-

The PRA Rulebook contains the rules made and enforced by the PRA under powers conferred by the Financial Services and Markets Act 2000 (FSMA), as well as the PRA’s expectations in the form of SS and SoP. The PRA Rulebook presents this material in a consolidated and time-travelable format so that users can see the past, present, and upcoming versions of PRA rules and policy. It also contains PRA guidance in the form of Supervisory Statements (SS) and Statements of Policy (SoP). The PRA will continue populating the guidance over time.

-

The PRA Rulebook applies to all PRA-authorised persons and certain unauthorised persons (e.g. auditors) in respect of their involvement with authorised firms and the PRA. The PRA Rulebook contains the applicable prudential requirements (and guidance) for PRA-regulated firms. It should be read by PRA-regulated firms and those unauthorised persons to whom the PRA rules apply.

-

PRA rules and guidance are categorised by Sector, indicating the type of firm or person to which they apply. PRA rules are set out in topic-specific Parts. Some Parts are applicable across several Sectors, which is noted in the panel on the left side of each Part.

Guidance documents (SS and SoP) also provide guidance by topic.

Firms should choose the Sector appropriate to them from the PRA rules or Sector navigation pages, or on the Guidance navigation page, to see the rules and guidance relevant to their type of firm. A description of the types of firms or persons appropriate for each Sector can be viewed on the navigation pages or the home page.

-

Authorised firms must ensure they meet the PRA’s and FCA’s Threshold Conditions at all times in order to carry out regulated activities. Please refer to the Threshold Conditions for further information.

In addition to the Threshold Conditions, there are eight PRA Fundamental Rules. These are high-level rules that collectively act as an expression of the PRA’s general objective to promote the safety and soundness of PRA-authorised firms. They apply proportionately to all PRA-regulated firms, taking into account the differences between sectors and between sizes of firms.

-

The PRA Rulebook contains Statements of Policy and guidance documents (e.g. Supervisory Statements) which set out the PRA expectations as to how to interpret the relevant rules, but does not provide a direct link between a rule and the applicable guidance. The Related Links sidebar for each Part contains links to policy statements, relevant SS, and other relevant material. The consultation papers setting out the PRA’s policy rationale for making rules can be accessed from the Policy Statement (accessible from the Legal Instruments that changed a rule) landing page on the Bank’s website.

-

The application provision in the first Chapter of each Part explains the type of firm or persons which a Part or Chapter applies. Some Chapters apply only to certain firms, and the application provision will change if this is the case.

The application provision may apply to all firms or specify the subset of firms to which the rules within a Part apply. The application provision always remains at the top of the page to enable the user to see the type of firm or persons to which the rules being viewed apply.

-

No, the PRA Rulebook is designed to be accessed online. However, firms can print or download a PDF of full Parts/Chapters via the 'Export part/chapter as' icons at the top of each Part or end of each Chapter.

-

Please see the Legal page for terms of use and contact the PRA via the Contact Us page for licensing information.

-

The PRA Rulebook replaced the PRA Handbook between January 2014 and March 2016. To access PRA Handbook modules in force prior to this, return to the ‘PRA Rules’ homepage, and select the desired date from the left-hand menu.

-

The PRA and FCA replaced the FSA in 2013. The PRA Rulebook also contains the legacy instruments from the FSA, from 2001 to 2013/2014. These are available on the Legal Instruments page.

Legacy FSA rules are available in the PRA Rulebook from 1 December 2014. Attempting to time-travel before that date will result in an error message.

-

How often is the PRA Rulebook updated?

The PRA Rulebook website will be updated after each publication of new PRA policy (rules or guidance documents [SS/SoP]) – this normally happens in the form of a Policy Statement published on the Bank of England website. The processing of new content through the system will normally be done in 24hours, but can take longer for large updates, or when viewing from an overseas location due to updates on the various cloud servers.

-

Continuous Improvement

This section identifies ongoing development work to the PRA Rulebook website, including bug fixes.

PDF export: Users may experience long delays / time outs when attempting to ‘Export part as…pdf’. In addition, formulas may not display correctly. To mitigate these problems, and until we can find a solution, users should use the ‘print’ option, then select ‘print to pdf’.

