (4) BIPRU 2.2.16 G to BIPRU 2.2.18 G apply for the purpose of this paragraph as they apply to guidance given on a solo basis. References to capital resources should be read as being to consolidated capital resources.

BIPRU 2.2.19A

See Notes

BIPRU 2.2.19B

See Notes

Failure to meet individual capital guidance and monitoring and reporting on the capital planning buffer

BIPRU 2.2.20

See Notes

A firm's continuing to hold capital in accordance with its individual capital guidance and its ability to carry on doing so is a fundamental part of the FSA's supervision of that firm. Therefore if a firm's capital resources have fallen, or are expected to fall, below the level advised in individual capital guidance, then, consistent with Principle 11 (Relations with regulators), a firm should inform the FSA of this fact as soon as practicable, explaining why this has happened or is expected to happen and:

- (1) what action the firm intends to take to increase its capital resources or to reduce its risks and hence its capital requirements; or

- (2) what modification the firm considers should be made to the individual capital guidance which it has been given.

BIPRU 2.2.21

See Notes

BIPRU 2.2.22

See Notes

BIPRU 2.2.23

See Notes

BIPRU 2.2.23A

See Notes

Consistent with Principle 11 (Relations with regulators), a firm should notify the FSA as early as possible in advance where it has identified that it would need to use its capital planning buffer. The firm's notification should at least state:

- (1) what adverse circumstances are likely to force the firm to draw down its capital planning buffer;

- (2) how the capital planning buffer will be used up in line with the firm's capital planning projections; and

- (3) what plan is in place for the eventual restoration of the capital planning buffer.

BIPRU 2.2.23B

See Notes

BIPRU 2.2.23C

See Notes

BIPRU 2.2.23D

See Notes

BIPRU 2.2.23E

See Notes

BIPRU 2.2.23F

See Notes

Proportionality of an ICAAP

BIPRU 2.2.24

See Notes

BIPRU 2.2.25

See Notes

- (1) This paragraph applies to a small firm whose activities are simple and primarily not credit-related.

- (2) In carrying out its ICAAP it could:

- (a) identify and consider that firm's largest losses over the last 3 to 5 years and whether those losses are likely to recur;

- (b) prepare a short list of the most significant risks to which that firm is exposed;

- (c) consider how that firm would act, and the amount of capital that would be absorbed, in the event that each of the risks identified were to materialise;

- (d) consider how that firm's CRR might alter under the scenarios in (c) and how its CRR might alter in line with its business plans for the next 3 to 5 years;

- (e) consider whether any of the risks in the overall Pillar 2 rule is applicable to the firm (it is unlikely that any of those risks not already identified in (a) or (b) will apply to a firm whose activities are simple);

- (f) document the ranges of capital required in the scenarios identified and form an overall view on the amount and quality of capital which that firm should hold, ensuring that its senior management is involved in arriving at that view; and

- (g) (in order to determine the amount of capital that would be absorbed in the circumstances detailed in (c)) carry out simple sensitivity tests where the firm analyses the impact of a shift in the key risk parameters identified in (b) on the earnings of the firm.

- (3) A firm is also expected to form a view on the consolidated amount of capital it should hold as well as the capital required to be held in respect of each of the individual risks identified under the overall Pillar 2 rule. For that purpose, it may conservatively sum the results of the individual tests performed in (2)(c). If the firm chooses however to reduce that sum on the understanding that not all risks will materialise at the same time, then the firm should perform scenario tests that demonstrate that a reduction in capital is legitimate.

- (4) A firm should conduct stress tests and scenario analyses in accordance with GENPRU 1.2.42 R to assess how that firm's capital and CRR would alter and what that firm's reaction might be to a range of adverse scenarios, including operational and market events. Where relevant, a firm should also consider the impact of a severe economic or industry downturn on its future earnings, capital resources and capital resources requirement, taking into account its business plans. The downturn scenario should be based on forward looking hypothetical events calibrated against the most adverse movements in individual risk drivers experienced over a long historical period.

