INSPRU 1

Capital resources requirements and technical provisions for insurance business

INSPRU 1.1

Application

- 31/12/2006

INSPRU 1.1.1

See Notes

INSPRU 1.1.2

See Notes

INSPRU 1.1.3

See Notes

INSPRU 1.1.4

See Notes

INSPRU 1.1.5

See Notes

INSPRU 1.1.6

See Notes

Purpose

INSPRU 1.1.7

See Notes

INSPRU 1.1.8

See Notes

INSPRU 1.1.9

See Notes

INSPRU 1.1.10

See Notes

INSPRU 1.1.11

See Notes

Establishing technical provisions

INSPRU 1.1.12

See Notes

INSPRU 1.1.13

See Notes

INSPRU 1.1.14

See Notes

INSPRU 1.1.15

See Notes

INSPRU 1.1.16

See Notes

INSPRU 1.1.17

See Notes

INSPRU 1.1.18

See Notes

INSPRU 1.1.19

See Notes

Reinsurance and analogous non-reinsurance financing agreements: risk transfer principle

INSPRU 1.1.19A

See Notes

INSPRU 1.1.19B

See Notes

INSPRU 1.1.19C

See Notes

INSPRU 1.1.19D

See Notes

INSPRU 1.1.19E

See Notes

INSPRU 1.1.19F

See Notes

Assets of a value sufficient to cover technical provisions and other liabilities

INSPRU 1.1.20

See Notes

INSPRU 1.1.21

See Notes

INSPRU 1.1.22

See Notes

INSPRU 1.1.23

See Notes

INSPRU 1.1.24

See Notes

INSPRU 1.1.25

See Notes

INSPRU 1.1.26

See Notes

INSPRU 1.1.27

See Notes

INSPRU 1.1.28

See Notes

INSPRU 1.1.29

See Notes

Localisation (UK firms only)

INSPRU 1.1.30

See Notes

INSPRU 1.1.31

See Notes

INSPRU 1.1.32

See Notes

INSPRU 1.1.33

See Notes

Matching of assets and liabilities

INSPRU 1.1.34

See Notes

INSPRU 1.1.34A

See Notes

INSPRU 1.1.35

See Notes

INSPRU 1.1.36

See Notes

INSPRU 1.1.37

See Notes

INSPRU 1.1.38

See Notes

INSPRU 1.1.39

See Notes

INSPRU 1.1.40

See Notes

Premiums for new business

INSPRU 1.1.41

See Notes

INSPRU 1.1.42

See Notes

Capital requirements for insurers

INSPRU 1.1.43

See Notes

General insurance capital requirement

INSPRU 1.1.44

See Notes

The premiums amount

INSPRU 1.1.45

See Notes

INSPRU 1.1.46

See Notes

The claims amount

INSPRU 1.1.47

See Notes

INSPRU 1.1.48

See Notes

INSPRU 1.1.49

See Notes

INSPRU 1.1.50

See Notes

The brought forward amount

INSPRU 1.1.51

See Notes

INSPRU 1.1.52

See Notes

Reinsurance ratio used in calculating the premiums amount and the claims amount

INSPRU 1.1.54

See Notes

INSPRU 1.1.54A

See Notes

INSPRU 1.1.55

See Notes

Gross adjusted premiums amount used in calculating the premiums amount

INSPRU 1.1.56

See Notes

INSPRU 1.1.57

See Notes

INSPRU 1.1.58

See Notes

INSPRU 1.1.59

See Notes

Gross adjusted claims amount used in calculating the claims amount

INSPRU 1.1.60

See Notes

INSPRU 1.1.61

See Notes

INSPRU 1.1.62

See Notes

INSPRU 1.1.63

See Notes

INSPRU 1.1.64

See Notes

INSPRU 1.1.65

See Notes

Accounting for premiums and claims

INSPRU 1.1.66

See Notes

INSPRU 1.1.67

See Notes

INSPRU 1.1.68

See Notes

INSPRU 1.1.69

See Notes

INSPRU 1.1.70

See Notes

INSPRU 1.1.71

See Notes

Actuarial health insurance

INSPRU 1.1.72

See Notes

Enhanced capital requirement for general insurance business

INSPRU 1.1.72A

See Notes

INSPRU 1.1.72B

See Notes

INSPRU 1.1.72C

See Notes

INSPRU 1.1.72D

See Notes

Calculation of the insurance-related capital requirement

INSPRU 1.1.76

See Notes

INSPRU 1.1.77

See Notes

INSPRU 1.1.78

See Notes

INSPRU 1.1.79

See Notes

| Class of Business | Net Written Premium capital charge factor | Technical provision capital charge factor |

| Reporting Group: Direct and facultative business | ||

| Direct and facultative accident and health | 5.0% | 7.5% |

| Direct and facultative personal lines motor business | 10.0% | 9.0% |

| Direct and facultative household and domestic all risks | 10.0% | 10.0% |

| Direct and facultative personal lines financial loss | 25.0% | 14.0% |

| Direct and facultative commercial motor business | 10.0% | 9.0% |

| Direct and facultative commercial lines property | 10.0% | 10.0% |

| Direct and facultative commercial lines liability | 14.0% | 14.0% |

| Direct and facultative commercial lines financial loss | 25.0% | 14.0% |

| Direct and facultative aviation | 32.0% | 14.0% |

| Direct and facultative marine | 22.0% | 17.0% |

| Direct and facultative goods in transit | 12.0% | 14.0% |

| Direct and facultative miscellaneous | 25.0% | 14.0% |

| Reporting Group: Non-Proportional Treaty | ||

| Non-proportional accident & health | 35.0% | 16.0% |

| Non-proportional motor | 10.0% | 14.0% |

| Non-proportional transport | 16.0% | 15.0% |

| Non-proportional aviation | 61.0% | 16.0% |

| Non-proportional marine | 38.0% | 17.0% |

| Non-proportional property | 53.0% | 12.0% |

| Non-proportional liability (non-motor) | 14.0% | 14.0% |

| Non-proportional financial lines | 39.0% | 14.0% |

| Non-proportional aggregate cover | 53.0% | 12.0% |

| Reporting Group: Proportional Treaty | ||

| Proportional accident & health | 12.0% | 16.0% |

| Proportional motor | 10.0% | 12.0% |

| Proportional transport | 12.0% | 15.0% |

| Proportional aviation | 33.0% | 16.0% |

| Proportional marine | 22.0% | 17.0% |

| Proportional property | 23.0% | 12.0% |

| Proportional liability (non-motor) | 14.0% | 14.0% |

| Proportional financial lines | 25.0% | 14.0% |

| Proportional aggregate cover | 23.0% | 12.0% |

| Reporting Group: Miscellaneous Reinsurance | ||

| Miscellaneous reinsurance accepted business | 39.0% | 14.0% |

Long-term insurance capital requirement

INSPRU 1.1.80

See Notes

Insurance death risk capital component

INSPRU 1.1.81

See Notes

INSPRU 1.1.81A

See Notes

INSPRU 1.1.82

See Notes

INSPRU 1.1.83

See Notes

INSPRU 1.1.83A

See Notes

INSPRU 1.1.84

See Notes

INSPRU 1.1.84A

See Notes

Insurance health risk and life protection reinsurance capital component

INSPRU 1.1.85

See Notes

INSPRU 1.1.86

See Notes

INSPRU 1.1.87

See Notes

Insurance expense risk capital component

INSPRU 1.1.88

See Notes

INSPRU 1.1.88A

See Notes

Insurance market risk capital component

INSPRU 1.1.89

See Notes

Adjusted mathematical reserves

INSPRU 1.1.89A

See Notes

INSPRU 1.1.90

See Notes

INSPRU 1.1.91

See Notes

INSPRU 1.1.92

See Notes

Insurance special purpose vehicles

INSPRU 1.1.92A

See Notes

INSPRU 1.1.92B

See Notes

Application of INSPRU 1.1 to Lloyd's

INSPRU 1.1.93

See Notes

INSPRU 1.1.94

See Notes

INSPRU 1.1.95

See Notes

INSPRU 1.1.96

See Notes

INSPRU 1.2

Mathematical reserves

- 31/12/2006

Application

INSPRU 1.2.1

See Notes

Purpose

INSPRU 1.2.2

See Notes

INSPRU 1.2.3

See Notes

INSPRU 1.2.4

See Notes

INSPRU 1.2.5

See Notes

INSPRU 1.2.6

See Notes

INSPRU 1.2.6A

See Notes

- 01/04/2013

Basic valuation method

INSPRU 1.2.7

See Notes

INSPRU 1.2.8

See Notes

INSPRU 1.2.9

See Notes

Methods and assumptions

INSPRU 1.2.10

See Notes

INSPRU 1.2.11

See Notes

INSPRU 1.2.12

See Notes

Margins for adverse deviation

INSPRU 1.2.13

See Notes

INSPRU 1.2.14

See Notes

INSPRU 1.2.15

See Notes

INSPRU 1.2.16

See Notes

The margin for adverse deviation of a risk should generally be greater than or equal to the relevant market price for that risk.

INSPRU 1.2.17

See Notes

INSPRU 1.2.18

See Notes

INSPRU 1.2.19

See Notes

The rules and guidance on margins for adverse deviation in respect of future investment returns, which are also required in the calculation of mathematical reserves, are set out in INSPRU 3.1.28 R to INSPRU 3.1.48 G.