Using the PRA Rulebook

-

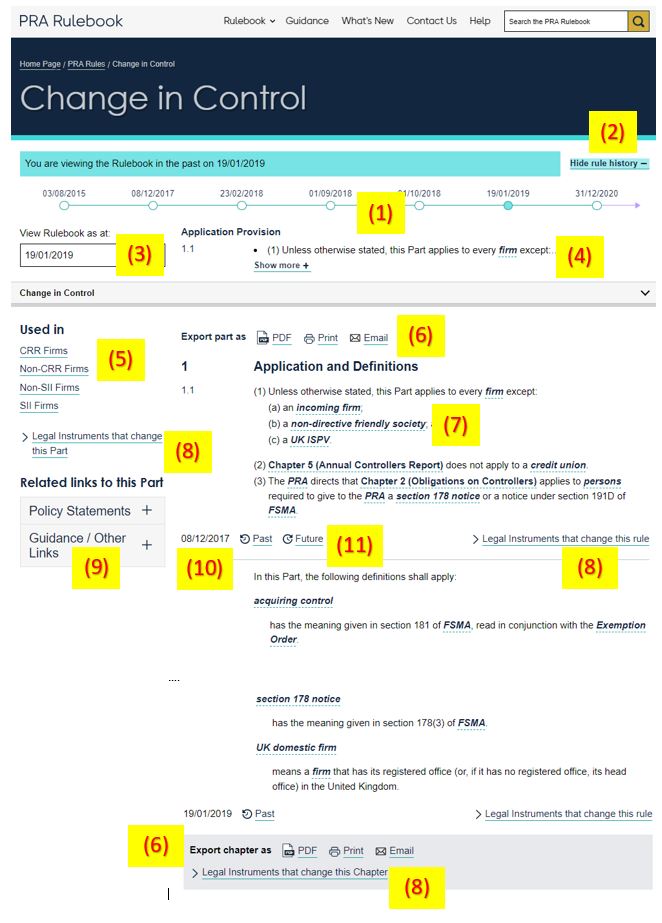

Key functionality of the rules page:

- The rule history timeline shows the dates where rules within the Part were amended, including future dated versions. Selecting a date moves the Rulebook date.

The filled marker shows the latest version of the Part being viewed at the date selected (see (3)). - Allows the rule history timeline to be opened or closed.

- Allows the viewing date of the Rulebook to be changed manually.

- The Application Provision indicates the firms the Part would normally apply to. Application provisions can change within the Part (eg a chapter or rule may only apply to certain firms).

- Shows the other Sectors where the Part may apply, with links to those Sectors navigation pages.

- Export the Part or Chapter in PDF, Print, or Email.

- Clicking a highlighted defined term open a drop-down box with the definition.

- Shows the Legal Instruments that changed the Part / Chapter / Rule.

- Expand Related Links to access the policy statements (and from there the consultation papers), related guidance documents, and other links related to this Part.

- The date the rule took effect on or before the viewing date.

- Changes the viewing date to the past or future version of a rule (if applicable).

- The rule history timeline shows the dates where rules within the Part were amended, including future dated versions. Selecting a date moves the Rulebook date.

-

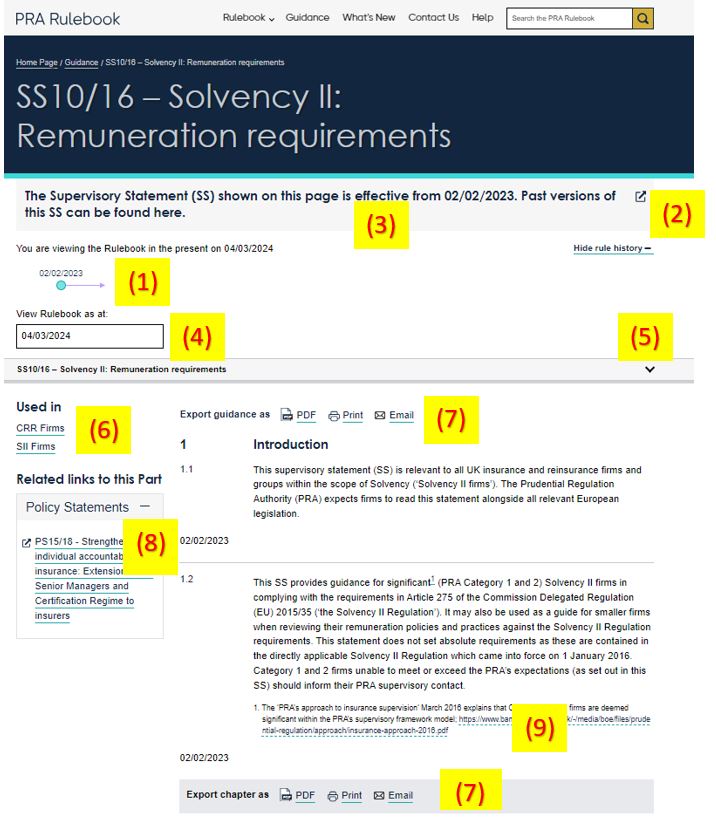

Key functionality of the rules page:

- The rule history timeline shows the dates when the guidance document was amended. Selecting a date moves the viewing date of the Rulebook.