BIPRU 2.2.26

See Notes

In relation to a firm whose activities are moderately complex, in carrying out its ICAAP, BIPRU 2.2.25 G (3) to (4) apply. In addition, it could:

- (1) having consulted the management in each major business line, prepare a comprehensive list of the major risks to which the business is exposed;

- (2) estimate, with the aid of historical data, where available, the range and distribution of possible losses which might arise from each of those risks and consider using shock stress tests to provide risk estimates;

- (3) consider the extent to which that firm's CRR adequately captures the risks identified in (1) and (2);

- (4) for areas in which the CRR is either inadequate or does not address a risk, estimate the additional capital (if any) needed to protect that firm and its customers, in addition to any other risk mitigation action that firm plans to take;

- (5) consider the risk that that firm's own analyses of capital adequacy may be inaccurate and that it may suffer from management weaknesses, which affect the effectiveness of its risk management and mitigation;

- (6) project that firm's business activities forward in detail for one year and in less detail for the next 3 to 5 years and estimate how that firm's capital and CRR would alter, assuming that business develops as expected;

- (7) assume that business does not develop as expected and consider how that firm's capital and CRR would alter and what that firm's reaction to a range of adverse economic scenarios might be (see GENPRU 1.2.30 R to GENPRU 1.2.43 G (the overall Pillar 2 rule and related rules and guidance)). Where appropriate, the adverse scenarios should consider the impact of market events that are instantaneous or occur over an extended period of time but which are nevertheless still co-dependent on movements in economic conditions;

- (8) document the results obtained from the analyses in (2), (4), (6), and (7) in a detailed report for that firm's senior management, and, where relevant, its governing body; and

- (9) ensure that systems and processes are in place to review against performance the accuracy of the estimates made in (2), (4), (6) and (7).

BIPRU 2.2.27

See Notes

- (1) This paragraph applies to a proportional ICAAP in the case of a firm whose activities are complex.

- (2) A proportional approach to that firm's ICAAP should cover the matters identified in BIPRU 2.2.26 G, but is likely also to involve the use of models, most of which will be integrated into its day-to-day management and operation.

- (3) Models of the sort referred to in (2) may be linked so as to generate an overall estimate of the amount of capital that a firm considers appropriate to hold for its business needs. For example, a firm is likely to use value at risk models for market risk (see BIPRU 7.10), advanced modelling approaches for credit risk (see BIPRU 4) and, possibly, advanced measurement approaches for operational risk (see BIPRU 6.5). A firm might also use economic scenario generators to model stochastically its business forecasts and risks. A firm may also link such models to generate information on the economic capital desirable for that firm. A model which a firm uses to generate its target amount of economic capital is known as an economic capital model (ECM). Economic capital is the target amount of capital which maximises the return for a firm's stakeholders for a desired level of risk.

- (4) A firm is also likely to be part of a group and to be operating internationally. There is likely to be centralised control over the models used throughout the group, the assumptions made and their overall calibration.

- (5) The more a firm integrates into its business such economic capital modelling, the more it is likely to focus on managing risks for the benefit of its stakeholders. Consequently, ECMs may produce capital estimates that differ from the amount of capital needed for regulatory purposes. For the FSA to rely on the results of a firm's models, including ECMs, a firm should be able to explain the basis and results of its models and how the amount of capital produced by its models reflects the amount of capital needed for regulatory purposes. It may be that those amounts are not equal. Where they are not equal, the FSA will expect a firm to discuss any differences with the FSA. However, it may prove difficult to reconcile the outcome of a firm's modelling with the FSA's own assessment of the adequacy of that firm's capital. This may be the case when, for instance, matters of judgment are involved in arriving at a firm's capital assessment, or the FSA relies on information which cannot be fully disclosed to the firm (for example comparisons with the firm's peers). Nevertheless, a firm whose ECM produces a different amount of capital to that required for regulatory purposes is still obliged to comply with the overall Pillar 2 rule. A firm should therefore be able to explain to the FSA how the outcome of its ECM is adjusted so that it complies with the overall financial adequacy rule and the overall Pillar 2 rule.

- (6) Stress testing should provide senior management with a consolidated view of the amount of risk the firm is or might be exposed to under the chosen stress events. Senior management should therefore be presented with information that considers the possibility of the risks materialising simultaneously in various proportions. For instance, it would be misrepresentative to simulate market risk stressed events without considering that, in those circumstances, market counterparties may be more likely to default. Accordingly, a firm could:

- (a) carry out combined stress tests where assets and liabilities are individually subjected to simultaneous changes in two or more risk drivers; for instance, the change in value of each loan made by a firm may be estimated using simultaneous changes to both interest rates and stock market or property values;

- (b) integrate the results of market and credit risk models rather than aggregating the results of each model separately; and

- (c) consider scenarios which include systemic effects on the firm of wider failures in the firm's market or systems upon which the firm depends and also any possible systemic effects caused by the firm itself suffering losses which affect other market participants which in turn exacerbate the firm's position.