Record keeping

INSPRU 1.2.20

See Notes

INSPRU 1.2.21

See Notes

Valuation of individual contracts

INSPRU 1.2.22

See Notes

INSPRU 1.2.23

See Notes

Negative mathematical reserves

INSPRU 1.2.24

See Notes

INSPRU 1.2.25

See Notes

INSPRU 1.2.25A

See Notes

Avoidance of future valuation strain

INSPRU 1.2.26

See Notes

INSPRU 1.2.27

See Notes

Cash flows to be valued

INSPRU 1.2.28

See Notes

INSPRU 1.2.28A

See Notes

INSPRU 1.2.29

See Notes

INSPRU 1.2.30

See Notes

INSPRU 1.2.31

See Notes

Valuation assumptions: detailed rules and guidance

INSPRU 1.2.32

See Notes

Valuation rates of interest

INSPRU 1.2.33

See Notes

INSPRU 1.2.34

See Notes

Future premiums

INSPRU 1.2.35

See Notes

INSPRU 1.2.36

See Notes

Future premiums: firms reporting only on a regulatory basis

INSPRU 1.2.37

See Notes

INSPRU 1.2.38

See Notes

INSPRU 1.2.39

See Notes

INSPRU 1.2.40

See Notes

INSPRU 1.2.41

See Notes

INSPRU 1.2.42

See Notes

Future net premiums: adjustment for deferred acquisition costs

INSPRU 1.2.43

See Notes

INSPRU 1.2.44

See Notes

INSPRU 1.2.45

See Notes

Future premiums: firms also reporting with-profits insurance liabilities on a realistic basis

INSPRU 1.2.46

See Notes

INSPRU 1.2.47

See Notes

Future premiums: accumulating with-profits policies

INSPRU 1.2.48

See Notes

INSPRU 1.2.49

See Notes

Expenses

INSPRU 1.2.50

See Notes

INSPRU 1.2.51

See Notes

INSPRU 1.2.52

See Notes

INSPRU 1.2.53

See Notes

INSPRU 1.2.54

See Notes

INSPRU 1.2.54A

See Notes

INSPRU 1.2.54B

See Notes

INSPRU 1.2.55

See Notes

INSPRU 1.2.56

See Notes

INSPRU 1.2.57

See Notes

INSPRU 1.2.58

See Notes

Mortality and Morbidity

INSPRU 1.2.59

See Notes

INSPRU 1.2.60

See Notes

INSPRU 1.2.61

See Notes

Options

INSPRU 1.2.62

See Notes

INSPRU 1.2.62A

See Notes

INSPRU 1.2.63

See Notes

INSPRU 1.2.64

See Notes

INSPRU 1.2.65

See Notes

INSPRU 1.2.66

See Notes

INSPRU 1.2.67

See Notes

INSPRU 1.2.68

See Notes

INSPRU 1.2.69

See Notes

INSPRU 1.2.70

See Notes

INSPRU 1.2.71

See Notes

INSPRU 1.2.72

See Notes

Persistency assumptions

INSPRU 1.2.76

See Notes

INSPRU 1.2.77

See Notes

Reinsurance

INSPRU 1.2.77A

See Notes

INSPRU 1.2.78

See Notes

INSPRU 1.2.79

See Notes

INSPRU 1.2.79A

See Notes

INSPRU 1.2.79B

See Notes

INSPRU 1.2.80

See Notes

INSPRU 1.2.81

See Notes

INSPRU 1.2.82

See Notes

INSPRU 1.2.83

See Notes

INSPRU 1.2.84

See Notes

INSPRU 1.2.85

See Notes

INSPRU 1.2.86

See Notes

INSPRU 1.2.87

See Notes

INSPRU 1.2.88

See Notes

INSPRU 1.2.89

See Notes

Application of INSPRU 1.2 to Lloyd's

INSPRU 1.2.92

See Notes

Approved reinsurance to close

INSPRU 1.2.93

See Notes

INSPRU 1.3

With-profits insurance capital component

- 31/12/2006

Application

INSPRU 1.3.1

See Notes

INSPRU 1.3.2

See Notes

Purpose

INSPRU 1.3.3

See Notes

INSPRU 1.3.4

See Notes

INSPRU 1.3.5

See Notes

Main requirements

INSPRU 1.3.6

See Notes

INSPRU 1.3.7

See Notes

INSPRU 1.3.7A

See Notes

INSPRU 1.3.8

See Notes

INSPRU 1.3.9

See Notes

Definitions

INSPRU 1.3.10

See Notes

INSPRU 1.3.11

See Notes

INSPRU 1.3.12

See Notes

INSPRU 1.3.13

See Notes

INSPRU 1.3.14

See Notes

INSPRU 1.3.15

See Notes

INSPRU 1.3.16

See Notes

Record keeping

INSPRU 1.3.17

See Notes

INSPRU 1.3.18

See Notes

INSPRU 1.3.19

See Notes

General principles for allocating aggregate amounts

INSPRU 1.3.21

See Notes

INSPRU 1.3.22

See Notes

Calculation of regulatory excess capital

INSPRU 1.3.23

See Notes

Regulatory value of assets

INSPRU 1.3.24

See Notes

INSPRU 1.3.25

See Notes

INSPRU 1.3.26

See Notes

INSPRU 1.3.28

See Notes

Regulatory value of liabilities

INSPRU 1.3.29

See Notes

INSPRU 1.3.30

See Notes

INSPRU 1.3.31

See Notes

as disclosed at lines 49 and 12 respectively of the appropriate Form 14 ('Long-term business liabilities and margins') for that fund as part of the Annual Returns required to be deposited with the PRA under IPRU(INS) rule 9.6R(1).

Calculation of realistic excess capital

INSPRU 1.3.32

See Notes

Realistic value of assets

INSPRU 1.3.33

See Notes

INSPRU 1.3.34

See Notes

INSPRU 1.3.35

See Notes

INSPRU 1.3.36

See Notes

INSPRU 1.3.37

See Notes

INSPRU 1.3.38

See Notes

INSPRU 1.3.39

See Notes

INSPRU 1.3.39A

See Notes

INSPRU 1.3.39B

See Notes

Realistic value of liabilities: general

INSPRU 1.3.40

See Notes

INSPRU 1.3.41

See Notes

INSPRU 1.3.42

See Notes

Risk capital margin

INSPRU 1.3.43

See Notes

INSPRU 1.3.44

See Notes

INSPRU 1.3.45

See Notes

INSPRU 1.3.46

See Notes

INSPRU 1.3.47

See Notes

arising from the effects of market risk, credit risk and persistency risk. Other risks are not explicitly addressed by the risk capital margin.

INSPRU 1.3.48

See Notes

INSPRU 1.3.49

See Notes

INSPRU 1.3.50

See Notes

INSPRU 1.3.51

See Notes

INSPRU 1.3.51A

See Notes

Management actions

INSPRU 1.3.52

See Notes

INSPRU 1.3.53

See Notes

INSPRU 1.3.54

See Notes

INSPRU 1.3.55

See Notes

INSPRU 1.3.56

See Notes

INSPRU 1.3.57

See Notes

Policyholder actions

INSPRU 1.3.58

See Notes

INSPRU 1.3.59

See Notes

INSPRU 1.3.60

See Notes

INSPRU 1.3.61

See Notes

Market risk scenario

INSPRU 1.3.62

See Notes

INSPRU 1.3.63

See Notes

INSPRU 1.3.63A

See Notes

INSPRU 1.3.64

See Notes

INSPRU 1.3.65

See Notes

INSPRU 1.3.67

See Notes

Market risk scenario for exposures to UK assets and certain non-UK assets

INSPRU 1.3.68

See Notes

INSPRU 1.3.69

See Notes

INSPRU 1.3.70

See Notes

Equity market adjustment ratio

INSPRU 1.3.71

See Notes

INSPRU 1.3.72

See Notes

Market risk scenario for exposures to other non-UK assets

INSPRU 1.3.73

See Notes

INSPRU 1.3.74

See Notes

INSPRU 1.3.75

See Notes

INSPRU 1.3.76

See Notes

General

INSPRU 1.3.77

See Notes

INSPRU 1.3.78

See Notes

INSPRU 1.3.79

See Notes

INSPRU 1.3.80

See Notes

INSPRU 1.3.81

See Notes

INSPRU 1.3.82

See Notes

INSPRU 1.3.83

See Notes

Spread stresses to be assumed for bonds and debt

INSPRU 1.3.84

See Notes

INSPRU 1.3.85

See Notes

INSPRU 1.3.86

See Notes

INSPRU 1.3.87

See Notes

INSPRU 1.3.88

See Notes

INSPRU 1.3.89

See Notes

Table : Listed rating agencies, credit rating descriptions, spread factors

INSPRU 1.3.90

See Notes

| Credit Rating Description | Listed rating agencies | Spread Factor | |||

| A. M. Best Company | Fitch Ratings | Moodys Investors Service | Standard & Poors Corporation | ||

| Exceptional or extremely strong | aaa | AAA | Aaa | AAA | 3.00 |

| Very strong | aa | AA | Aa | AA | 5.25 |

| Strong | a | A | A | A | 6.75 |

| Adequate | bbb | BBB | Baa | BBB | 9.25 |

| Speculative or less vulnerable | bb | BB | Ba | BB | 15.00 |

| Very speculative or more vulnerable | B | B | B | B | 24.00 |

| Highly speculative or very vulnerable | Below B | Below B | Below B | Below B | 24.00 |

INSPRU 1.3.91

See Notes

INSPRU 1.3.92

See Notes

INSPRU 1.3.93

See Notes

Credit risk scenario for reinsurance

INSPRU 1.3.94

See Notes

INSPRU 1.3.95

See Notes

INSPRU 1.3.96

See Notes

INSPRU 1.3.97

See Notes

| Financial Strength Description | A. M. Best Company | Fitch Ratings | Moodys Investors Service | Standard & Poors Corporation | Spread Factor |

| Superior, extremely strong | A++ | AAA | Aaa | AAA | 3.00 |

| Superior, very strong | A+ | AA | Aa | AA | 5.25 |

| Excellent or strong | A, A- | A | A | A | 6.75 |

| Good | B++, B+ | BBB | Baa | BBB | 9.25 |

| Fair, marginal | B, B- | BB | Ba | BB | 15.00 |

| Marginal, weak | C++, C+ | B | B | B | 24.00 |

| Unrated or very weak | Unrated or below C++, C+ | Unrated or below B | Unrated or below B | Unrated or below B | 24.00 |

Credit risk scenario for other exposures (including any derivative or quasi-derivative)