The Rulebook contains the latest versions of most guidance documents (SS and SoP) at the launch of the new Rulebook (April 2024). Further guidance documents will be added over time. - Allows the [rule history] timeline to be opened or closed.

- Indicates when previous versions of guidance documents are available, and links to its landing page on the Bank of England website.

- Allows the viewing date of the Rulebook to be changed manually.

- Opens the chapter navigation pane.

- Shows the Sectors where the guidance also applies, with links to those Sectors rule navigation pages.

- Export the guidance document or chapter in PDF, Print, or Email.

- Expand Related Links to access the policy statements (and from there the consultation papers) that published the guidance document.

- Footnotes for each paragraph appear under the paragraph.

- The rule history timeline shows the dates when the guidance document was amended. Selecting a date moves the viewing date of the Rulebook.

-

The PRA Rulebook website’s ‘time-travel’ function allows users to view the rules that were, are or shall be, in force at a given date. There are several facilities for time-travel within website’s functionality. The Rulebook will default to today’s date.

PRA Rules, Sector and Guidance navigation pages, and the Glossary page:

- Enter a date in the ‘View Parts / Guidance as of:’ box.

Specific Part / Guidance pages:

- Enter a date in the ‘View Rulebook as at:’ box;

- Select ‘today’ in the ‘date picker’ by clicking in the ‘View Rulebook as at:’ box;

- Select a date from the History timeline; or

- Select ‘past’ / ‘future’ (if present) at the bottom of each rule.

- Enter a date in the ‘View Parts / Guidance as of:’ box.

-

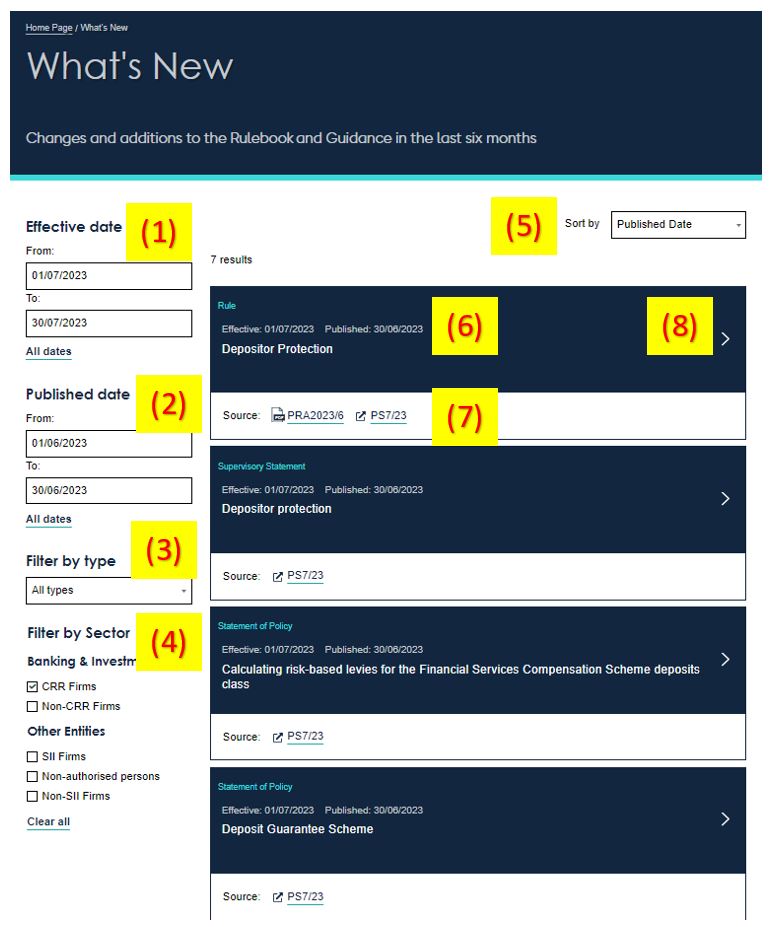

The What’s New page displays recent changes and additions to the Rules and guidance documents. Users can filter by type (Rules or guidance), by Sector and date range. Results can be sorted by either published or effective date.