- (7) Furthermore, if a complex firm uses an ECM it should validate the assumptions of the model through a comprehensive stress testing programme. In particular this validation should:

- (a) test correlation assumptions (where risks are aggregated in this way) using combined stresses and scenario analyses;

- (b) use stress tests to identify the extent to which the firm's risk models omit non-linear effects, for instance the behaviour of derivatives in market risk models; and

- (c) consider not just the effect of parallel shifts in interest rate curves, but also the effect of curves becoming steeper or flatter.

Guidance on risks to be covered in an ICAAP

BIPRU 2.2.28

See Notes

BIPRU 2.2.29

See Notes

- (1) A firm may take into account factors other than those identified in the overall Pillar 2 rule when it assesses the level of capital it wishes to hold. These factors might include external rating goals, market reputation and its strategic goals. However, a firm should be able to distinguish, for the purpose of its dialogue with the FSA, between capital it holds in order to comply with the overall financial adequacy rule, capital that it holds as a capital planning buffer and capital held for other purposes.

- (2) The calibration of the CRR assumes that a firm's business is well-diversified, well-managed with assets matching its liabilities and good controls, and stable with no large, unusual or high risk transactions. A firm may find it helpful to assess the extent to which its business in fact differs from these assumptions and therefore what adjustments it might be reasonable for it to make to the CRR to arrive at an adequate level of capital resources.

Interest rate risk arising from non-trading book activities

BIPRU 2.2.30

See Notes

Securitisation risk

BIPRU 2.2.31

See Notes

Residual risk

BIPRU 2.2.32

See Notes

Concentration risk

BIPRU 2.2.33

See Notes

Liquidity risk

BIPRU 2.2.34

See Notes

BIPRU 2.2.35

See Notes

BIPRU 2.2.36

See Notes

BIPRU 2.2.37

See Notes

Some further areas to consider in developing the liquidity risk scenario might include:

- (1) any mismatching between expected asset and liability cash flows;

- (2) the inability to sell assets quickly;

- (3) the extent to which a firm's assets have been pledged; and

- (4) the possible need to reduce large asset positions at different levels of market liquidity and the related potential costs and timing constraints.

Business risk: General

BIPRU 2.2.38

See Notes

BIPRU 2.2.39

See Notes

BIPRU 2.2.40

See Notes

Business risk: Stress tests for firms using the IRB approach

BIPRU 2.2.41

See Notes

BIPRU 2.2.42

See Notes

BIPRU 2.2.43

See Notes

If BIPRU 2.2.41 R applies to a firm on a consolidated basis the following adjustments are made to BIPRU 2.2.41 R in accordance with the general principles of BIPRU 8 (Group risk - consolidation):

- (1) references to capital resources are to the consolidated capital resources of the firm's UK consolidation group or, as the case may be, its non-EEA sub-group; and

- (2) references to the capital requirements in GENPRU 2.1 (Calculation of capital resources requirements) are to the consolidated capital requirements with respect to the firm's UK consolidation group or, as the case may be, its non-EEA sub-group under BIPRU 8 (Group risk - consolidation).

BIPRU 2.2.44

See Notes

BIPRU 2.2.45

See Notes

Systems and controls

BIPRU 2.2.46

See Notes

A firm may decide to hold additional capital to mitigate any weaknesses in its overall control environment. These weaknesses might be indicated by the following:

- (1) a failure by a firm to complete an assessment of its systems and controls to establish whether they comply with SYSC; or

- (2) a failure by a firm's senior management to approve its financial results; or

- (3) a failure by a firm to consider an analysis of relevant internal and external information on its business and control environment.

BIPRU 2.2.47

See Notes

Risks which may be considered according to the nature of the activities of a firm

BIPRU 2.2.48

See Notes

- (1) BIPRU 2.2.49 G to BIPRU 2.2.70 G set out guidance for:

- (a) a bank or building society;

- (b) an asset management firm; and

- (c) a securities firm;

- whose activities are either simple or moderately complex.

- (2) BIPRU 2.2.49 G to BIPRU 2.2.70 G provide examples of the sorts of risks which such a firm might typically face and of stress tests or scenario analyses which it might carry out as part of its ICAAP.