INSPRU 1.3.98

See Notes

INSPRU 1.3.99

See Notes

Persistency risk scenario

INSPRU 1.3.100

See Notes

INSPRU 1.3.101

See Notes

INSPRU 1.3.102

See Notes

INSPRU 1.3.103

See Notes

Realistic value of liabilities: detailed provisions

INSPRU 1.3.104

See Notes

Methods and assumptions: general

INSPRU 1.3.105

See Notes

INSPRU 1.3.106

See Notes

INSPRU 1.3.107

See Notes

Valuation of contracts: General

INSPRU 1.3.109

See Notes

INSPRU 1.3.110

See Notes

INSPRU 1.3.111

See Notes

INSPRU 1.3.112

See Notes

INSPRU 1.3.113

See Notes

INSPRU 1.3.114

See Notes

INSPRU 1.3.115

See Notes

With-profits benefits reserve

INSPRU 1.3.116

See Notes

INSPRU 1.3.117

See Notes

Retrospective method

INSPRU 1.3.118

See Notes

INSPRU 1.3.119

See Notes

INSPRU 1.3.120

See Notes

INSPRU 1.3.121

See Notes

INSPRU 1.3.122

See Notes

INSPRU 1.3.123

See Notes

INSPRU 1.3.124

See Notes

INSPRU 1.3.125

See Notes

INSPRU 1.3.126

See Notes

INSPRU 1.3.127

See Notes

Prospective method

INSPRU 1.3.128

See Notes

INSPRU 1.3.129

See Notes

INSPRU 1.3.130

See Notes

INSPRU 1.3.131

See Notes

INSPRU 1.3.132

See Notes

INSPRU 1.3.133

See Notes

INSPRU 1.3.134

See Notes

INSPRU 1.3.135

See Notes

Future policy related liabilities

INSPRU 1.3.136

See Notes

INSPRU 1.3.137 R lists the future policy related liabilities for a with-profits fund that form part of a firm'srealistic value of liabilities in INSPRU 1.3.40 R. Detailed rules and guidance relating to particular types of liability and asset are set out in INSPRU 1.3.139 R to INSPRU 1.3.168 G. These are followed by rules and guidance that deal with certain aspects of several liabilities (that is, liabilities relating to guarantees, options and smoothing):

INSPRU 1.3.137

See Notes

INSPRU 1.3.138

See Notes

Past miscellaneous surplus (or deficit) planned to be attributed to the with-profits benefits reserve

INSPRU 1.3.139

See Notes

INSPRU 1.3.140

See Notes

Planned enhancements to the with-profits benefits reserve

INSPRU 1.3.141

See Notes

INSPRU 1.3.142

See Notes

INSPRU 1.3.143

See Notes

Planned deductions for the costs of guarantees, options and smoothing from the with-profits benefits reserve

INSPRU 1.3.144

See Notes

INSPRU 1.3.145

See Notes

Planned deductions for other costs deemed chargeable to the with-profits benefits reserve

INSPRU 1.3.146

See Notes

INSPRU 1.3.147

See Notes

Future costs of contractual guarantees (other than financial options)

INSPRU 1.3.148

See Notes

INSPRU 1.3.149

See Notes

INSPRU 1.3.150

See Notes

INSPRU 1.3.151

See Notes

INSPRU 1.3.152

See Notes

INSPRU 1.3.153

See Notes

Future costs of non-contractual commitments

INSPRU 1.3.154

See Notes

INSPRU 1.3.155

See Notes

Future costs of financial options

INSPRU 1.3.156

See Notes

INSPRU 1.3.157

See Notes

Future costs of smoothing

INSPRU 1.3.158

See Notes

INSPRU 1.3.159

See Notes

INSPRU 1.3.160

See Notes

INSPRU 1.3.161

See Notes

Financing costs

INSPRU 1.3.162

See Notes

INSPRU 1.3.163

See Notes

INSPRU 1.3.164

See Notes

Other long-term insurance liabilities

INSPRU 1.3.165

See Notes

INSPRU 1.3.166

See Notes

INSPRU 1.3.167

See Notes

INSPRU 1.3.168

See Notes

Valuing the costs of guarantees, options and smoothing

INSPRU 1.3.169

See Notes

INSPRU 1.3.170

See Notes

INSPRU 1.3.171

See Notes

INSPRU 1.3.172

See Notes

INSPRU 1.3.173

See Notes

INSPRU 1.3.174

See Notes

INSPRU 1.3.175

See Notes

Stochastic approach

INSPRU 1.3.176

See Notes

INSPRU 1.3.177

See Notes

INSPRU 1.3.178

See Notes

INSPRU 1.3.179

See Notes

INSPRU 1.3.180

See Notes

Deterministic approach

INSPRU 1.3.181

See Notes

INSPRU 1.3.182

See Notes

INSPRU 1.3.183

See Notes

INSPRU 1.3.184

See Notes

Management and policyholder actions

INSPRU 1.3.185

See Notes

INSPRU 1.3.186

See Notes

Treatment of surplus on guarantees, options and smoothing

INSPRU 1.3.187

See Notes

INSPRU 1.3.188

See Notes

INSPRU 1.3.189

See Notes

Realistic current liabilities

INSPRU 1.3.190

See Notes

INSPRU 1.3.191

See Notes

INSPRU 1.4

Equalisation provisions

- 31/12/2006

Application

INSPRU 1.4.1

See Notes

INSPRU 1.4.2

See Notes

INSPRU 1.4.3

See Notes

Purpose

INSPRU 1.4.4

See Notes

INSPRU 1.4.5

See Notes

INSPRU 1.4.6

See Notes

INSPRU 1.4.7

See Notes

| Table: Scope of insurance business to be included in calculations | ||||

| Type Of Firm | Credit Equalisation Provision | Non Credit Equalisation Provision | ||

| Threshold in INSPRU 1.4.4 G | Provision in INSPRU 1.4.43 R | Threshold in INSPRU 1.4.18R (2) and provision in INSPRU 1.4.17 R | ||

| UK insurer | World-wide | World-wide | World-wide | |

| Pure reinsurer with head office outside United Kingdom | UK | World-wide | UK | |

| Pure reinsurer with head office in United Kingdom | World-wide | World-wide | World-wide | |

| Non-EEA direct insurers | EEA-deposit insurer | UK | UK | UK |

| Swiss general insurer | UK | UK | UK | |

| UK-deposit insurer | All EEA | World-wide | UK | |

| All other non-EEA direct insurers | UK | World-wide | UK | |

INSPRU 1.4.8

See Notes

INSPRU 1.4.9

See Notes

INSPRU 1.4.10

See Notes

Non-credit equalisation provision

INSPRU 1.4.11

See Notes

INSPRU 1.4.12

See Notes

| Insurance Business Grouping | General Insurance Contracts | |

| A | Contracts of insurance which fall within general insurance businessclasses 4, 8 or 9, other than: | |

| (a) | contracts of insurance under non-proportional reinsurance treaties; and | |

| (b) | contracts of insurance against nuclear risks | |

| B | Contracts of insurance which fall within general insurance businessclass 16(a), other than: | |

| (a) | contracts of insurance under non-proportional reinsurance treaties; and | |

| (b) | contracts of insurance against nuclear risks | |

| C | Contracts of insurance which fall within general insurance business classes 5, 6, 11 or 12, other than: | |

| (a) | contracts of insurance against nuclear risks; and | |

| (b) | reinsurance contracts corresponding to contracts in (a). | |

| D | Contracts of insurance against nuclear risks. | |

| E | Contracts of insurance under non-proportional reinsurance treaties and which fall within general insurance business classes 4, 8, 9 or 16(a) other than contracts of insurance against nuclear risks. | |

INSPRU 1.4.13

See Notes

INSPRU 1.4.14

See Notes

INSPRU 1.4.15

See Notes

INSPRU 1.4.16

See Notes

Requirement to maintain non-credit equalisation provision

INSPRU 1.4.17

See Notes

INSPRU 1.4.18

See Notes

INSPRU 1.4.19

See Notes

Calculating the amount of the provision

INSPRU 1.4.20

See Notes

INSPRU 1.4.21

See Notes

INSPRU 1.4.22

See Notes

INSPRU 1.4.23

See Notes

The calculation: the maximum provision

INSPRU 1.4.24

See Notes

INSPRU 1.4.25

See Notes

| Insurance Business Grouping | Percentage of average annualised net written premiums |

| A | 20 |

| B | 20 |

| C | 40 |

| D | 600 |

| E | 75 |

The calculation: provisional transfers-in

INSPRU 1.4.26

See Notes

INSPRU 1.4.27

See Notes

| Insurance Business Grouping | Percentage of net written premiums |

| A | 3 |

| B | 3 |

| C | 6 |

| D | 75 |

| E | 11 |

INSPRU 1.4.28

See Notes

The calculation: provisional transfers-out

INSPRU 1.4.29

See Notes

INSPRU 1.4.30

See Notes

INSPRU 1.4.31

See Notes

| Insurance Business Grouping | Percentage of net written premiums |

| A | 72.5 |

| B | 72.5 |

| C | 95 |

| D | 25 |

| E | 100 |

Adjustments to calculations

INSPRU 1.4.32

See Notes

INSPRU 1.4.33

See Notes

Transfers of business to the firm

INSPRU 1.4.34

See Notes

INSPRU 1.4.35

See Notes

INSPRU 1.4.36

See Notes

INSPRU 1.4.37

See Notes

Credit equalisation provisions

INSPRU 1.4.38

See Notes

INSPRU 1.4.39 R to INSPRU 1.4.47 G apply to any firm which carries on the business of effecting or carrying out general insurance contracts falling within general insurance businessclass 14 (which business is referred to in INSPRU 1.4 as "credit insurance business"), unless it is:

INSPRU 1.4.39

See Notes

INSPRU 1.4.40

See Notes

INSPRU 1.4.41

See Notes

INSPRU 1.4.42

See Notes

Requirement to maintain credit equalisation provision

INSPRU 1.4.43

See Notes

INSPRU 1.4.44

See Notes

Calculating the amount of the provision

INSPRU 1.4.45

See Notes

INSPRU 1.4.46

See Notes

INSPRU 1.4.47

See Notes

Euro conversion

INSPRU 1.4.48

See Notes

Application of INSPRU 1.4 to Lloyd's

INSPRU 1.4.49

See Notes

INSPRU 1.4.50

See Notes

INSPRU 1.4.51

See Notes

INSPRU 1.5

Internal-contagion risk

- 31/12/2006

Application

INSPRU 1.5.1

See Notes

INSPRU 1.5.2

See Notes

INSPRU 1.5.3

See Notes

INSPRU 1.5.4

See Notes

INSPRU 1.5.5

See Notes

INSPRU 1.5.6

See Notes

INSPRU 1.5.7

See Notes

Purpose

INSPRU 1.5.8

See Notes

INSPRU 1.5.9

See Notes

INSPRU 1.5.10

See Notes

INSPRU 1.5.11

See Notes

INSPRU 1.5.12

See Notes

Restriction of business

INSPRU 1.5.13

See Notes

INSPRU 1.5.13A

See Notes

INSPRU 1.5.13B

See Notes

Financial limitation of non-insurance activities

INSPRU 1.5.14

See Notes

INSPRU 1.5.15

See Notes

Requirements: long-term insurance business

INSPRU 1.5.16

See Notes

Permissions not to include both types of insurance

INSPRU 1.5.17

See Notes

Separately identify and maintain long term insurance assets

INSPRU 1.5.18

See Notes

INSPRU 1.5.19

See Notes

INSPRU 1.5.20

See Notes

INSPRU 1.5.21

See Notes

INSPRU 1.5.22

See Notes

INSPRU 1.5.23

See Notes

INSPRU 1.5.24

See Notes

INSPRU 1.5.25

See Notes

INSPRU 1.5.26

See Notes

INSPRU 1.5.27

See Notes

INSPRU 1.5.28

See Notes

INSPRU 1.5.29

See Notes

Exclusive use of long-term insurance assets

INSPRU 1.5.30

See Notes

INSPRU 1.5.31

See Notes

INSPRU 1.5.32

See Notes

Requirements: property-linked funds

INSPRU 1.5.35

See Notes

Requirements: UK branches of certain non-EEA firms

INSPRU 1.5.38

See Notes

INSPRU 1.5.39

See Notes

INSPRU 1.5.40

See Notes

Worldwide financial resources

INSPRU 1.5.41

See Notes

UK or EEA MCR to be covered by admissible assets

INSPRU 1.5.42

See Notes

INSPRU 1.5.43

See Notes

INSPRU 1.5.44

See Notes

INSPRU 1.5.45

See Notes

INSPRU 1.5.46

See Notes

INSPRU 1.5.47

See Notes

Localisation of assets

INSPRU 1.5.48

See Notes

INSPRU 1.5.49

See Notes

INSPRU 1.5.50

See Notes

INSPRU 1.5.51

See Notes

INSPRU 1.5.52

See Notes

INSPRU 1.5.53

See Notes

Deposit of assets as security

INSPRU 1.5.54

See Notes

INSPRU 1.5.55

See Notes

Branch accounting records in the United Kingdom

INSPRU 1.5.56

See Notes

INSPRU 1.5.57

See Notes

Application of INSPRU 1.5 to Lloyd's

INSPRU 1.5.58

See Notes

INSPRU 1.5.59

See Notes

INSPRU 1.5.60

See Notes

INSPRU 1.6

Insurance Special Purpose Vehicles

- 31/12/2006

Application and Purpose

INSPRU 1.6.1

See Notes

INSPRU 1.6.2

See Notes

INSPRU 1.6.3

See Notes

INSPRU 1.6.4

See Notes

Assets and liabilities

INSPRU 1.6.5

See Notes

INSPRU 1.6.5A

See Notes

INSPRU 1.6.6

See Notes

INSPRU 1.6.7

See Notes

INSPRU 1.6.8

See Notes

Contractual arrangements

INSPRU 1.6.9

See Notes

INSPRU 1.6.10

See Notes

INSPRU 1.6.11

See Notes

INSPRU 1.6.12

See Notes

Reinsurance with an ISPV

INSPRU 1.6.13

See Notes

unless it first obtains a waiver from the PRA . INSPRU 1.6.14 G to INSPRU 1.6.18 G set out the information which the PRA will expect to receive as part of the application for the waiver. Those paragraphs also set out the factors, in addition to the statutory tests under sections 138A and 138B of the Act, to which the PRA will have regard in deciding:

INSPRU 1.6.14

See Notes

INSPRU 1.6.15

See Notes

INSPRU 1.6.16

See Notes

INSPRU 1.6.17

See Notes

INSPRU 1.6.18

See Notes

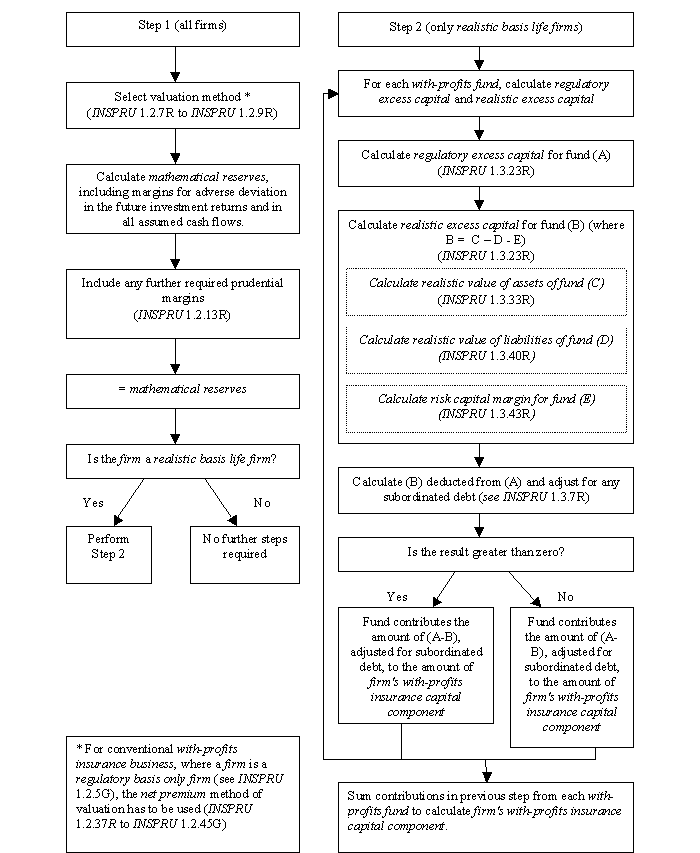

INSPRU 1 Annex 1

INSPRU 1.2 (Mathematical reserves) and INSPRU 1.3 (With-profits insurance capital component)

- 31/12/2006

See Notes

INSPRU 2

Credit risk in insurance

INSPRU 2.1

Application

- 31/12/2006

INSPRU 2.1.1

See Notes

INSPRU 2.1.2

See Notes

INSPRU 2.1.3

See Notes

INSPRU 2.1.4

See Notes

Purpose

INSPRU 2.1.5

See Notes

INSPRU 2.1.6

See Notes

INSPRU 2.1.7

See Notes

Overall limitation of credit risk

INSPRU 2.1.8

See Notes

INSPRU 2.1.9

See Notes

INSPRU 2.1.10

See Notes

INSPRU 2.1.11

See Notes

INSPRU 2.1.12

See Notes

INSPRU 2.1.13

See Notes

INSPRU 2.1.14

See Notes

INSPRU 2.1.15

See Notes

INSPRU 2.1.16

See Notes

INSPRU 2.1.17

See Notes

INSPRU 2.1.18

See Notes

INSPRU 2.1.19

See Notes

Large exposure limits

INSPRU 2.1.20

See Notes

INSPRU 2.1.21

See Notes

Market risk and counterparty limits

INSPRU 2.1.22

See Notes

INSPRU 2.1.22A

See Notes

Large exposure calculation for reinsurance exposures

INSPRU 2.1.23

See Notes

INSPRU 2.1.24

See Notes

INSPRU 2.1.25

See Notes

INSPRU 2.1.26

See Notes

INSPRU 2.1.27

See Notes

INSPRU 2.1.28

See Notes

INSPRU 2.1.29

See Notes

INSPRU 2.1.30

See Notes

INSPRU 2.1.31

See Notes

INSPRU 2.1.32

See Notes

Exposures excluded from limits

INSPRU 2.1.33

See Notes

INSPRU 2.1.34

See Notes

INSPRU 2.1.35

See Notes

INSPRU 2.1.36

See Notes

INSPRU 2.1.37

See Notes

INSPRU 2.1.38

See Notes

INSPRU 2.1.39

See Notes

INSPRU 2.1.39A

See Notes

Meaning of closely related

INSPRU 2.1.40

See Notes

INSPRU 2.1.41

See Notes

Meaning of reinsurance

INSPRU 2.1.41A

See Notes

Application of INSPRU 2.1 to Lloyd's

INSPRU 2.1.42

See Notes

INSPRU 2.1.43

See Notes

Overall limitation of credit risk

INSPRU 2.1.44

See Notes

Large exposures

INSPRU 2.1.45

See Notes

INSPRU 2.1.46

See Notes

INSPRU 2.1.47

See Notes

INSPRU 2.1.48

See Notes

Exposures excluded from the large exposure limits

INSPRU 2.1.49

See Notes

INSPRU 2.2

Asset-related Capital Requirement

- 31/12/2006

Application

INSPRU 2.2.1

See Notes

INSPRU 2.2.2

See Notes

INSPRU 2.2.3

See Notes

INSPRU 2.2.4

See Notes

INSPRU 2.2.5

See Notes

Purpose

INSPRU 2.2.6

See Notes

INSPRU 2.2.7

See Notes

INSPRU 2.2.8

See Notes

INSPRU 2.2.9

See Notes

Calculation of asset-related capital requirement

INSPRU 2.2.10

See Notes

INSPRU 2.2.11

See Notes

INSPRU 2.2.12

See Notes

INSPRU 2.2.13

See Notes

INSPRU 2.2.14

See Notes

INSPRU 2.2.15

See Notes

INSPRU 2.2.16

See Notes

| Asset item | ECR asset-related capital charge factor | |||

| Investments | Land and Buildings | 7.5% | ||

| Investments in groupundertakings and participating interests | Shares in groupundertakings excluding participating interests | Insurance dependants | 0% | |

| Other | 7.5% | |||

| Debt securities issued by, and loans to, groupundertakings | 3.5% | |||

| Participating interests | 7.5% | |||

| Debt securities issued by, and loans to, undertakings in which the insurer has a participating interest | 3.5% | |||

| Other financial investments | Shares and other variable-yield securities and units in unit trusts | 16.0% | ||

| Money market funds | 0% | |||

| Debt securities and other fixed income securities | Approved securities | 3.5% | ||

| Other | 3.5% | |||

| Participation in investment pools | 16.0% | |||

| Loans secured by mortgages | 2.5% | |||

| Other loans | 2.5% | |||

| Deposits with approved credit institutions and approved financial institutions | 0% | |||

