1

Application and Definitions

1.1

Unless otherwise stated, this Part applies to:

- (1) a UK Solvency II firm; and

- (2) in accordance with Insurance General Application 3, the Society, as modified by 8.

- 01/01/2016

1.2

In this Part, the following definitions shall apply:

standard equity capital charge

means the standard capital requirement for equity risk calculated in accordance with the Solvency II Regulations before any symmetric adjustment is applied.

means the symmetric adjustment that may be applied to the standard equity capital charge in accordance with the Solvency II Regulations.

- 01/01/2016

2

Structure of the SCR Standard Formula

2.1

For a firm calculating its SCR on the basis of the standard formula, its SCR is the sum of the following items:

- (1) the basic SCR;

- (2) the capital requirement for operational risk, as set out in 5; and

- (3) the adjustment for the loss-absorbing capacity of technical provisions and deferred taxes, as set out in 6.

[Note: Art. 103 of the Solvency II Directive]

- 01/01/2016

3

The Basic SCR

3.1

For the purposes of calculating its basic SCR, a firm must:

- (1) calculate the capital requirements for:

- (a) the non-life underwriting risk module;

- (b) the life underwriting risk module;

- (c) the health underwriting risk module;

- (d) the market risk module; and

- (e) the counterparty default risk module; and

- (2) aggregate the capital requirements referred to in (1) in accordance with the following formula:

basic SCR =

where:

- (a) ‘SCRi’ and ‘SCRj’ denote the non-life underwriting risk module, the life underwriting risk module, the health underwriting risk module, the market risk module and the counterparty default risk module;

- (b) ‘i,j’ means that the sum of the different terms should cover all possible combinations of ‘i’ and ‘j’;

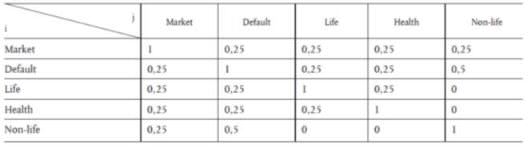

- (c) the factor ‘Corr i,j’ denotes the item set out in row ‘i’ and column ‘j’ of the correlation matrix in (d); and

- (d)

[Note: Art. 104(1) and Annex IV point (1) of the Solvency II Directive]

- 01/01/2016

3.2

For the purposes of calculating the capital requirements in 3.1(1) for non-life underwriting risk, life underwriting risk and health underwriting risk, a firm must allocate its insurance and reinsurance operations to the underwriting risk that best reflects the technical nature of the underlying risks.

[Note: Art. 104(2) of the Solvency II Directive]

- 01/01/2016

3.3

Each of the risk modules referred to in 3.1(1) must be calibrated using a Value-at-Risk measure, with a 99.5% confidence level over a one-year period.

- 01/01/2016

3.4

Where appropriate, diversification effects must be taken into account in the design of each risk module.

[Note: Art. 104(4) of the Solvency II Directive]

- 01/01/2016

3.5

For the purposes of the basic SCR, a firm must calculate the capital requirement for the non-life underwriting risk module so that it:

- (1) reflects the risk arising from its non-life insurance obligations, in relation to the perils covered and the processes used in the conduct of business; and

- (2) takes account of the uncertainty in its results related to existing insurance and reinsurance obligations, as well as to new business expected to be written within the following 12 months.

[Note: Art. 105(2) of the Solvency II Directive]

- 01/01/2016

3.6

For the purposes of 3.1(1)(a), the capital requirement for the non-life underwriting risk module is a combination of the capital requirements for at least the following sub-modules:

- (1) a non-life premium and reserve risk sub-module covering the risk of loss, or of adverse change in the value of insurance liabilities, resulting from fluctuations in the timing, frequency and severity of insured events, and in the timing and amount of claim settlements; and

- (2) a non-life catastrophe risk sub-module covering the risk of loss, or of adverse change in the value of insurance liabilities, resulting from significant uncertainty of pricing and provisioning assumptions related to extreme or exceptional events.

[Note: Art. 105(2) of the Solvency II Directive]

- 01/01/2016

3.7

For the purposes of 3.1(1)(b) a firm must calculate the capital requirement for the life underwriting risk module so as to reflect the risk arising from its life insurance obligations, in relation to the perils covered and the processes used in the conduct of business.