- (3) The material on securities firms is also relevant to a commodities firm.

Banks and building societies

BIPRU 2.2.49

See Notes

BIPRU 2.2.50

See Notes

BIPRU 2.2.51

See Notes

BIPRU 2.2.52

See Notes

BIPRU 2.2.53

See Notes

BIPRU 2.2.54

See Notes

BIPRU 2.2.55

See Notes

BIPRU 2.2.56

See Notes

BIPRU 2.2.57

See Notes

BIPRU 2.2.58

See Notes

BIPRU 2.2.59

See Notes

BIPRU 2.2.60

See Notes

An asset management firm

BIPRU 2.2.61

See Notes

- 01/01/2007

BIPRU 2.2.62

See Notes

When assessing reputational risk an asset manager should consider issues such as:

- (1) how poor performance can affect its ability to generate profits;

- (2) the effect on its financial position should one or more of its key fund managers leave that firm;

- (3) the effect on its financial position should it lose some of its largest customers; and

- (4) how poor customer services can affect its financial position; for example, a firm which has outsourced the management of customer accounts may want to consider the impact on its own reputation of the service provider failing to deliver the service.

- 01/01/2007

BIPRU 2.2.63

See Notes

- 01/01/2007

BIPRU 2.2.64

See Notes

In relation to the issues identified in BIPRU 2.2.63 G, an asset manager should consider, for example:

- (1) the direct cost to it resulting from fraud or theft;

- (2) the direct cost arising from customers' claims and legal action in the future; an asset manager could consider the impact on its financial position if a legal precedent were to encourage its customers to take legal action against that firm for failing to advise correctly on a certain type of product; the relevance of such scenarios is likely to depend on whether the asset manager is acting on a discretionary basis or solely as advisor; and

- (3) where it has obtained professional indemnity insurance, the deductibles and individual or aggregate limits on the sums insured.

- 01/01/2007

BIPRU 2.2.65

See Notes

The FSA expects an asset manager to consider the impact of economic factors on its ability to meet its liabilities as they fall due. An asset manager should therefore develop scenarios which relate to its strategic and business plan. An asset manager might therefore consider:

- (1) the effect of a market downturn affecting both transaction volumes and the market values of assets in its funds; in assessing the impact of such a scenario, an asset manager may consider the extent to which it can remain profitable (for example, by rapidly scaling down its activities and reducing its costs);

- (2) the impact on current levels of capital if it plans to undertake a significant restructuring; and

- (3) the impact on current levels of capital if it plans to enter a new market or launch a new product; it should assess the amount of capital it needs to hold, when operating for the first time in a market in which it lacks expertise.

- 01/01/2007

A securities firm

BIPRU 2.2.66

See Notes

- (1) A securities firm may consider the impact of the situations listed in (a) to (c) on its capital levels when assessing its exposure to concentration risk:

- (a) the potential loss that could arise from large exposures to a single counterparty;

- (b) the potential loss that could arise from exposures to large transactions or to a product type; and

- (c) the potential loss resulting from a combination of events such as a sudden increase in volatility leaving a hitherto fully-margined client unable to meet the margin calls due to the large size of the underlying position and the subsequent difficulties involved in liquidating its position.

- (2) An example of the analysis in (1)(b) relates to a securities firm which relies on the income generated by a large, one-off corporate finance transaction. It may want to consider the possibility of legal action arising from that transaction which prevents the payment of its fees. Additionally, an underwriting firm may, as a matter of routine, commit to place a large amount of securities. It may therefore like to assess the impact of losses arising from a failure to place the securities successfully.

- 01/01/2007

BIPRU 2.2.67

See Notes

Where a securities firm deals in illiquid securities (for example, unlisted securities or securities listed on illiquid markets), or holds illiquid assets, potentially large losses can arise from trades that have failed to settle or because of large unrealised market losses. A securities firm may therefore consider the impact of liquidity risk on its exposure to:

- (1) credit risk; and

- (2) market risk.

- 01/01/2007

BIPRU 2.2.68

See Notes

Counterparty risk rules only partially capture the risk of settlement failure as the quantification of risk is only based on mark-to-market values and does not take account of the volatility of the securities over the settlement period. A securities firm's assessment of its exposure to counterparty risk should take into account:

- (1) whether it acts as arranger only or whether it also executes trades;

- (2) the types of execution venues which it uses; for example, the London Stock Exchange or a retail service provider (RSP) have more depth than multilateral trading facilities; and

- (3) whether it offers extended settlements and free delivery compared to delivery versus payment business.