| Other | 7.5% | |||

| Deposits with ceding undertakings | 3.5% | |||

| Reinsurers' share of technical provisions | Provision for unearned premium | 2.5% | ||

| Claims outstanding | 2.5% | |||

| Other | 2.5% | |||

| Debtors | Debtors arising out of direct insurance operations | Policyholders | 4.5% | |

| Intermediaries | 3.5% | |||

| Debtors arising out of reinsurance operations | 2.5% | |||

| Other debtors | 1.5% | |||

| Called up share capital not paid | 0% | |||

| Other Assets | Tangible assets | 7.5% | ||

| Cash at bank and in hand | 0% | |||

| Other | 0% | |||

| Prepayments and accrued income | Accrued interest and rent | 0% | ||

| Deferred acquisition costs | 0% | |||

| Other prepayments and accrued income | 0% | |||

Application of INSPRU 2.2 to Lloyd's

INSPRU 2.2.17

See Notes

INSPRU 2.2.18

See Notes

INSPRU 3

Market risk

INSPRU 3.1

Market risk in insurance

- 31/12/2006

INSPRU 3.1.1

See Notes

INSPRU 3.1.2

See Notes

INSPRU 3.1.3

See Notes

Purpose

INSPRU 3.1.4

See Notes

INSPRU 3.1.5

See Notes

INSPRU 3.1.6

See Notes

INSPRU 3.1.7

See Notes

Definitions

INSPRU 3.1.8

See Notes

Resilience capital requirement (only applicable to the long-term insurance business of regulatory basis only life firms)

INSPRU 3.1.9

See Notes

INSPRU 3.1.10

See Notes

INSPRU 3.1.10A

See Notes

INSPRU 3.1.11

See Notes

arising from the effects of market risk for equities, real estate and fixed interest securities. Other risks are not explicitly addressed by the resilience capital requirement.

INSPRU 3.1.12

See Notes

INSPRU 3.1.13

See Notes

INSPRU 3.1.13A

See Notes

INSPRU 3.1.13B

See Notes

Where, however, the nature of a firm's investment is such that the economic risks to which it is principally exposed are risks relating to assets invested in, or the currency of, a different country or territory to that in which are invested the assets directly invested in by the firm, then the firm should consider whether it would be more reasonable to treat the assets as invested in that other country or territory. For example, if a firm has invested in the securities of a collective investment scheme which are dealt in on a regulated market in country A, but the scheme principally invests in real estate situated in country B, the firm should consider whether its principal exposure is in fact to the country in which the underlying assets are situated (that is, country B). Another example might be where a firm has invested in a bond or other fixed interest security that is denominated in the currency of a country or territory other than that in which the security would be treated as invested under (1) or (2) above. The firm may wish to consider whether that bond or fixed interest security should be treated as invested in the country or territory of the currency of denomination.

INSPRU 3.1.15

See Notes

Market risk scenario for assets invested in the United Kingdom

INSPRU 3.1.16

See Notes

INSPRU 3.1.17

See Notes

INSPRU 3.1.18

See Notes

Equity market adjustment ratio

INSPRU 3.1.19

See Notes

INSPRU 3.1.20

See Notes

Real estate market adjustment ratio

INSPRU 3.1.21

See Notes

INSPRU 3.1.22

See Notes

Market risk scenario for assets invested outside the United Kingdom

INSPRU 3.1.23

See Notes

INSPRU 3.1.24

See Notes

INSPRU 3.1.25

See Notes

INSPRU 3.1.26

See Notes

Interest rates: general insurance liabilities

INSPRU 3.1.27

See Notes

Interest rates: long-term insurance liabilities

INSPRU 3.1.28

See Notes

INSPRU 3.1.29

See Notes

INSPRU 3.1.29A

See Notes

Risk-adjusted yield

INSPRU 3.1.30

See Notes

INSPRU 3.1.31

See Notes

INSPRU 3.1.32

See Notes

INSPRU 3.1.33

See Notes

INSPRU 3.1.34

See Notes

INSPRU 3.1.35

See Notes

The running yield for real estate

INSPRU 3.1.36

See Notes

The running yield for equities

INSPRU 3.1.37

See Notes

INSPRU 3.1.38

See Notes

The internal rate of return

INSPRU 3.1.39

See Notes

INSPRU 3.1.40

See Notes

Credit risk

INSPRU 3.1.41

See Notes

INSPRU 3.1.42

See Notes

INSPRU 3.1.43

See Notes

INSPRU 3.1.44

See Notes

Investment and reinvestment

INSPRU 3.1.45

See Notes

INSPRU 3.1.46

See Notes

INSPRU 3.1.47

See Notes

INSPRU 3.1.47A

See Notes

INSPRU 3.1.48

See Notes

Currency risk

INSPRU 3.1.49

See Notes

Cover for spot and forward currency transactions

INSPRU 3.1.50

See Notes

INSPRU 3.1.51

See Notes

Currency matching of assets and liabilities

INSPRU 3.1.52

See Notes

INSPRU 3.1.53

See Notes

INSPRU 3.1.53A

See Notes

INSPRU 3.1.54

See Notes

INSPRU 3.1.55

See Notes

INSPRU 3.1.56

See Notes

Covering linked liabilities

INSPRU 3.1.57

See Notes

INSPRU 3.1.58

See Notes

INSPRU 3.1.58A

See Notes

INSPRU 3.1.59

See Notes

INSPRU 3.1.60

See Notes

INSPRU 3.1.61

See Notes

INSPRU 3.1.61-A

See Notes

Pure reinsurers

INSPRU 3.1.61A

See Notes

Application of INSPRU 3.1 to Lloyd's

INSPRU 3.1.62

See Notes

Resilience capital requirement (applicable to long-term business only)