[Note: Art. 105(3) of the Solvency II Directive]

- 01/01/2016

3.8

The life underwriting risk module must be calculated as:

- (1) a combination of the capital requirements for the following sub-modules:

- (a) mortality risk;

- (b) longevity risk;

- (c) disability-morbidity risk;

- (d) life expense risk;

- (e) revision risk;

- (f) lapse risk; and

- (g) life catastrophe risk;

- (2) aggregated in accordance with the following formula:

where: ‘SCRi’ and ‘SCRj’ denote the mortality risk sub-module, the longevity risk sub-module, the disability-morbidity risk sub-module, the life expense risk sub-module, the revision risk sub-module, the lapse risk sub-module and the life catastrophe risk sub-module; and

‘i,j’ means that the sum of the different terms should cover all possible combinations of ‘i’ and ‘j’.

[Note: Art. 105(3) and Annex IV point (3) Solvency II Directive]

- 01/01/2016

3.9

For the purposes of 3.8:

- (1) the mortality risk sub-module covers the risk of loss, or of adverse change, in the value of insurance liabilities, resulting from changes in the level, trend or volatility of mortality rates, where an increase in the mortality rate leads to an increase in the value of insurance liabilities;

- (2) the longevity risk sub-module covers the risk of loss, or of adverse change, in the value of insurance liabilities, resulting from changes in the level, trend or volatility of mortality rates, where a decrease in the mortality rate leads to an increase in the value of insurance liabilities;

- (3) the disability-morbidity risk sub-module covers the risk of loss, or of adverse change, in the value of insurance liabilities, resulting from changes in the level, trend or volatility of disability, sickness and morbidity rates;

- (4) the life-expense risk sub-module covers the risk of loss, or of adverse change, in the value of insurance liabilities, resulting from changes in the level, trend or volatility of the expenses incurred in servicing contracts of insurance or reinsurance contracts;

- (5) the revision risk sub-module covers the risk of loss, or of adverse change, in the value of insurance liabilities, resulting from changes in the level, trend or volatility of the revision rates applied to annuities, due to changes in the legal environment or in the state of health of the person insured;

- (6) the lapse risk sub-module covers the risk of loss, or of adverse change, in the value of insurance liabilities, resulting from changes in the level or volatility of the rates of policy lapses, terminations, renewals and surrenders; and

- (7) the life-catastrophe risk sub-module covers the risk of loss, or of adverse change, in the value of insurance liabilities, resulting from the significant uncertainty of pricing and provisioning assumptions related to extreme or irregular events.

[Note: Art. 105(3) of the Solvency II Directive)]

- 01/01/2016

3.10

For the purposes of 3.1(1)(c):

- (1) a firm must calculate the capital requirement for the health underwriting risk module to reflect the risk arising from its underwriting of health insurance obligations, whether it is pursued on a similar technical basis to that of life insurance or not, following from both the perils covered and the processes used in the conduct of business; and

- (2) the health underwriting risk module must cover at least the risk of loss, or of adverse change, in the value of insurance liabilities resulting from:

- (a) changes in the level, trend, or volatility of the expenses incurred in servicing contracts of insurance or reinsurance contracts;

- (b) fluctuations in the timing, frequency and severity of insured events, and in the timing and amount of claim settlements at the time of provisioning; and

- (c) the significant uncertainty of pricing and provisioning assumptions related to outbreaks of major epidemics, as well as the unusual accumulation of risks under such extreme circumstances.

[Note: Art. 105(4) of the Solvency II Directive]

- 01/01/2016

3.11

For the purposes of 3.1(1)(d):

- (1) a firm must calculate the capital requirement for the market risk module so that it:

- (a) reflects the risk arising from the level or volatility of market prices of financial instruments which have an impact upon the value of the assets and liabilities of the firm;

- (b) properly reflects the structural mismatch between assets and liabilities, in particular with respect to the duration of assets and liabilities; and

- (2) the capital requirement for the market risk module is a combination of the capital requirements for at least the following sub-modules:

- (a) an interest-rate risk sub-module covering the sensitivity of the values of assets, liabilities and financial instruments to changes in the term structure of interest rates, or in the volatility of interest rates;

- (b) an equity risk sub-module covering the sensitivity of the values of assets, liabilities and financial instruments to changes in the level or in the volatility of market prices of equities;

- (c) a property risk sub-module covering the sensitivity of the values of assets, liabilities and financial instruments to changes in the level or in the volatility of market prices of real estate;

- (d) a spread risk sub-module covering the sensitivity of the values of assets, liabilities and financial instruments to changes in the level or in the volatility of credit spreads over the risk-free interest-rate term structure;

- (e) a currency risk sub-module covering the sensitivity of the values of assets, liabilities and financial instruments to changes in the level or in the volatility of currency exchange rates; and

- (f) a market risk concentrations sub-module covering additional risks to a firm stemming either from lack of diversification in the asset portfolio or from large exposure to default risk by a single issuer of securities or a group of related issuers.