BIPRU 2.2.69

See Notes

- (1) A securities firm should also consider the impact of external factors on the levels of capital it needs to hold. Scenarios covering such external factors should relate to its strategy and business plan. A securities firm might wish to consider the questions in (2) to (7).

- (2) Whether it plans to participate in a one-off transaction that might strain temporarily or permanently its capital.

- (3) Whether the unevenness of its revenue suggests that it should hold a capital buffer. Such an assessment could be based, for instance, on an analysis of past revenue and the volatility of its capital.

- (4) How its income might alter as interest rates fluctuate where it is obliged to pay interest to its clients in excess of interest it earns on client money deposits.

- (5) How its capital would be affected by a market downturn. For instance, how sensitive that firm is to a sharp reduction of trading volumes.

- (6) How political and economic factors will affect that firm's business. For instance, a commodity firm may wish to consider the impact of a sharp increase in prices on initial margins and, consequently, on its liquidity.

- (7) Whether it anticipates expanding its activities (for example, by offering clearing services), and if so, the impact on its capital.

- 01/01/2007

BIPRU 2.2.70

See Notes

- 01/01/2007

Capital models

BIPRU 2.2.71

See Notes

BIPRU 2.2.72

See Notes

BIPRU 2.2.73

See Notes

There is no prescribed approach as to how a firm should develop its internal capital model. However, a firm should be able to demonstrate:

- (1) the confidence levels set and whether these are linked to its corporate strategy;

- (2) the time horizons set for the different types of business that it undertakes;

- (3) the extent of historic data used and back-testing carried out;

- (4) that it has in place a process to verify the correctness of the model's outputs; and

- (5) that it has the skills and resources to operate, maintain and develop the model.

BIPRU 2.2.74

See Notes

In relation to the use of an ECM (see BIPRU 2.2.27 G), the FSA is likely to place more reliance on a firm's ICAAP if the firm provides the following information:

- (1) a comparison of the amount of capital that the ECM generates in respect of each of the risks captured in the CRR before aggregation with the corresponding components of the CRR calculation; and

- (2) evidence that the guidance in BIPRU 2.2.71 G to BIPRU 2.2.78 G has been followed.

BIPRU 2.2.75

See Notes

BIPRU 2.2.76

See Notes

BIPRU 2.2.77

See Notes

BIPRU 2.2.78

See Notes

BIPRU 2.3

Interest rate risk in the non-trading book

- 01/01/2007

Application

BIPRU 2.3.1

See Notes

BIPRU 2.3.2

See Notes

- (1) Interest rate risk in the non-trading book will normally be a major source of risk for:

- (a) a bank;

- (b) a building society; and

- (c) a BIPRU investment firm that deals on own account (including underwriting on a firm commitment basis) and whose non-trading book business equals or exceeds 15% of its total business.

- (2) However it will not normally be a significant risk for any other BIPRU investment firm.

- (3) The test in (1)(c) should be carried out in the same way as it is for the purpose of the 5% test in BIPRU 1.2.17 R (Definition of the trading book).

- (4) Where BIPRU 2.3 is applied on a consolidated basis (see BIPRU 2.3.13 R) the test in (1)(c) should be carried out in the same way as it is under BIPRU 8.7.24 R (Trading book size for the purposes of consolidation).

BIPRU 2.3.3

See Notes

Interest rate risk in the non-trading book may arise from a number of sources for example:

- (1) risks related to the mismatch of repricing of assets and liabilities and off balance sheet short and long-term positions;

- (2) risks arising from hedging exposure to one interest rate with exposure to a rate which reprices under slightly different conditions;

- (3) risk related to the uncertainties of occurrence of transactions e.g. when expected future transactions do not equal the actual transactions; and

- (4) risks arising from consumers redeeming fixed rate products when market rates change.

Purpose

BIPRU 2.3.4

See Notes

BIPRU 2.3.5

See Notes

Proportionality

Stress testing for interest rate risk: General requirement

BIPRU 2.3.7

See Notes

- (1) As part of its obligations under GENPRU 1.2.30 R (Processes, strategies and systems for risks) and GENPRU 1.2.36 R (Stress and scenario tests) a firm must carry out an evaluation of its exposure to the interest rate risk arising from its non-trading activities.