INSPRU 3.1.63

See Notes

INSPRU 3.1.64

See Notes

Currency risk: matching of assets and liabilities

INSPRU 3.1.65

See Notes

INSPRU 3.1.66

See Notes

INSPRU 3.2

Derivatives in insurance

- 31/12/2006

Application

INSPRU 3.2.1

See Notes

INSPRU 3.2.2

See Notes

INSPRU 3.2.3

See Notes

- 01/04/2013

Purpose

INSPRU 3.2.4

See Notes

Derivatives and quasi-derivatives

INSPRU 3.2.5

See Notes

INSPRU 3.2.5A

See Notes

Efficient portfolio management

INSPRU 3.2.6

See Notes

Generation of additional capital or income

INSPRU 3.2.7

See Notes

Reduction of investment risk

INSPRU 3.2.8

See Notes

Significant increase in risk

INSPRU 3.2.9

See Notes

INSPRU 3.2.10

See Notes

INSPRU 3.2.11

See Notes

Investment risk

INSPRU 3.2.12

See Notes

INSPRU 3.2.13

See Notes

Cover

INSPRU 3.2.14

See Notes

INSPRU 3.2.15

See Notes

INSPRU 3.2.16

See Notes

INSPRU 3.2.17

See Notes

INSPRU 3.2.18

See Notes

INSPRU 3.2.19

See Notes

INSPRU 3.2.20

See Notes

INSPRU 3.2.21

See Notes

INSPRU 3.2.22

See Notes

INSPRU 3.2.23

See Notes

INSPRU 3.2.24

See Notes

Offsetting transactions

INSPRU 3.2.25

See Notes

INSPRU 3.2.26

See Notes

INSPRU 3.2.27

See Notes

Lending and borrowing assets

INSPRU 3.2.28

See Notes

INSPRU 3.2.29

See Notes

INSPRU 3.2.30

See Notes

INSPRU 3.2.31

See Notes

Examples of cover requirements

INSPRU 3.2.32

See Notes

INSPRU 3.2.33

See Notes

Off-market transactions

INSPRU 3.2.34

See Notes

INSPRU 3.2.34A

See Notes

INSPRU 3.2.35

See Notes

INSPRU 3.2.35A

See Notes

Stock lending

INSPRU 3.2.36

See Notes

INSPRU 3.2.36A

See Notes

INSPRU 3.2.37

See Notes

Collateral

INSPRU 3.2.38

See Notes

INSPRU 3.2.38A

See Notes

INSPRU 3.2.39

See Notes

INSPRU 3.2.40

See Notes

INSPRU 3.2.41

See Notes

INSPRU 3.2.42

See Notes

Application of INSPRU 3.2 to Lloyd's

INSPRU 3.2.43

See Notes

INSPRU 4

Liquidity risk management

INSPRU 4.1

Application

- 31/12/2006

INSPRU 4.1.1

See Notes

INSPRU 4.1.2

See Notes

INSPRU 4.1.3

See Notes

INSPRU 4.1.4

See Notes

Purpose

INSPRU 4.1.5

See Notes

INSPRU 4.1.6

See Notes

INSPRU 4.1.7

See Notes

INSPRU 4.1.8

See Notes

Requirements

INSPRU 4.1.9

See Notes

INSPRU 4.1.10

See Notes

Managing liquidity risk

INSPRU 4.1.11

See Notes

Governing body and senior management oversight

INSPRU 4.1.12

See Notes

INSPRU 4.1.13

See Notes

INSPRU 4.1.14

See Notes

Liquidity risk policy

INSPRU 4.1.15

See Notes

INSPRU 4.1.16

See Notes

INSPRU 4.1.17

See Notes

Identifying liquidity risk

INSPRU 4.1.18

See Notes

INSPRU 4.1.19

See Notes

Asset liquidity

INSPRU 4.1.20

See Notes

INSPRU 4.1.21

See Notes

INSPRU 4.1.22

See Notes

Marketable assets

INSPRU 4.1.23

See Notes

INSPRU 4.1.24

See Notes

INSPRU 4.1.25

See Notes

Adjusting for the behavioural characteristics of assets

INSPRU 4.1.26

See Notes

INSPRU 4.1.27

See Notes

Inflows from off balance sheet items

INSPRU 4.1.28

See Notes

Liability liquidity

INSPRU 4.1.29

See Notes

INSPRU 4.1.30

See Notes

INSPRU 4.1.31

See Notes

INSPRU 4.1.32

See Notes

Adjusting for the behavioural characteristics of liabilities

INSPRU 4.1.33

See Notes

INSPRU 4.1.34

See Notes

Outflows from off balance sheet items

INSPRU 4.1.35

See Notes

INSPRU 4.1.36

See Notes

INSPRU 4.1.37

See Notes

Asset securitisations

INSPRU 4.1.38

See Notes

INSPRU 4.1.39

See Notes

INSPRU 4.1.40

See Notes

INSPRU 4.1.41

See Notes

Foreign currency liquidity

INSPRU 4.1.42

See Notes

INSPRU 4.1.43

See Notes

Intra-day liquidity

INSPRU 4.1.44

See Notes

INSPRU 4.1.45

See Notes

INSPRU 4.1.46

See Notes

Measuring liquidity risk

INSPRU 4.1.47

See Notes

INSPRU 4.1.48

See Notes

INSPRU 4.1.49

See Notes

Monitoring liquidity risk

INSPRU 4.1.50

See Notes

INSPRU 4.1.51

See Notes

INSPRU 4.1.52

See Notes

Management information systems

INSPRU 4.1.53

See Notes

INSPRU 4.1.54

See Notes

INSPRU 4.1.55

See Notes

Controlling liquidity risk

INSPRU 4.1.56

See Notes

INSPRU 4.1.57

See Notes

INSPRU 4.1.58

See Notes

INSPRU 4.1.59

See Notes

INSPRU 4.1.60

See Notes

Limit Setting

INSPRU 4.1.61

See Notes

INSPRU 4.1.62

See Notes

INSPRU 4.1.63

See Notes

INSPRU 4.1.64

See Notes

INSPRU 4.1.65

See Notes

Managing market access

INSPRU 4.1.66

See Notes

INSPRU 4.1.67

See Notes

INSPRU 4.1.68

See Notes

Application of INSPRU 4.1 to Lloyd's

INSPRU 4.1.69

See Notes

INSPRU 4.1.70

See Notes

INSPRU 5

Operational Risk Management

INSPRU 5.1

Application

- 31/12/2006

INSPRU 5.1.1

See Notes

INSPRU 5.1.2

See Notes

only in respect of the activities of the firm carried on from a branch in the United Kingdom.

Purpose

INSPRU 5.1.3

See Notes

INSPRU 5.1.4

See Notes

INSPRU 5.1.5

See Notes

INSPRU 5.1.6

See Notes

INSPRU 5.1.7

See Notes

INSPRU 5.1.8

See Notes

Operational risk policy

INSPRU 5.1.9

See Notes

INSPRU 5.1.10

See Notes

INSPRU 5.1.11

See Notes

INSPRU 5.1.12

See Notes

INSPRU 5.1.13

See Notes

Risk identification

INSPRU 5.1.14

See Notes

INSPRU 5.1.15

See Notes

INSPRU 5.1.16

See Notes

Risk assessment

INSPRU 5.1.17

See Notes

INSPRU 5.1.18

See Notes

INSPRU 5.1.19

See Notes

INSPRU 5.1.20

See Notes

Risk monitoring

INSPRU 5.1.21

See Notes

Risk control

INSPRU 5.1.22

See Notes

Record keeping

INSPRU 5.1.23

See Notes

Application of INSPRU 5.1 to Lloyd's

INSPRU 5.1.24

See Notes

INSPRU 5.1.25

See Notes

INSPRU 6

Group Risk: Insurance Groups

INSPRU 6.1

Application

- 31/12/2006

INSPRU 6.1.1

See Notes

INSPRU 6.1.2

See Notes

INSPRU 6.1.3

See Notes

INSPRU 6.1.4

See Notes

Purpose

INSPRU 6.1.5

See Notes

INSPRU 6.1.5A

See Notes

- 10/06/2013

INSPRU 6.1.6

See Notes

INSPRU 6.1.6A

See Notes

otherwise it remains an insurance holding company for the purposes of this chapter.

INSPRU 6.1.7

See Notes

Requirement to calculate GCR and GCRR

INSPRU 6.1.8

See Notes

Requirement to maintain group capital

INSPRU 6.1.9

See Notes

INSPRU 6.1.10

See Notes

INSPRU 6.1.11

See Notes

INSPRU 6.1.12

See Notes

INSPRU 6.1.13

See Notes

INSPRU 6.1.14

See Notes

INSPRU 6.1.15

See Notes

INSPRU 6.1.16

See Notes

Scope - undertakings whose group capital is to be calculated and maintained

INSPRU 6.1.17

See Notes

INSPRU 6.1.18

See Notes

INSPRU 6.1.19

See Notes

INSPRU 6.1.20

See Notes

INSPRU 6.1.21

See Notes

INSPRU 6.1.22

See Notes

Optional alternative method of calculation for firms subject to supplementary supervision by another EEA competent authority

INSPRU 6.1.23

See Notes

INSPRU 6.1.24

See Notes

Non-EEA ultimate insurance parent undertakings or non-EEA ultimate mixed financial holding companies

INSPRU 6.1.25

See Notes

INSPRU 6.1.26

See Notes

INSPRU 6.1.27

See Notes

Proportional holdings

INSPRU 6.1.28

See Notes

INSPRU 6.1.29

See Notes

INSPRU 6.1.30

See Notes

INSPRU 6.1.31

See Notes

INSPRU 6.1.32

See Notes

Calculation of the GCRR

INSPRU 6.1.33

See Notes

INSPRU 6.1.34

See Notes

INSPRU 6.1.34A

See Notes

INSPRU 6.1.35

See Notes

Calculation of GCR

INSPRU 6.1.36

See Notes

INSPRU 6.1.37

See Notes

INSPRU 6.1.38

See Notes

INSPRU 6.1.39

See Notes

INSPRU 6.1.40

See Notes

INSPRU 6.1.41

See Notes

INSPRU 6.1.42

See Notes

INSPRU 6.1.42A

See Notes

INSPRU 6.1.42B

See Notes

INSPRU 6.1.43

See Notes

| Stage | Related text | |

| Total group tier one capital | A | INSPRU 6.1.48 R |

| Total group tier two capital | B | INSPRU 6.1.50 R |

| Group capital resources before deductions | C=(A+B) | |

| Total deductions of inadmissible assets | D | INSPRU 6.1.59 R |

| Total deductions under the requirement deduction method from group capital resources | E | INSPRU 6.1.62 R |

| Total deductions of ineligible surplus capital* | F | INSPRU 6.1.65 R |

| Deduction of assets in excess of market risk and counterparty exposure limits* | G | INSPRU 6.1.70 R |

| Group capital resources | H=(C-(D+E+F*+G*)) | |

| * = section (F) of the table (the deductions for ineligible surplus capital) and section (G) of the table (assets in excess of market risk and counterparty exposure limits) only apply and are required to be calculated for the purposes of the adjusted solo calculation of an undertaking in INSPRU 6.1.17 R that is a participating insurance undertaking. | ||

Notification of issuance of capital instruments

INSPRU 6.1.43A

See Notes

INSPRU 6.1.43B

See Notes

INSPRU 6.1.43C

See Notes

INSPRU 6.1.43D

See Notes

INSPRU 6.1.43E

See Notes

INSPRU 6.1.43F

See Notes

Calculation of GCR - Limits on the use of different forms of capital

INSPRU 6.1.44

See Notes

INSPRU 6.1.45

See Notes

(P - Q + T) = 1/3 X + (R - S - U - X).

INSPRU 6.1.46

See Notes

INSPRU 6.1.47

See Notes

Calculation of GCR - Total group tier one capital

INSPRU 6.1.48

See Notes

INSPRU 6.1.49

See Notes

Calculation of GCR - Total group tier two capital

INSPRU 6.1.50

See Notes

INSPRU 6.1.51

See Notes

INSPRU 6.1.52

See Notes

Calculation of GCR - Innovative tier one capital resources, lower tier two capital resources and core tier one capital

INSPRU 6.1.53

See Notes

INSPRU 6.1.54

See Notes

INSPRU 6.1.55

See Notes

INSPRU 6.1.56

See Notes

INSPRU 6.1.57

See Notes

INSPRU 6.1.58

See Notes

Calculation of GCR - Inadmissible assets

INSPRU 6.1.59

See Notes

INSPRU 6.1.60

See Notes

INSPRU 6.1.61

See Notes

Calculation of GCR - Deductions under requirement deduction method from group capital resources

INSPRU 6.1.62

See Notes

INSPRU 6.1.63

See Notes

INSPRU 6.1.64

See Notes

INSPRU 6.1.64A

See Notes

- 10/06/2013

Calculation of GCR - Deductions of ineligible surplus capital

INSPRU 6.1.65

See Notes

INSPRU 6.1.66

See Notes

INSPRU 6.1.67

See Notes

INSPRU 6.1.68

See Notes

INSPRU 6.1.69

See Notes

| Share capital | Audited reserves | FFA | Tier two | Requirement |

| 30 | 20 | 0 | 40 | 50 |

Example 2

| Share capital | Audited reserves | FFA (of which 5 is restricted) | Tier two | Requirement (of which 4 relates to the long-term insurance business) |

| 30 | 20 | 10 | 40 | 50 |

Example 3

| Share capital | Audited reserves | FFA (of which 0 is restricted) | Tier two (40, of which 5 is excluded at the solo level - see below) | Requirement (of which 25 relates to the long-term insurance business) |

| 20 | 10 | 20 | 35 | 50 |

The requirement relating to the long-term insurance business is met by the FFA of 20 and tier two capital resources of 5. Of the remaining tier two capital resources of 35, 5 is excluded at the solo level because the tier one capital resources allocated to the general insurance business are 30.