[Note: Art. 105(5) of the Solvency II Directive]

- 01/01/2016

3.12

For the purposes of 3.1(1)(e), the counterparty default risk module:

- (1) must reflect possible losses due to unexpected default, or deterioration in the credit standing, of the counterparties and debtors of the firm over the following 12 months;

- (2) must cover risk-mitigating contracts, such as reinsurance arrangements, securitisations and derivatives, and receivables from intermediaries, as well as any other credit exposures which are not covered in the spread risk sub-module;

- (3) must take appropriate account of collateral or other security held by, or for the account of, the firm and the associated risks;

- (4) for each counterparty, must take account of the overall counterparty risk exposure of the firm to that counterparty, irrespective of the legal form of the counterparty’s contractual obligations to the firm.

[Note: Art. 105(6) of the Solvency II Directive]

- 01/01/2016

4

Calculation of the Equity Risk Sub-Module and Application of the Symmetric Adjustment Mechanism

4.1

For the purposes of calculating the equity risk sub-module referred to in 3.11(2)(b), a firm must apply a symmetric adjustment to the standard equity capital charge to cover the risk arising from changes in the level of equity prices.

[Note: Art. 106(1) of the Solvency II Directive]

- 01/01/2016

5

Capital Requirement for Operational Risk

5.1

A firm’s capital requirement for operational risk must:

- (1) reflect its operational risks to the extent that they are not already reflected in the risk modules used to calculate its basic SCR; and

- (2) be calibrated in accordance with Solvency Capital Requirement – General Provisions 3.3 to 3.4.

[Note: Art. 107(1) of the Solvency II Directive]

- 01/01/2016

5.2

With respect to linked long-term contracts of insurance, the calculation of the capital requirement for operational risk must take into account the amount of annual expenses incurred in respect of those insurance obligations.

[Note: Art. 107(2) of the Solvency II Directive]

- 01/01/2016

5.3

With respect to insurance business operations other than those referred to in 5.2, the capital requirement for operational risk must:

- (1) take into account the volume of those operations, in terms of earned premiums and technical provisions which are held in respect of that insurance business; and

- (2) not exceed 30% of the basic SCR relating to those operations.

[Note: Art. 107(3) of the Solvency II Directive]

- 01/01/2016

6

Adjustment for Loss-Absorbing Capacity of Technical Provisions and Deferred Taxes

6.1

The adjustment for the loss-absorbing capacity of technical provisions and deferred taxes as referred to in 2.1(3):

- (1) must reflect potential compensation of unexpected losses through a simultaneous decrease in technical provisions or deferred taxes, or a combination of the two; and

- (2) must take account of the risk-mitigating effect provided by future discretionary benefits of contracts of insurance.

[Note: Art. 108 of the Solvency II Directive]

- 01/01/2016

6.2

For the purposes of 6.1(2):

- (1) a firm must take account of the risk-mitigating effect provided by future discretionary benefits to the extent that it can establish that a reduction in future discretionary benefits may be used to cover unexpected losses when they arise;

- (2) the risk-mitigating effect provided by future discretionary benefits must be no higher than the sum of technical provisions and deferred taxes relating to those future discretionary benefits; and

- (3) the value of future discretionary benefits under adverse circumstances must be compared to the value of those benefits under the underlying assumptions of the best estimate calculation.

[Note: Art. 108 of the Solvency II Directive]

- 01/01/2016

7

Simplification in the Standard Formula

7.1

- (1) A firm may use a simplified calculation for a specific sub-module or risk module where the nature, scale and complexity of the risks it faces justifies it.

- (2) A firm must calibrate its simplified calculation in accordance with Solvency Capital Requirement – General Provisions 3.3 to 3.4.

[Note: Art. 109 of the Solvency II Directive]

- 01/01/2016

8

Lloyd’s

8.1

This Chapter applies to the Society in relation to the use of the standard formula for the purpose of Solvency Capital Requirement – General Provisions 3.1.

- 01/01/2016

8.2

The Society must aggregate the results of each notional SCR referred to in Solvency Capital Requirement – General Provisions 8.4 together with the central requirement, in order to obtain the SCR for Lloyd’s.

- 01/01/2016