- (2) The evaluation under (1) must cover the effect of a sudden and unexpected parallel change in interest rates of 200 basis points in both directions.

- (3) A firm must immediately notify the FSA if any evaluation under this rule suggests that, as a result of the change in interest rates described in (2), the economic value of the firm would decline by more than 20% of its capital resources.

BIPRU 2.3.8

See Notes

BIPRU 2.3.9

See Notes

For a larger and/or more complex firm, appropriate systems to evaluate and manage interest rate risk in the non-trading book should include:

- (1) the ability to measure the exposure and sensitivity of the firm's activities, if material, to repricing risk, yield curve risk, basis risk and risks arising from embedded optionality (for example, pipeline risk, prepayment risk) as well as changes in assumptions (for example those about customer behaviour);

- (2) consideration as to whether a purely static analysis of the impact on their current portfolio of a given shock or shocks should be supplemented by a more dynamic simulation approach; and

- (3) scenarios in which different interest rate paths are computed and in which some of the assumptions (e.g. about behaviour, contribution to risk and balance sheet size and composition) are themselves functions of interest rate level.

BIPRU 2.3.10

See Notes

Under GENPRU 1.2.60 R, a firm is required to make a written record of its assessments made under GENPRU 1.2. A firm's record of its approach to evaluating and managing interest rate risk as it affects the firm's non-trading activities should cover the following issues:

- (1) the internal definition of and boundary between "banking book" and "trading activities" (see BIPRU 1.2);

- (2) the definition of economic value and its consistency with the method used to value assets and liabilities (e.g. discounted cashflows);

- (3) the size and the form of the different shocks to be used for internal calculations;

- (4) the use of a dynamic and / or static approach in the application of interest rate shocks;

- (5) the treatment of commonly called "pipeline transactions" (including any related hedging);

- (6) the aggregation of multicurrency interest rate exposures;

- (7) the inclusion (or not) of non-interest bearing assets and liabilities (including capital and reserves);

- (8) the treatment of current and savings accounts (i.e. the maturity attached to exposures without a contractual maturity);

- (9) the treatment of fixed rate assets (liabilities) where customers still have a right to repay (withdraw) early;

- (10) the extent to which sensitivities to small shocks can be scaled up on a linear basis without material loss of accuracy (i.e. covering both convexity generally and the non-linearity of pay-off associated with explicit option products);

- (11) the degree of granularity employed (for example offsets within a time bucket); and

- (12) whether all future cash flows or only principal balances are included.

BIPRU 2.3.11

See Notes

Stress testing for interest rate risk: Frequency

BIPRU 2.3.12

See Notes

- (1) A firm must carry out the evaluations required by BIPRU 2.3.7 R as frequently as necessary for it to be reasonably satisfied that it has at all times a sufficient understanding of the degree to which it is exposed to the risks referred to in that rule and the nature of that exposure. In any case it must carry out those evaluations no less frequently than required by (2) or (3).

- (2) The minimum frequency of the evaluation in BIPRU 2.3.7 R (1) is once each year.

- (3) The minimum frequency of the evaluation in BIPRU 2.3.7 R (2) is once each quarter.

Consolidation

BIPRU 2.3.13

See Notes

BIPRU 3

Standardised credit risk

BIPRU 3.1

Application and purpose

- 01/01/2007

Application

BIPRU 3.1.1

See Notes

Purpose

BIPRU 3.1.2

See Notes

BIPRU 3 implements:

- (1) Articles 78 to 80, paragraph (1) of Article 81, Article 83, Annex II and Parts 1 and 3 of Annex VI of the Banking Consolidation Directive;

- (2) Article 18 of the Capital Adequacy Directive so far as it applies Articles 78 to 80, paragraph (1) of Article 81, Article 83 and Parts 1 and 3 of Annex VI of the Banking Consolidation Directive to investment firms; and

- (3) Article 40 of the Capital Adequacy Directive for the purposes of the calculation of credit risk under the Banking Consolidation Directive.

BIPRU 3.1.3

See Notes

BIPRU 3.1.4

See Notes

Calculation of the credit risk capital component

BIPRU 3.1.5

See Notes

BIPRU 3.1.6

See Notes

An exposure falls into this rule if:

- (1) it is in a firm's non-trading book; and

- (2) it has not been deducted from the firm's capital resources under GENPRU 2.2.