Calculation of GCR - Assets in excess of market risk and counterparty exposure limits

INSPRU 6.1.70

See Notes

INSPRU 6.1.70A

See Notes

INSPRU 6.1.71

See Notes

INSPRU 6.1.72

See Notes

INSPRU 6.1.73

See Notes

INSPRU 6.1.74

See Notes

INSPRU 6.1.74A

See Notes

INSPRU 6.1.75

See Notes

INSPRU 6.1.76

See Notes

INSPRU 6.1.77

See Notes

INSPRU 6.1.78

See Notes

INSPRU 7

Individual Capital Assessment

INSPRU 7.1

Application

- 31/12/2006

INSPRU 7.1.1

See Notes

INSPRU 7.1.2

See Notes

INSPRU 7.1.3

See Notes

INSPRU 7.1.3A

See Notes

Purpose

INSPRU 7.1.4

See Notes

INSPRU 7.1.5

See Notes

INSPRU 7.1.6

See Notes

INSPRU 7.1.7

See Notes

INSPRU 7.1.8

See Notes

General approach

INSPRU 7.1.9

See Notes

INSPRU 7.1.9A

See Notes

INSPRU 7.1.9B

See Notes

INSPRU 7.1.10

See Notes

INSPRU 7.1.11

See Notes

INSPRU 7.1.12

See Notes

INSPRU 7.1.13

See Notes

INSPRU 7.1.14

See Notes

Methodology of capital resources assessment

INSPRU 7.1.15

See Notes

Representative of the firm's characteristics

INSPRU 7.1.16

See Notes

INSPRU 7.1.17

See Notes

INSPRU 7.1.18

See Notes

INSPRU 7.1.19

See Notes

INSPRU 7.1.20

See Notes

INSPRU 7.1.21

See Notes

Intra-group capital considerations

INSPRU 7.1.22

See Notes

INSPRU 7.1.23

See Notes

INSPRU 7.1.24

See Notes

Consistency with a firm's practice, systems and controls

INSPRU 7.1.25

See Notes

INSPRU 7.1.26

See Notes

INSPRU 7.1.26A

See Notes

- 19/06/2014

INSPRU 7.1.27

See Notes

INSPRU 7.1.28

See Notes

Considering all material risks

INSPRU 7.1.29

See Notes

INSPRU 7.1.30

See Notes

INSPRU 7.1.31

See Notes

INSPRU 7.1.32

See Notes

INSPRU 7.1.33

See Notes

INSPRU 7.1.34

See Notes

INSPRU 7.1.35

See Notes

Valuation basis

INSPRU 7.1.36

See Notes

INSPRU 7.1.37

See Notes

INSPRU 7.1.38

See Notes

INSPRU 7.1.39

See Notes

INSPRU 7.1.40

See Notes

INSPRU 7.1.41

See Notes

ICA submitted to appropriate regulator: confidence level

INSPRU 7.1.42

See Notes

INSPRU 7.1.43

See Notes

INSPRU 7.1.44

See Notes

INSPRU 7.1.45

See Notes

Measurement

INSPRU 7.1.46

See Notes

INSPRU 7.1.47

See Notes

INSPRU 7.1.48

See Notes

Documenting ICAs submitted to the appropriate regulator

INSPRU 7.1.49

See Notes

INSPRU 7.1.50

See Notes

INSPRU 7.1.51

See Notes

INSPRU 7.1.52

See Notes

INSPRU 7.1.53

See Notes

INSPRU 7.1.54

See Notes

Justifying assumptions used

INSPRU 7.1.55

See Notes

INSPRU 7.1.56

See Notes

INSPRU 7.1.57

See Notes

Approach taken for significant assumptions

INSPRU 7.1.58

See Notes

INSPRU 7.1.59

See Notes

INSPRU 7.1.60

See Notes

Justification of prospective management actions

INSPRU 7.1.61

See Notes

INSPRU 7.1.62

See Notes

INSPRU 7.1.63

See Notes

Regular review of assumptions

INSPRU 7.1.64

See Notes

Methodology

INSPRU 7.1.65

See Notes

INSPRU 7.1.66

See Notes

INSPRU 7.1.67

See Notes

Stress tests and scenario analyses

INSPRU 7.1.68

See Notes

INSPRU 7.1.69

See Notes

Documenting the results

INSPRU 7.1.70

See Notes

INSPRU 7.1.71

See Notes

INSPRU 7.1.72

See Notes

INSPRU 7.1.73

See Notes

Additional guidance for Lloyd's

INSPRU 7.1.74

See Notes

INSPRU 7.1.75

See Notes

INSPRU 7.1.76

See Notes

INSPRU 7.1.77

See Notes

INSPRU 7.1.78

See Notes

INSPRU 7.1.79

See Notes

INSPRU 7.1.80

See Notes

INSPRU 7.1.81

See Notes

INSPRU 7.1.82

See Notes

INSPRU 7.1.83

See Notes

INSPRU 7.1.84

See Notes

INSPRU 7.1.85

See Notes

INSPRU 7.1.86

See Notes

INSPRU 7.1.87

See Notes

INSPRU 7.1.88

See Notes

INSPRU 7.1.89

See Notes

INSPRU 7.1.90

See Notes

Appropriate regulator assessment process - all firms

INSPRU 7.1.91

See Notes

INSPRU 7.1.92

See Notes

INSPRU 7.1.93

See Notes

INSPRU 7.1.94

See Notes

INSPRU 7.1.95

See Notes

INSPRU 7.1.96

See Notes

INSPRU 7.1.97

See Notes

INSPRU 7.1.98

See Notes

INSPRU 7.1.99

See Notes

INSPRU 8

General provisions applying INSPRU and GENPRU to Lloyd's

INSPRU 8.1

Application

- 31/12/2006

INSPRU 8.1.1

See Notes

INSPRU 8.1.2

See Notes

INSPRU 8.1.4

See Notes

INSPRU 8.1.5

See Notes

INSPRU 8.1.6

See Notes

INSPRU 8.1.7

See Notes

INSPRU 8.1.8

See Notes

INSPRU 8.1.9

See Notes

| Key INSPRU and GENPRU requirements | INSPRU | GENPRU |

| Risk management, systems and controls | ||

| The Society to establish and maintain systems and controls to address risks affecting the Lloyd's market | INSPRU 8.2 | |

| The Society to manage prudential, credit, market, liquidity and operational risks affecting funds at Lloyd's and central assets | INSPRU 4.1, INSPRU 5.1, INSPRU 8.2 & INSPRU 8.5 | |

| Managing agents to establish and maintain systems and controls for the management of prudential, credit, market, liquidity, operational, and insurance risks affecting each syndicate | INSPRU 4.1, INSPRU 5.1, INSPRU 8.2 & INSPRU 8.5 | |

| Adequacy of financial resources | ||

| The Society to ensure that members' financial resources are adequate | GENPRU 1.2 & GENPRU 1.5 | |

| Members taken together to maintain adequate financial resources in respect of the insurance business conducted at Lloyd's | GENPRU 1.5 | |

| Managing agents to ensure that financial resources are adequate for each syndicate | GENPRU 1.2 & GENPRU 1.5 | |

| Valuation | ||

| The Society and managing agents to apply generally accepted accounting principles to valuing assets, liabilities, equity and income statement items for the purposes of the rules and guidance in GENPRU, INSPRU and IPRU (INS) unless the contrary is expressly stated | INSPRU 3.1 & INSPRU 3.2 | GENPRU 1.3 & GENPRU 1.5 |

| Capital resources requirements | ||

| The Society to calculate the MCR in respect of the general insurance business of each member | GENPRU 2.1 & GENPRU 2.3 | |

| The Society to calculate the CRR (higher of MCR and ECR) in respect of the long-term insurance business of each member | GENPRU 2.1 & GENPRU 2.3 | |

| Capital resources | ||

| The Society and managing agents to calculate capital resources in accordance with the rules and guidance in GENPRU | GENPRU 2.2 & GENPRU 2.3 | |

| Adequacy of capital resources | ||

| Managing agents to assess the adequacy of capital resources held at syndicate level in respect of insurance business carried on through each syndicate (annual ICA for each syndicate) | INSPRU 7.1 | |

| The Society to assess the adequacy of capital resources available to support each member'sinsurance business (ICA for each member), both at syndicate level (taking account of syndicate ICAs), and as funds at Lloyd's | INSPRU 7.1 |

INSPRU 8.2

Special provisions for Lloyd's

- 31/12/2006

Management of insurance business

INSPRU 8.2.1

See Notes

Obligations under INSPRU and GENPRU

INSPRU 8.2.2

See Notes

Management of risk

INSPRU 8.2.3

See Notes

INSPRU 8.2.4

See Notes

INSPRU 8.2.5

See Notes

INSPRU 8.2.6

See Notes

INSPRU 8.2.7

See Notes

INSPRU 8.2.8

See Notes

INSPRU 8.2.9

See Notes

INSPRU 8.2.10

See Notes

INSPRU 8.2.12

See Notes

INSPRU 8.2.13

See Notes

Approved reinsurance to close

INSPRU 8.2.14

See Notes

INSPRU 8.2.15

See Notes

INSPRU 8.2.16

See Notes

Provision of information by managing agents

INSPRU 8.2.17

See Notes

INSPRU 8.2.18

See Notes

Insurance receivables to be carried to trust funds

INSPRU 8.2.19

See Notes

INSPRU 8.2.20

See Notes

INSPRU 8.2.21

See Notes

INSPRU 8.2.22

See Notes

Amendments to byelaws, trust deeds and standard form letters of credit and guarantees