- Select an Effective Date range – select ‘all dates’ to clear the selection.

- Select a Published Date range – select ‘all dates’ to clear the selection.

- Filter by policy type – Rules, or Guidance documents (Supervisory Statements / Statements of Policy).

- Filter by Sector.

- Sort results by: Published Date (descending), Effective Date (descending) or Effective Date ASC (ascending).

- Details of the policy change: Type, Effective Date, Published Date, and Description.

- Links to source of the policy – Legal Instrument (for rules) and Policy Statement

- Click the section to go to the policy page at the effective date shown.

-

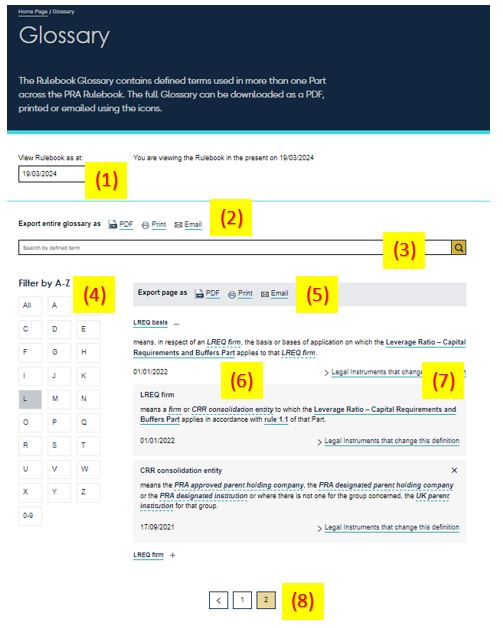

To access the Glossary, select Rulebook / Glossary from the main menu.

The Glossary contains defined terms used in more than one Part. Defined terms are rendered in italics in the Rules (defined terms are not used in guidance documents), and will show the definition of the term when clicked on. If a term is defined in both the Glossary and within a particular Part, the definition in the Part will apply within that Part; the definition in the Glossary will apply to the rest of the Rulebook.

- Set the Effective Date to view the Glossary.

- Options to export the entire Glossary.

- Search the Glossary for a term, either in the ‘letter’ selected, or choose ‘All’ (see ‘Filter by A-Z’) to search the entire Glossary.

- Limit the Glossary view to terms starting with specific letters.

- Export the current Glossary page.

- Expand the defined terms being viewed by clicking a term within a term.

- Opens the Legal Instruments page showing the instruments that changed the selected defined term.

- Select other pages for this letter (the Glossary shows 20 defined terms per page).