BIPRU 3.2

The central principles of the standardised approach to credit risk

- 01/01/2007

BIPRU 3.2.1

See Notes

Subject to BIPRU 13:

- (1) the exposure value of an asset item must be its balance-sheet value, subject to any value adjustments required by GENPRU 1.3; and

- (2) the exposure value of an off-balance sheet item listed in the table in BIPRU 3.7.2 R must be the percentage of its value set out in that table.

[Note: BCD Article 78(1) part]

BIPRU 3.2.2

See Notes

The off-balance sheet items listed in the table in BIPRU 3.7.2 R must be assigned to the risk categories as indicated in that table.

BIPRU 3.2.3

See Notes

Where an exposure is subject to funded credit protection, a firm may modify the exposure value applicable to that item in accordance with BIPRU 5.

BIPRU 3.2.4

See Notes

BIPRU 13 sets out the method for determination of the exposure value of a financial derivative instrument, with the effects of contracts of novation and other netting agreements taken into account for the purposes of that method in accordance with BIPRU 13.7.

BIPRU 3.2.5

See Notes

BIPRU 13.3 and BIPRU 13.8 set out the provisions applying to the treatment and determination of the exposure value of repurchase transactions, securities or commodities lending or borrowing transactions, long settlement transactions and margin lending transactions (SFTs).

[Note: reference to BCD Article 78(2) second sentence. Implementation in BIPRU 13]

BIPRU 3.2.6

See Notes

BIPRU 3.2.7

See Notes

BIPRU 13.8 provides that, in the case of a firm using the financial collateral comprehensive method under BIPRU 5, where an exposure takes the form of an SFT, the exposure value should be increased by the volatility adjustment appropriate to such securities or commodities set out in BIPRU 5.4.30 R to BIPRU 5.4.65 R (Supervisory volatility adjustments approach and the own estimates of volatility adjustments approach).

BIPRU 3.2.8

See Notes

BIPRU 13.3.13 R and BIPRU 13.8.8 R set out the provisions relating to determination of the exposure value of certain credit risk exposures outstanding with a central counterparty, where the central counterparty credit risk exposures with all participants in its arrangements are fully collateralised on a daily basis.

Exposure Classes

BIPRU 3.2.9

See Notes

A firm must assign each exposure to one of the following exposure classes:

- (1) claims or contingent claims on central governments or central banks;

- (2) claims or contingent claims on regional governments or local authorities;

- (3) claims or contingent claims on administrative bodies and non-commercial undertakings;

- (4) claims or contingent claims on multilateral development banks;

- (5) claims or contingent claims on international organisation;

- (6) claims or contingent claims on institutions;

- (7) claims or contingent claims on corporates;

- (8) retail claims or contingent retail claims;

- (9) claims or contingent claims secured on real estate property;

- (10) past due items;

- (11) items belonging to regulatory high-risk categories;

- (12) claims in the form of covered bonds;

- (13) securitisation positions;

- (14) short-term claims on institutions and corporates;

- (15) claims in the form of CIUs; or

- (16) other items.

[Note: BCD Article 79(1)]

BIPRU 3.2.10

See Notes

To be eligible for the retail exposure class, an exposure must meet the following conditions:

- (1) the exposure must be either to an individual person or persons, or to a small or medium sized entity;

- (2) the exposure must be one of a significant number of exposures with similar characteristics such that the risks associated with such lending are substantially reduced; and

- (3) the total amount owed to the firm, its parent undertakings and its subsidiary undertakings, including any past due exposure, by the obligor client or group of connected clients, but excluding claims or contingent claims secured on residential real estate collateral, must not, to the knowledge of the firm, exceed €1 million.

[Note: BCD Article 79(2)]

BIPRU 3.2.11

See Notes

A firm must take reasonable steps to acquire the knowledge referred to in BIPRU 3.2.10 R (3).

BIPRU 3.2.12

See Notes

Securities are not eligible for the retail exposure class.

BIPRU 3.2.13

See Notes

The present value of retail minimum lease payments is eligible for the retail exposure class.

Retail exposures: Significance

BIPRU 3.2.14

See Notes

Retail exposures: Aggregation: Reasonable steps

BIPRU 3.2.15

See Notes

Retail exposures: Aggregation: Single risk

BIPRU 3.2.16

See Notes