INSPRU 8.2.23

See Notes

INSPRU 8.2.24

See Notes

INSPRU 8.2.25

See Notes

INSPRU 8.2.26

See Notes

INSPRU 8.2.27

See Notes

INSPRU 8.2.28

See Notes

INSPRU 8.2.29

See Notes

INSPRU 8.3

The Central Fund

- 31/12/2006

Application

INSPRU 8.3.1

See Notes

Purpose

INSPRU 8.3.2

See Notes

Enabling Provision

INSPRU 8.3.3

See Notes

INSPRU 8.3.4

See Notes

INSPRU 8.3.5

See Notes

INSPRU 8.3.6

See Notes

INSPRU 8.3.7

See Notes

INSPRU 8.4

Capacity Transfer Market

- 31/12/2006

Application

INSPRU 8.4.1

See Notes

Purpose

INSPRU 8.4.2

See Notes

Requirement to make byelaws governing conduct in the capacity transfer market

INSPRU 8.4.3

See Notes

INSPRU 8.4.4

See Notes

INSPRU 8.4.5

See Notes

INSPRU 8.4.6

See Notes

INSPRU 8.4.7

See Notes

INSPRU 8.5

Former underwriting members

- 31/12/2006

Application

INSPRU 8.5.1

See Notes

Purpose

INSPRU 8.5.2

See Notes

Requirements relating to former underwriting members

INSPRU 8.5.3

See Notes

INSPRU 8.5.4

See Notes

INSPRU 8.6

Prudential risk management and associated systems and controls

- 31/12/2006

Application of SYSC 14

INSPRU 8.6.1

See Notes

INSPRU 8.6.2

See Notes

Application of SYSC 11, 15 and 16

INSPRU 8.6.3

See Notes

Application of SYSC 17

INSPRU 8.6.4

See Notes

INSPRU 8.6.5

See Notes

Transitional Provisions and Schedules

INSPRU TP

Transitional provisions

| Application | |||

| 1.1 | R | INSPRU TP 1 applies to an insurer unless it is: | |

| (1) | a non-directive friendly society; or | ||

| (2) | an incoming EEA firm; or | ||

| (3) | an incoming Treaty firm. | ||

| Version of IPRU to be used | |||

| 1.2 | R | Any reference in INSPRU TP to IPRU(INS) is to the version in force on 30 December 2004. | |

| Duration of transitional | |||

| 1.3 | R | INSPRU TP 1 applies until the relevant rule is revoked. | |

| Continuing effect of waivers | |||

| 1.4 | R | A rule in INSPRU listed in the Table at INSPRU TP Table 2 is disapplied, or is modified in its application, to a firm: | |

| (1) | in order to produce the same effect, including any conditions, as a waiver had on the corresponding rule in IPRU(INS); | ||

| (2) | for the same period as the waiver would have lasted, if shorter than the period in INSPRU TP 1.3; | ||

| provided the conditions set out in INSPRU TP 1.5 are satisfied. | |||

| 1.5 | R | The conditions referred to in INSPRU TP 1.4 are: | |

| (1) | the rule is shown in the Table at INSPRU TP Table 2 as corresponding with the rule in IPRU(INS) in relation to which the waiver was granted to the firm; | ||

| (2) | the waiver was current as respects the firm immediately before 31 December 2004; and | ||

| (3) | there is no specific transitional rule relating to the waiver. | ||

| 1.6 | R | INSPRU TP 1.4 does not have effect if, and to the extent that, it would be inconsistent with any EU law obligation of the United Kingdom. | |

| 1.7 | R | A firm which has the benefit of a waiver to which INSPRU TP 1.4 applies must: | |

| (1) | notify the appropriate regulator immediately if it becomes aware of any matter which is material to the relevance or appropriateness of the waiver; | ||

| (2) | maintain a written record of the rule in INSPRU to which it considers the waiver applies; and | ||

| (3) | make the record available to the appropriate regulator on request. | ||

| Rules in INSPRU | Corresponding rules in IPRU (INS) |

| 2.1.22 | 4.14(1) |

| 3.1.34 | 5.11 |

| 3.1.39 |

5.11 5.11(4) 5.11(5) 5.11(9) 5.11(11) |

| 3.1.58 | 2.3(2) |

| 1.1.51 | 2.4(6) |

| 1.1.56 | 2.4(1) |

| 1.1.66 | Appendix 2.1 2.4(1)(b) Appendix 2.2 2.4(1)(b) 5.9(1) |

| 1.2.40 | 5.9(2) |

| 1.2.41 | 5.9(2) |

| 1.2.43 | 5.10 |

| 1.2.74 | [deleted] |

| 6.1.17 | 10.1 10.2 10.2(1) 10.2(2) 10.2(3) |

| 6.1.23 | 10.2 10.2(1) 10.2(2) 10.2(3) |

| 3 | PRU waivers | ||

| Application | |||

| 3.1 | R | INSPRU TP 3 applies to an insurer unless it is: | |

| (1) | a non-directive friendly society; or | ||

| (2) | an incoming EEA firm; or | ||

| (3) | an incoming Treaty firm. | ||

| Version of PRU to be used | |||

| 3.2 | R | A reference in INSPRU TP 3 to PRU is to the version in force on 30 December 2006. | |

| Duration of transitional | |||

| 3.3 | R | INSPRU TP 3 applies until the relevant INSPRUrule is revoked. | |

| Continuing effect of waivers | |||

| 3.4 | R | A rule in INSPRU is disapplied, or is modified in its application, to a firm: | |

| (1) | in order to produce the same effect, including any conditions, as a waiver had on the rule in PRU; | ||

| (2) | for the same period as the waiver would have lasted, if shorter than the period in INSPRU TP 3.3; | ||

| provided the conditions set out in INSPRU TP 3.5 are satisfied. | |||

| 3.5 | R | The conditions referred to in INSPRU TP 3.4 are: | |

| (1) | the rule in PRU in relation to which the waiver was granted to the firm was redesignated as the relevant rule in INSPRU by the Prudential Sourcebook for Insurers Instrument 2006; | ||

| (2) | the waiver was current as respects the firm immediately before 31 December 2006; and | ||

| (3) | there is no specific transitional rule relating to the waiver. | ||

| 3.6 | R | INSPRU TP 3.4 does not have effect if, and to the extent that, it would be inconsistent with any EU law obligation of the United Kingdom. | |

| 3.7 | R | A firm which has the benefit of a waiver to which INSPRU TP 3.4 applies must: | |

| (1) | notify the appropriate regulator immediately if it becomes aware of any matter which is material to the relevance or appropriateness of the waiver; | ||

| (2) | maintain a written record of the rule in INSPRU to which it considers the waiver applies; and | ||

| (3) | make the record available to the appropriate regulator on request. | ||

| 4 | EEA pure reinsurers | ||

| [deleted] | |||

| 5 | Pure reinsurance groups | |

| [deleted] | ||

| 6 | Admissible assets | ||

| [deleted] | |||

| 7 | Mathematical reserves | |

| Application | ||

| 7.1 | R | INSPRU TP 7 applies to an insurer to which INSPRU 1.2 applies. |

| Duration of transitional | ||

| 7.2 | R | INSPRU TP 7 applies until the relevant rule is revoked. |

| 7.3 | R | INSPRU 1.2.79A R does not apply in respect of reinsurance and analogous non-reinsurance financing agreements entered into and the terms of which came into effect before 10 December 2009, provided that immediately before 6 October 2010 the firm had the benefit of INSPRU 1.2.79 R (2) in relation to those reinsurance or analogous non-reinsurance financing agreements. |

- 01/04/2013

- Past version of INSPRU TP before 01/04/2013

INSPRU Sch 1

Record keeping requirements

- 31/12/2006

INSPRU Schedule 1.1

See Notes

INSPRU Schedule 1.2

See Notes

INSPRU Schedule 1.3

See Notes

| Handbook reference |

Subject of Record | Contents of Record | When record must be made | Retention Period |

| INSPRU 1.2.20 R |

Mathematical reserves |

(1)The methods and assumptions used in establishing the firm'smathematical reserves, including the margins for adverse deviation, and the reasons for their use(2)The nature of, reasons for, and effect of, any change in approach, including the amount by which the change in approach increases or decreases its mathematical reserves

|

Not specified | An appropriate period |

| INSPRU 1.3.17 R, INSPRU 1.3.19 R |

Calculation of with-profits insurance capital component |

(1)The methods and assumptions used in making any calculation required for the purposes of INSPRU 1.3 (and any subsequent changes) and the reasons for their use(2)Any change in practice (in particular changes in those items which will or may be significant in relation to the eventual claim values) and the nature of, reasons for, and effect of, any change in approach with respect to those methods and assumptions

|

Not specified | An appropriate period |

| INSPRU 1.5.23 R |

Long-term insurance funds | A separate accounting record in respect of each of a firm'slong-term insurance funds | Not specified | Not specified |

| INSPRU 1.5.56 R, INSPRU 1.5.57 R |

Branch accounting records in the United Kingdom | A record of the activities carried on from a non-EEA direct insurer's United Kingdombranch and, if it is an EEA-deposit insurer, from its branches in other EEA states including a record of:

(1)the income, expenditure and liabilities arising from activities of the branch or branches(2)the assets identified under INSPRU 1.1.20 R as available to meet those liabilities

|

Not specified | Not specified |

INSPRU Sch 2

Notification and reporting requirements

- 31/12/2006

INSPRU Schedule 2.1

See Notes

INSPRU Schedule 2.2

See Notes

INSPRU Schedule 2.3

See Notes

| Handbook reference | Matter to be notified | Contents of notification | Trigger event | Time allowed |

| INSPRU 2.1.23 R | That a reinsurance exposure to a reinsurer or group of closely related reinsurers is reasonably likely to exceed, or has exceeded, 100% of the firm'scapital resources excluding capital resources held to cover property-linked liabilities | Fact that the limit is reasonably likely to be, or has been, exceeded Note: upon notification under INSPRU 2.1.23 R the firm must: (1)demonstrate that prudent provision has been made for the reinsurance exposure in excess of the 100% limit, or explain why in the opinion if the firm no provision is required, and(2)explain how the reinsurance exposure is being safely managed (see INSPRU 2.1.24R)

|

(1)A reasonable likelihood that the limit will be exceeded, or(2)if (1) does not apply , the limit being exceeded

|

As soon as the firm first becomes aware of the matter required to be notified |

| INSPRU 2.1.29 R | That the firm has exceeded, or anticipates exceeding, the limit expressed in INSPRU 2.1.28 E (in each financial year a firm should restrict the gross earned premiums which it pays to a reinsurer or group of closely related reinsurers to the higher of (a) 20% of the firm's projected gross earned premiums for that financial year and (b) £4 million) | Fact that the limit has been exceeded, or that the firm anticipates exceeding the limit Note: upon notification under INSPRU 2.1.29 R the firm must explain to the appropriate regulator how, despite the excess reinsurance concentration, the credit risk is being safely managed (see INSPRU 2.1.30 R) |

The limit being exceeded, or an anticipation that the limit will be exceeded | Immediately |

| INSPRU 3.1.65 R | Syndicate liabilities not covered by matching syndicate assets as required by INSPRU 3.1.53 R | Nature and extent of syndicate liabilities not covered by matching syndicate assets as required by INSPRU 3.1.53 R | Syndicate liabilities are no longer covered by matching syndicate assets as required by INSPRU 3.1.53 R | Immediately |

| INSPRU 6.1.43B R | Intention of a groupundertaking to issue a capital instrument for inclusion in group capital resources | Fact of intention and details of intended amount, issue date, type of investor, stage of capital, features of instrument and confirmation of compliance with rules | Intention to issue | As soon as proposed issue becomes known to firm |