-

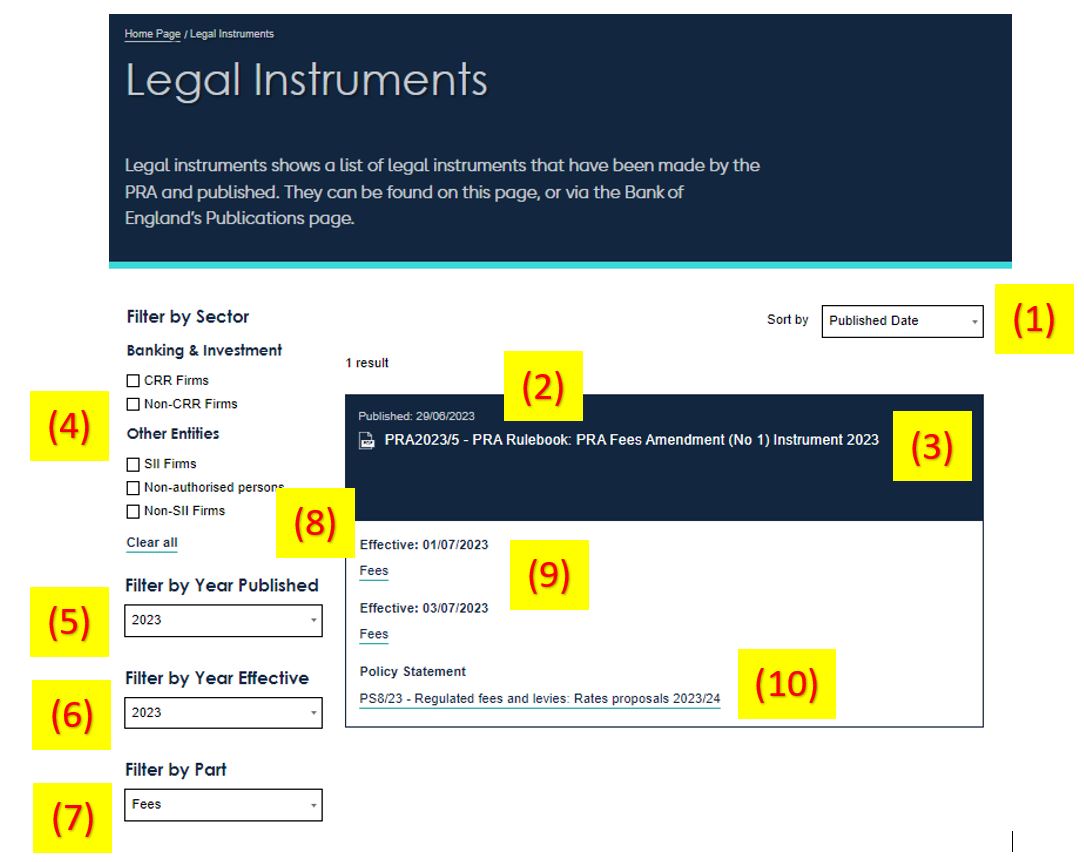

To access the Legal Instruments page, select Rulebook / Legal Instruments from the main menu.

Section 138G of FSMA requires the PRA to exercise its rule-making powers in writing, in a document FSMA calls a ‘rule-making instrument’, and to make all such instruments publicly available. The consolidated Rulebook text combines all extant rule instruments to create a readable view of the PRA Rulebook for firms. Although the online PRA Rulebook will contain the most accessible version of the PRA’s rules which will be consolidated on a regular basis, the definitive rules are always contained in the PRA's rule-making instruments, and those should be used if there is a discrepancy.

Legal instruments pertaining to a particular Part, Chapter, Rule and Article (for CRR Parts) can be viewed by clicking on ‘Legal instruments that have changed this [Part]’ on the left side of the page for the Part. This functionality is not available for the PRA Handbook. Legal instruments can also be found via the [Legal Instruments] page.

Key functionality of the Legal Instruments page:

- Sort the instrument list by ‘Published Date’ (descending) or ‘Effective Date’ (also descending).

- Date that the instrument was published – normally this will be the publication date of the respective policy statement. Note: Instruments issued by the FSA that are included in the PRA Rulebook for historical purposes will not have a published date.

- Legal instrument reference number and title.

- Filter instruments by Sector.

- Filter instruments by year published.

- Filter instruments by year effective.

- Filter instruments by Part amended (PRA Rulebook Parts only)

- The effective date of the change. Instruments may make changes at different effective dates – in this case all the effective dates will be shown.

- List of the Parts amended by the instrument. Note: At present, amendments to the Central Glossary are not shown, and neither will be instruments that only change the Glossary.

- Link to the Policy Statement on the Bank of England website that published the instrument.

-

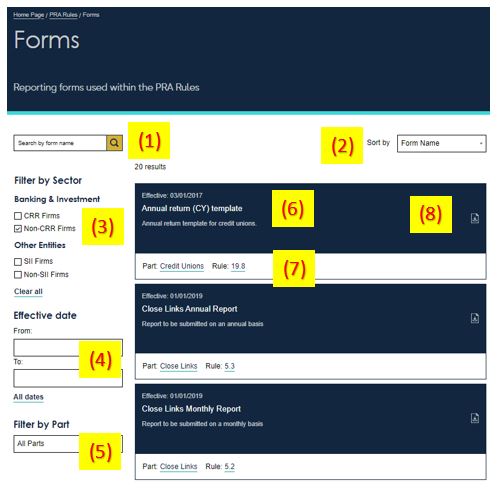

To access the Forms page, select Rulebook / Forms from the main menu.

Forms contained within Rules can also be accessed from the Forms page.

- Search by Form name (the search is on the title, not the description).

- Sort by Form Name, Effective Date (descending), or Relevancy (when using search).

- Filter by Sector.

- Filter by a range of Effective Dates.

- Filter by a single Part (only Parts containing Forms are shown).

- Form Name, description, and Effective Date.

- The Part name that contains the Form, and the Rule reference.

- Opens / Downloads the Form.